2X Group Health Insurance Benefits

at 0 Extra Premium

Employee Centric Group Health Insurance Plan

We know your to-do list is a mile long. Between finding the right talent, keeping payroll running smoothly, and boosting employee morale, you barely have time to breathe! And then there's the headache of sorting out group health insurance... 😫

But guess what? It doesn't have to be a struggle! We are here to make finding the perfect group health plan a breeze. 😎

This is the kind of insurance that covers your team's medical expenses when they need it most – think hospital visits, surgeries, and everything in between. And the best part? You can usually include family members too! Spouses, kids, even parents – everyone's covered.

For your employees, it's peace of mind knowing they're covered if something goes wrong. For you, it's a powerful way to attract and keep top talent (and who doesn't want that?).

Tax-wise, you can lower your income tax by counting the premiums as business expenses. No input credit on GST yet, but here's the good news: the government might even lower the GST rate by 5%, making it even easier on the wallet.

Okay, so we know healthcare in India can be a bit of a mixed bag. The wealthy can afford top-notch care, while those struggling financially depend on government programs. And the middle class? They often rely on the health insurance their jobs provide.

Okay, so we know healthcare in India can be a bit of a mixed bag. The wealthy can afford top-notch care, while those struggling financially depend on government programs. And the middle class? They often rely on the health insurance their jobs provide.

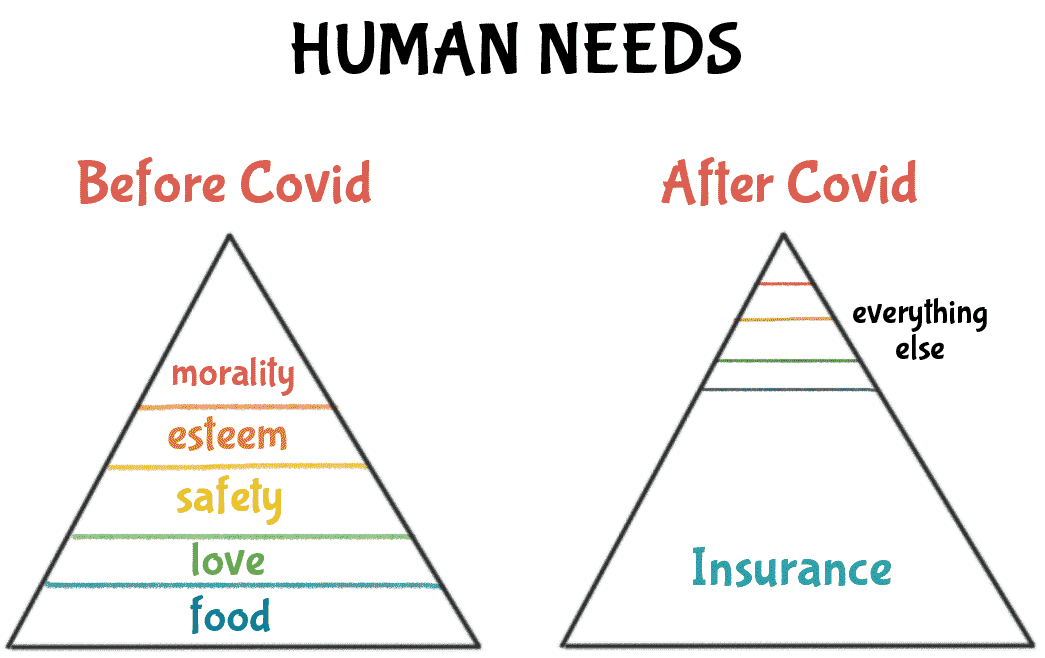

Now, here's the kicker: healthcare costs are shooting up like crazy. A recent report showed they're increasing by about 14% each year. That means what you pay for healthcare today could double in just five years! Can your employees keep up with that? Probably not. Sure, medical tech is getting better, but it also comes with a hefty price tag. Plus, experts are saying we might see more pandemics like COVID-19 in the future. So, how can you make sure your team can get the care they need when they need it most?

Sure, medical tech is getting better, but it also comes with a hefty price tag. Plus, experts are saying we might see more pandemics like COVID-19 in the future. So, how can you make sure your team can get the care they need when they need it most?

