The Indian tax landscape has seen some significant changes in recent years, particularly with the introduction of the New Tax Regime (NTR) in 2020. While the Old Tax Regime (OTR) continues to exist, taxpayers now face a crucial decision: which regime best suits their financial needs? Choosing the right one can significantly impact your final tax liability, so understanding the origins, current status, and key differences between these two options is essential.

What’s on this page?

The Genesis of Reform: Unveiling the New Tax Regime

Prior to 2020, the Indian tax structure was often viewed as complex and riddled with deductions and exemptions. Recognizing this complexity, the government introduced the NTR as part of the Union Budget 2020-21. The aim was to simplify the system and cajole taxpayers towards the New Tax Regime.

Why? The Government has been subsidizing taxpayers via tax exemptions for some time now. The Government has also tried to inculcate a sense of discipline by offering tax exemptions under sections catering to health insurance, home loans and the like. The tax burdens were increasing. The Government felt it was time that a new tax regime be introduced where subsidies could gradually be phased out.

Naturally the Government had to offer lower interest rates in the NTR for people to think of switching. Another psychological maneuver was asking people to opt out of NTR instead of asking them to opt in to it. The new regime has thus far existed alongside the OTR, allowing taxpayers to choose between them.

Let’s now look at the Budget of 2024 and try and understand which tax regime is more appropriate for you –

The first crucial step in tax planning is determining which tax regime suits you best. A thorough comparison of the old and new tax systems, considering your eligible deductions and exemptions, is essential.

You can also get a rough estimate of your tax liability at the income tax departments website by logging onto https://eportal.incometax.gov.in/iec/foservices/#/dashboard/estimator

You can utilize the income tax department’s tax calculator to assess which regime aligns with your financial situation.

Here’s how the Old Tax Regime stacks up against the New Tax Regime purely on the basis of income slabs –

| Taxable income | Old tax regime (individuals below 60 years) | Old tax regime (Senior citizens between 60 to 80 years) | Old tax regime (Very senior citizens between 60 to 80 years) | New Tax Regime (For all age group) |

| 0 to 2,50,000 | Nil | Nil | Nil | Nil |

| 2,50,001 to 3,00,000 | 5% | Nil | Nil | Nil |

| 3,00,001 to 5,00,000 | 5% | 5% | Nil | 5% |

| 5,00,001 to 6,00,000 | 20% | 20% | 20% | 5% |

| 6,00,001 to 9,00,000 | 20% | 20% | 20% | 10% |

| 9,00,001 to 10,00,000 | 20% | 20% | 20% | 15% |

| 10,00,001 to 12,00,000 | 30% | 30% | 30% | 15% |

| 12,00,001 to 15,00,000 | 30% | 30% | 30% | 20% |

| Above 15,00,000 | 30% | 30% | 30% | 30% |

The tax slab alone however cannot be the only criteria for selecting the Tax Regime. While the New Tax Regime might give you slightly more cash in hand, it also makes you responsible for your long term investment.