Listen, offering health insurance isn't just a nice perk anymore – it's essential. Smart companies know that group health insurance is a game-changer when it comes to attracting and keeping great employees. By investing in good health coverage, you're not only protecting your team's health, but you're also showing them you care. And that builds loyalty and a happier workforce.

Even though it's not mandatory in India yet, tons of companies, big and small, are offering Group Health Insurance.

Why? Because they know it's a smart investment in their team's well-being and a great way to boost morale and loyalty.

We're not some giant corporation with a zillion layers of bureaucracy.

We're a bootstrapped company, so we understand your challenges and your budget constraints better than our competitors. Let us help you find a plan that ticks all the boxes without costing a fortune.

Understanding Group Health Insurance Costs

Group Health Insurance is a collective policy offered by employers to cover their employees' medical expenses. While the initial premium costs may seem high, it's crucial to evaluate these expenses against the potential financial impacts of employee absenteeism and turnover caused by health-related issues.

Average Costs of Group Health Insurance:

The Financial Impact of Employee Absenteeism

Absenteeism, often driven by untreated health conditions, poses a substantial financial burden on organizations. According to various studies:

Turnover Costs Due to Health Issues

High turnover rates not only disrupt team dynamics but also incur additional costs for the organization

Return on Investment (ROI) for Comprehensive Health Plans

Investing in comprehensive Group Health Insurance can yield substantial returns for businesses:

By offering a strong health plan, employers can reduce absenteeism and turnover significantly. The cost savings from fewer sick days and lower turnover can often outweigh the premium costs.

Healthy employees contribute to higher productivity levels. Investing in their health can lead to a more engaged workforce, resulting in improved business performance.

A competitive health insurance plan is a strong attraction for top talent. Companies that prioritize employee well-being can improve their brand reputation and attract skilled professionals.

For every ₹1 spent on employee health benefits, companies can see returns in productivity, morale, and reduced healthcare costs. The ROI can range from 2:1 to 6:1, depending on the industry and the specific health initiatives implemented.

Want to keep your employees happy, healthy, and productive? Group Health Insurance is the answer! Here's why:

Reduce Employee Turnover:

Companies with great benefits, like Group Health Insurance, keep their employees 20% longer. (SHRM)

Boost Productivity

Healthier employees are more productive employees! Group Health Insurance can increase productivity by 15%. (SHRM)

Support Families

Many companies now offer coverage for families, showing they care about their employees' well-being. (Corporate Benefits Survey)

Close the Health Insurance Gap

Only 22% of employees in India have health insurance. Make a difference with Group Health Insurance. (IRDAI)

Stay Ahead of Rising Healthcare Costs

Healthcare in India is getting expensive, but Group Health Insurance helps you manage those costs. (Acko India Health Report 2024)

Fewer Sick Days

Group Health Insurance can reduce employee sick days by up to 27%. (WHO)

Attract Top Talent

More than 60% of employees say health insurance is a must-have. (Glassdoor)

Prioritize Mental Health

Offering mental health support can reduce employee turnover by 20%. (Deloitte)

Save on Taxes

Did you know you can get tax benefits by offering Group Health Insurance? (Income Tax Act, India)

Get a Great Return on Your Investment

Investing in your employees' health can save you money and boost their performance. (CDC)

Need help choosing the right health insurance? Here's a simple guide to the key

differences between Group and Individual plans:

| Feature | Group Health Insurance | Individual Health Insurance |

|---|---|---|

| Waiting Periods | Often waived, even for pre-existing conditions | Waiting periods for specific conditions or pre-existing diseases |

| Tax Benefits | Employers get tax breaks | Individuals can claim tax deductions |

| Premium Increases | Based on the group's claims history | Based on age and medical inflation |

| Adding/Removing Members | Easy to add or remove members as needed | Limited additions, usually only at renewal |

| Who Pays? | Usually paid by the employer | Paid by the individual |

| Coverage for Older Adults | Easier to get coverage for older employees and parents | Can be difficult to get coverage for older parents |

| Renewal Guarantee | Insurers might not renew coverage in some cases | Renewal is usually guaranteed |

| Switching Insurers | Easy to switch, with pre-existing conditions covered | Switching might require medical check-ups |

While a group health insurance is not a one-size-fit-all solution, the element of Customization is what makes it unique.

Your ideal group health insurance plan is one that matches the benefits you seek for your employees, with the cost you are willing to pay for these benefits.

Lets curate a plan that you might consider to be ideal for your employees. Here’s a list of benefits that such a plan should include

| Feature | Definition | Ideal Cover sought |

|---|---|---|

| Corporate Buffer | Extra Sum Insured available to the group as a whole - this sum insured can be availed in case of emergencies and when the Individual's Sum Insured has been exhausted. | About 10 times of your employee sum insured |

| Reasonable & Customary charges | The typical cost for a specific medical service in a given geographic area. Insurance providers negotiate rates with hospitals, and these negotiated rates are often considered reasonable and customary - most deductions also happen under this head. | Should be waived |

| Readmore.. | ||

| Modern Treatments coverage | Coverage for advanced medical treatments and procedures, which may include targeted therapies, robotic surgery, and other innovations. | 100% of Sum Insured |

| Domiciliary Hospitalization | Coverage for medical treatment taken at home under the advice of a physician, which would otherwise require hospitalization. This often applies to situations where hospital beds are unavailable or when home treatment is more appropriate. | 100% of Sum Insured |

| Psychiatric Treatment | Coverage for mental health conditions, including inpatient (IPD - In Patient Department) hospitalization and outpatient (OPD - Out Patient Department) consultations. | IPD & OPD |

| Group to Retail portability | The option for an employee to continue their health insurance coverage under an individual policy (retail) if they leave the company (group). This ensures continuous coverage without having to serve a waiting period for pre-existing conditions. | Allowed for all exiting employees |

| Room Rent | The maximum amount an insurer will pay for a specific type of hospital room. Policies with "no capping" offer more flexibility and avoid potential out-of-pocket expenses related to room charges. | No capping |

| Air Ambulance | Coverage for transportation to a hospital via helicopter or airplane in critical medical emergencies. | No capping |

| Coverage of non medicals in case of employee death | Coverage for expenses beyond medical treatment when an employee passes away, such as transportation of the body, funeral expenses, or other related costs. | No capping |

| Dependent coverage in case of employee death | Continuation of health insurance coverage for the employee's dependents (spouse and children) for the remaining policy year if the employee dies. | Throughout the balance policy year |

| Obesity Surgery | Coverage for bariatric surgical procedures to treat morbid obesity. | 100% of Sum Insured |

| Recovery benefit for employees hospitalized over ten days | A lump-sum payment to employees who are hospitalized for an extended period (typically over 10 days) to help with incidental expenses related to recovery. | 5 to 10% of Sum Insured |

| Pre & Post Hospitalization expenses | Coverage for medical expenses incurred before (pre) and after (post) hospitalization for a specific period. These often include diagnostic tests, consultations, medications, and follow-up care. | Reimbursement on actuals for 90 days in case of pre hospitalization and upto 180 days in case of post hospitalization. |

| Ayurvedic Treatment | Coverage for medical treatments and therapies within the traditional Indian system of Ayurveda. | 100% of Sum Insured |

| Coverage for same gender partner/ live-in partner/ LGBTQ+ community | Extends health insurance benefits to same-gender partners, individuals in live-in relationships, and members of the LGBTQ+ community, offering the same coverage as legally married spouses. | Allowed |

| Dioptre parameter coverage for Lasik Surgery | Coverage for Lasik or other refractive eye surgeries to correct vision. The dioptre parameter specifies the range of correction covered by the insurance. | upto +- 5.5 D |

| Maternity Limits | Specifies the maximum coverage available for maternity-related expenses, including prenatal care, childbirth, and postnatal care. Some policies may also limit the number of covered pregnancies. | Sum Insured Allowed for upto three children |

| Delivery charges for surrogate mother | Coverage for medical expenses related to the delivery of a child through surrogacy. | 100% of Sum Insured |

| Infertility Treatment | Coverage for diagnostic procedures, medications, and assisted reproductive technologies (ART) like IVF to treat infertility. | 100% of Sum Insured |

| Egg freezing cover &/ or retreival | Coverage for the process of freezing a woman's eggs for future use (fertility preservation), including the costs of retrieval and storage. | 100% of Sum Insured |

| Cochlear Implant Treatment | Coverage for the surgical procedure and device implantation to restore hearing in individuals with severe hearing loss. | Certain % of Employee Sum Insured |