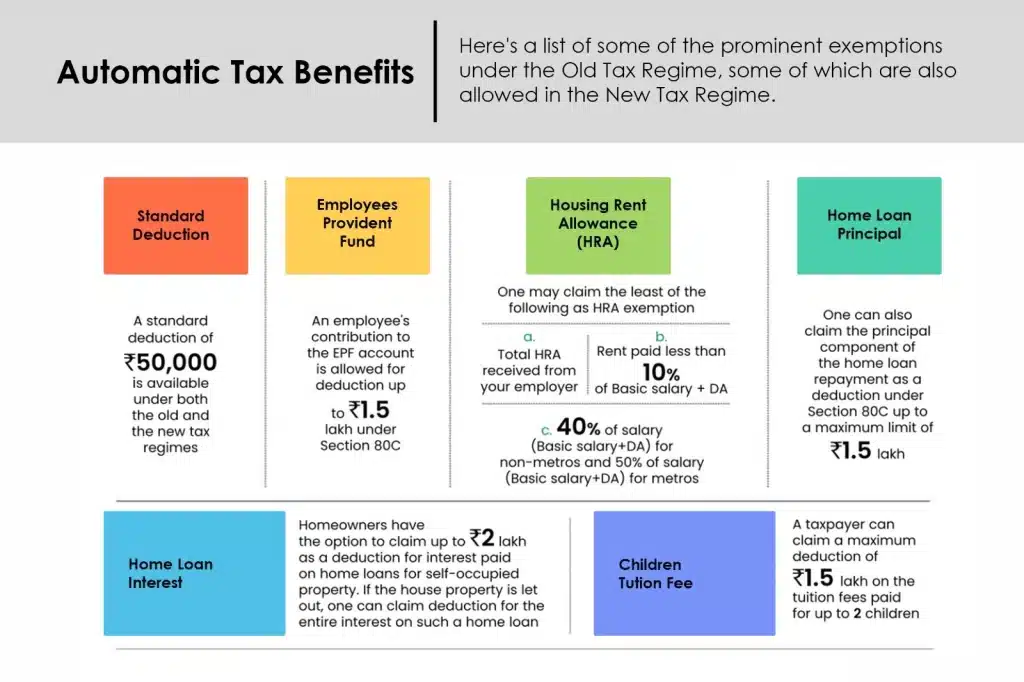

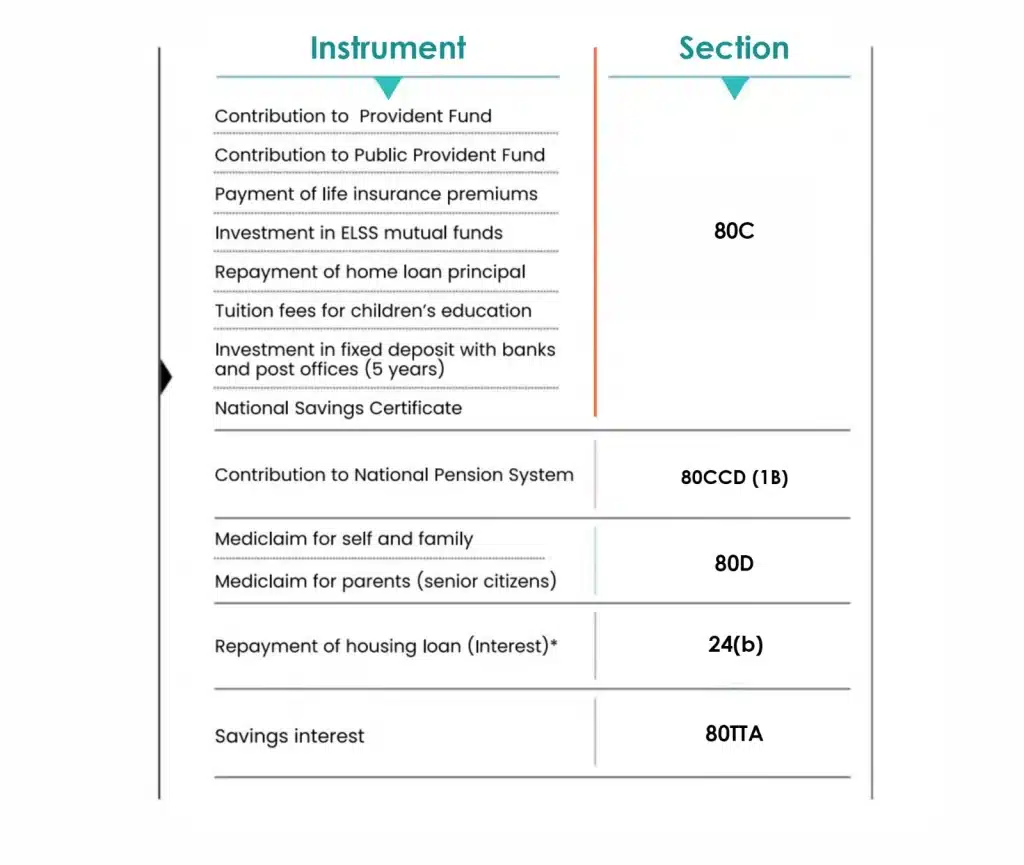

Here’s a look at some of the instruments and the prominent Sections where you get exemptions under the Old Tax Regime

How then, should you decide as to which Tax Regime is more appropriate for you?

While there’s no absolute “thumb rule” to answer the question, here are some general guidelines to help you decide which tax regime might be more appropriate for you:

Old Tax Regime (OTR) might be better if

- Your income is moderate (₹5 Lakhs – ₹10 Lakhs): Standard deduction in NTR might not fully compensate for potential OTR deductions.

- You extensively utilize deductions and exemptions: Sections like 80C, 80D, etc., can significantly reduce taxable income in OTR.

- You have complex financial planning: OTR offers more flexibility for deductions and planning strategies.

- You prefer familiarity and are comfortable with paperwork: OTR might be more familiar if you’ve used it previously.

New Tax Regime (NTR) might be better if:

- Your income is high or very high (Above ₹10 Lakhs): Lower NTR rates might benefit you even with fewer deductions.

- You don’t utilize many deductions or prefer simplicity.

- You expect your income to increase significantly in the future: Lower NTR rates can be more advantageous in the long run.

- You value convenience and appreciate lower upfront tax rates: NTR offers a simpler filing process and potentially lower immediate tax burden.

Choosing between the OTR and NTR requires careful consideration of several factors, including your income level, investment habits, and future financial goals. While the NTR offers simplicity and potentially lower tax rates, the OTR might be advantageous for those who can effectively utilize deductions. Analyzing your individual circumstances and consulting a tax advisor can help you navigate this decision and choose the regime that optimizes your tax liability.

FAQs

I earn around ₹7 lakhs per year. Should I opt for the Old Tax Regime (OTR) or the New Tax Regime (NTR)?

For an income of ₹7 lakhs, the decision is relatively close. If you utilize deductions like those under sections 80C, 80D, etc., effectively, the OTR might still be beneficial. However, if you don’t claim many deductions and value simplicity, the NTR’s lower tax rates could be attractive. Consider consulting a tax advisor for a personalized recommendation.

I don’t have much knowledge about tax deductions and find paperwork overwhelming. Is the NTR a good choice for me?

Yes, the NTR is likely a good fit for you. Its minimal deductions and exemptions simplify the filing process, reducing paperwork and hassle. While you might miss out on some potential tax savings, the convenience and lower upfront tax rates could be valuable.

I’m planning for retirement and invest heavily in long-term investment plans. Should I stick with the OTR?

The OTR might be advantageous in your case. The wider range of deductions allows you to claim exemptions for investments like PPF, ELSS, etc., potentially reducing your taxable income and boosting your retirement savings.

My income is expected to increase significantly in the coming years. Which regime is better in the long run?

While the NTR’s lower rates might seem tempting, consider the future impact. As your income grows, you might miss out on significant tax savings from deductions offered by the OTR. Analyzing your projected income growth and potential deductions can help determine the best long-term strategy.

Can an individual change between OTR and NTR every year?

Yes, individuals can switch between the OTR and NTR every year. They have the option to choose the regime they prefer during the tax filing process.