| Cyberknife Treatment | Coverage for stereotactic radiosurgery using the CyberKnife system, a non-invasive treatment for tumors and other medical conditions. | Certain % of Employee Sum Insured |

| Blood transfusion for anemia Cover on OPD/ daycare basis | Coverage for blood transfusions required due to anemia, even if administered in an outpatient (OPD) or daycare setting (where the patient doesn't stay overnight). | Certain % of Employee Sum Insured |

| Parkinson's and Alzheimer’s Diseases | Coverage for medical expenses related to the diagnosis, treatment, and management of Parkinson's and Alzheimer's diseases, both of which are neurodegenerative conditions. | Certain % of Employee Sum Insured |

| Avastin/ Lucentis/ Macugen/ Inj Rituximab/ FESS | Coverage for specific injectable medications (Avastin, Lucentis, Macugen, Rituximab) and Functional Endoscopic Sinus Surgery (FESS), often used in the treatment of various conditions, including cancer, macular degeneration, and chronic sinusitis. | Certain % of Employee Sum Insured |

| Internal Congenital / External Congenital incase of Life Threatening situations | Coverage for birth defects or abnormalities present from birth, whether internal or external, that pose a threat to the child's life. | 100% of Sum Insured |

| Day Care Treatments, Organ Donor Cover, Terrorism, Pandemic | Day Care Treatments: Coverage for medical procedures not requiring overnight hospitalization. Organ Donor Cover: Covers medical expenses for organ donors, often their surgery and aftercare. Terrorism: Protection against injuries or health issues from terrorist acts. Pandemic: Coverage for illnesses and treatment during a declared pandemic. | 100% of Sum Insured |

| Waiver of all waiting periods (including waiting period for pre-existing diseases) | This means that the insurance coverage is effective from the very first day of the policy (Day 1). Typically, health insurance policies have waiting periods before certain treatments or pre-existing conditions are covered. A waiver eliminates these waiting periods, providing immediate coverage. | Covered from Day 1 |

| Copayment outside of network hospitals | Insurers typically apply a copay when the hospitalization is in a out of network hospital; but you can ask for elimination of this so that your employee is not bound by the hospital that is a part of a Insurer network. | Not Applicable |

| Disease wise sublimits | These are limits on the amount the insurer will pay for specific diseases or treatments. For example, there might be a sublimit for cataract surgery or knee replacement. | Not Applicable |

| Copayment for delay in intimation or submission of claim | Some policies impose a copayment or penalty if you don't notify the insurer about your hospitalization or submit your claim within a specified timeframe. | Not Applicable |

| View less.. | ||

As mentioned, the element of Customization is what gives the product - Group Health Insurance - its beauty. While you have the ability to choose almost anything under the Sun, there are some things which might be typically excluded. Understanding what is included and what is excluded from your policy is what will give you a good amount of control over it. Listed are some of the typical inclusions and exclusions in a group health insurance policy -

| Feature/Benefit | Typically Included | Typically Excluded |

|---|---|---|

| Hospitalization | Charges for room, Doctor's fees, Surgery, ICU, Medicines, Nursing care, Operating theatre charges | Cosmetic & Aesthetic procedures (unless medically necessary for reconstruction after an accident, etc.), Experimental treatments, War-related injuries, Treatments for self-inflicted injuries, Lifestyle-related medical conditions (e.g., due to substance abuse) |

| Day-Care Procedures | Procedures not requiring overnight stay (e.g., cataract surgery) | |

| Ambulance | Emergency ambulance services | |

| Maternity Benefits | Maternity expenses (pre-natal, delivery, post-natal) | Infertility treatments, Abortion (unless medically necessary) |

| Newborn Coverage | Coverage for newborn babies from birth | |

| Pre-existing Diseases (PeD) | May be covered after a waiting period | Excluded during the waiting period |

| Specific Diseases | May be covered from day one with higher premium or after a waiting period | May have waiting periods (can be waived with higher premium) |

| Mental Health | Increasingly included, but may have limitations | |

| OPD Consultations & Diagnostic Tests | May be included as an add-on or with a higher premium | Typically excluded |

| Dental & Vision Care | May be offered as an add-on | Typically excluded (unless due to an accident) |

| Alternative Therapies | Typically excluded | Services such as acupuncture, chiropractic care, and holistic treatments are commonly excluded |

| STD Treatments | Typically excluded | HIV/AIDS and other STDs are typically excluded |

| Dependents & Family Coverage | Coverage can be availed for spouse, children and parents/ in-laws | |

| High-Cost Specialized Treatments | Typically excluded | Some plans may not cover advanced or experimental treatments |

| Experimental Treatments | Typically excluded | Excluded |

We keep mentioning that anything and everything can be typically covered under a Group Health Insurance policy. But a group health insurance has a basic structure. And while you can request additional coverages or enhancements to additional coverages by paying an additional premium, the fact of the matter remains that you have to request for these add-ons and the Insurer has to agree to them.

Listed are some of the common add-ons where you can either request for additional coverage or enhancement to the base coverage

you can request for additional coverage under these add-ons. Additional coverages are typically requested for Room Rent/ ICU charges, maternity, specific hospitalizations like cataract.

you can request for an additional sum insured for the group as a whole. This cover typically kicks in when an employee has exhausted his individual coverage under the policy.

you can request for cash allowance for employees to take care of incidentals during hospitalization.

Day 1 coverage for all hospitalizations including pre-existing diseases.

this add-on eliminates your employee from paying any extra monies for hospitalizations that are not in your approved city.

Picking the right Group Health Insurance can be tough. Here's a breakdown to help you make the best choice for your team:

ESI and Group Health Insurance: Do I Need Both?

Even if you're paying for Employee State Insurance (ESI), it's worth considering a Group Health Insurance plan to give your employees better coverage and care.

Keep Up with the Competition

Check what other companies in your industry are offering for health insurance. Make sure your benefits are competitive (or even better!).

How to Pay for the Plan

You can pay the entire premium yourself, or you can share the cost with your employees.

Covering Remote and Hybrid Teams

Make sure your plan works for employees who work remotely or in a hybrid setup.

Get It in Writing

Have a clear agreement with your insurance broker that outlines all the services they'll provide.

Technology and Health Insurance

Embrace technology for easier enrollment, claims management, and even virtual doctor visits.

Wellness Programs = Happy and Healthy Employees

Look for plans that include wellness programs. They can help your employees stay healthy and reduce your overall healthcare costs.

Should I Cover Contract Workers?

If your contract workers don't have their own health insurance, it's a good idea to include them in your Group Health Insurance plan.

Covering Employees' Parents

Many companies now offer coverage for employees' parents. It's a great way to show you care about their families.

Fast and Easy Claims

Make sure your insurance broker can handle claims quickly and efficiently.

Flexible Benefits for Everyone

Let your employees customize their benefits! They can choose options like higher coverage or adding family members.

By following these tips, you can create a Group Health Insurance plan that meets your company's needs and keeps your employees happy and healthy!

Okay, so you're trying to pick the right group health insurance. It's a jungle out there! 30+ companies are all screaming "Pick me! Pick me!" with a zillion different plans. Five of them are Standalone Health Insurers, each with their own unique vibe.

But wait, there's more! The insurance world is about to explode! Life insurers might be crashing the health insurance party. Can you imagine? Twice the companies, twice the chaos! Don't worry, this guide is your secret weapon. We'll arm you with the knowledge to slice through the confusion and choose like a boss.

Choosing the right insurer for your Group Health Insurance policy is a strategic decision. By evaluating factors like underwriting philosophy, claims processing capabilities, hospital network, and cost-saving opportunities, and partnering with an experienced Insurance Broker, you can secure a Group Health Insurance plan that provides reliable service, competitive premiums, and significant value for your employees.

At Ethika, we believe that a healthy workforce is a happy and productive one. That's why we are proud to offer free health camps as part of our Corporate Social Responsibility (CSR) initiatives. Our comprehensive health camps bring essential healthcare services directly to your workplace, promoting employee well-being and fostering a culture of health and wellness.

At Ethika Insurance Broking, we specialize in providing Group Health Insurance for software and ITES companies. Our step-by-step approach goes beyond simple insurance coverage, creating a comprehensive experience that engages employees and enhances their well-being. Here’s how we ensure your Group Health Insurance plan delivers maximum value through structured, effective implementation.

Onboarding is the foundation of a successful Group Health Insurance plan. We work closely with HR teams to make enrollment easy and transparent. With digital tools, online portals, and interactive sessions, we ensure each employee is informed and enrolled without hassle, laying the groundwork for a seamless experience with their health benefits.

A well-informed workforce is key to fully utilizing health insurance. Through webinars, email campaigns, informative guides, and dedicated FAQ resources, we educate employees on the specifics of their health coverage. Employees learn about core benefits, cashless treatments, and wellness add-ons, making them confident in their coverage and ready to access their benefits when needed.

Ready to give your employees comprehensive health coverage and wellness support? Partner with Ethika Insurance Broking for a Group Health Insurance plan that delivers security, wellness, and peace of mind. Connect with us to discuss how we can help you create a healthier, happier workplace with a plan that meets your company’s unique needs.

Our Group Health Insurance plans don’t stop at coverage—they include proactive wellness programs to keep employees healthy and engaged. We offer customized wellness programs that address preventive care, fitness challenges, mental health resources, and nutritional guidance. These programs foster a healthier, more productive workforce, reducing overall health costs and increasing employee loyalty and retention.

Your company's needs and your employees' expectations are constantly evolving. That's why we prioritize gathering feedback from both HR teams and employees on an annual basis. This valuable input, combined with detailed data analysis, allows us to pinpoint areas where your Group Health Insurance plan can be enhanced. By making data-driven adjustments at each renewal, we ensure your plan remains relevant, valuable, and perfectly aligned with the changing needs of your workforce.

The claims process can be complex, which is why we provide personalized claims assistance tailored to each employee’s needs. Our expert claims support team guides employees through each step, from documentation to final approval, ensuring fast, efficient claims processing. This personalized support creates a positive experience, enhancing employee trust and satisfaction with their Group Health Insurance plan.

So, you have implemented the group health insurance policy and are happy about it. But as the year goes by, you keep hearing complaints - some times about operational issues, at other times about the coverages.

You want to change all of that when you renew your policy. How do you go about it?

Employee Benefits Surveys help you do precisely that. They capture the psyche of what your employee is going through and translate that into an objective answer for you. These can be administered about a couple of months prior to your renewal.

What is group health insurance?

What is the difference between group health insurance and individual health insurance?

Can group health insurance be ported to an individual policy?

Yes, individuals covered under a group health insurance policy can migrate to an individual health insurance policy with the same insurer. This migration should be requested at least 45 days before the group policy renewal date. Continuity benefits, such as waiting periods for pre-existing diseases, are typically carried over to the new individual policy.

How to choose the best group health insurance plan in India?

Selecting the optimal group health insurance plan involves evaluating factors like coverage scope, network hospitals, claim settlement ratio, customization options, and premium costs. Given the complexities involved, consulting with an experienced insurance broker can provide valuable insights tailored to your organization's specific needs.

Which health insurance is best in India?

Determining the best health insurance plan depends on individual requirements, including coverage needs, budget, and specific health considerations. Engaging with a knowledgeable insurance broker can help navigate the myriad options and identify a plan that aligns with your personal or organizational health objectives.

What does employee health insurance cover?

Employee health insurance, often part of a group health insurance policy, typically covers hospitalization expenses, pre and post-hospitalization costs, daycare procedures, and sometimes extends to cover dependents. The exact coverage can vary, so it's advisable to review the policy details or consult with an insurance professional for clarity.

Can parents be included in employee health insurance plans?

What are the tax benefits of group health insurance for employers?

How does group health insurance benefit employees?

Employees benefit from group health insurance through lower premiums, immediate coverage without waiting periods for pre-existing conditions, and additional benefits like maternity coverage. Such policies often do not require medical examinations, making healthcare more accessible.

Are pre-existing conditions covered under group health insurance?

How can an insurance broker assist in selecting a group health insurance plan?

Are wellness benefits included in group health insurance policies?

Yes, many group health insurance policies in India incorporate wellness benefits aimed at promoting healthier lifestyles among employees. These benefits often include preventive health check-ups, fitness programs, nutritional counseling, and mental health support. For instance, some insurers offer reward systems for employees who meet health and wellness goals, fostering active participation in maintaining well-being.

However, the availability and extent of these benefits can vary between insurers and specific policies. It's advisable to review the policy details or consult with an insurance advisor to understand the wellness benefits included in a particular group health insurance plan.