Corporate Health Insurance has garnered a lot of attention, especially over the last 5 years. The onset of Covid has sent the world into a tailspin and health was the top priority on everyone’s mind.

Corporates who were not offering health insurance as a benefit adopted it in haste, while the ones who were already offering the benefit, upgraded to incorporate mental wellness during Covid.

But the Indian health insurance market is big. We have about 30 players who provide health insurance spread across three broad spectrums. In this short piece we will broadly look at the service providers of health insurance. We will also look at coverages to consider when onboarding a corporate policy – what are must have coverages, and which ones can be looked at from a cost sensitive perspective. We will also look at limitations of corporate policies and the exclusions in corporate health insurance.

Let’s have a comprehensive overview of corporate health insurance in India, including its benefits, considerations, and top providers.

At Ethika, we understand how important your corporate health insurance policy is. We ensure that you understand all the fine print in the policy. But more importantly, we understand the health insurance market. We understand what should be the appropriate pricing for an optimum cover.

Our claims settlement expertise has garnered us rave reviews on Google and we take pride in it.

What’s on this page?

TL;DR- Corporate Health Insurance Companies

India is home to three broad categories of Insurance Companies. Listed are the three categories with the Insurer mentioned in each

- New India Assurance

- Go Digit General Insurance

- HDFC General Insurance

- IFFCO Tokio General Insurance

- ICICI General Insurance

- Aditya Birla Health Insurance

- Star Health & Allied Insurance

What Is Corporate Health Insurance?

Group health insurance is a type of health insurance policy that provides health insurance coverage to a group of members under a single policy. The policy compensates the insured members of the policy up to the sum insured limit mentioned under the policy in return for a premium amount. Group health insurance policy is usually taken for a period of 1 year, after which the policy can be renewed on payment of renewal premium.

Group health insurance policy doesn’t require pre-policy medical checkups, unlike personal health insurance policies, which might require pre-acceptance policy checkups depending on the type of proposal. The sum insured under the group health insurance policy will be decided by the employer, it is the employer who generally pays the premium under the group health insurance policy.

There might be instances where the premium for a group health insurance policy is collected from the employees of the organization.

The coverage under the group health insurance may vary for the employees. There might be the different sum insured options under a single group health insurance policy. A group health insurance policy can be taken on an individual basis as well as a floater basis.

In individual policy only the employees of the organization would be covered and the sum insured availability would be restricted to them only.

In the case of floater policies, the sum insured would be floating among the family members who can utilize the sum insured without any restrictions.

The premium under the group health insurance policy depends on the number of members in the policy, the age of the employees, and the sum insured required. The higher the overall sum insured under the policy, the higher would be the premium to be paid under the policy.

A group health insurance policy requires a minimum of 7 members to be covered under the policy to satisfy the minimum number of lives requirement.

As per the Insurance Regulatory and Development Authority of India, it is mandatory to have at least 7 members under the group health insurance policy to avail of the coverage.

The premium would vary from one insurance company to another and also the minimum number of lives requirements. There are certain companies that have a minimum requirement of 15 members and certain companies which have a minimum requirement of 7.

It is advisable to go through an insurance broker while purchasing the group health insurance policy as the insurance brokers would be well versed with the terms and conditions of the policy and deal with multiple insurance companies.

Insurance brokers can advise the customer on the insurance company depending on their requirements. Insurance brokers also offer value-added services in addition to regular services.

Coverage in Corporate Health Insurance:

Understanding the coverage provided by corporate health insurance is crucial for both employers and employees.

Let us now look at the specific coverages offered by corporate health insurance plans, highlighting their key benefits:

- In-patient hospitalization expenses incurred by the insured members up to the sum insured mentioned under the policy.

- Day care hospitalization expenses incurred by the insured members up to the sum insured mentioned under the policy.

- Room rent and ICU expenses as specified under the policy.

- Pre and post hospitalization expenses for a certain number of days as mentioned under the policy. Pre hospitalization expenses cover the expenses incurred prior to the hospitalization whereas the post hospitalization expenses includes the expenses incurred after the hospitalization and discharge from the hospital.

- Emergency ambulance charges on a per event basis or per hospitalization basis.

- Waiver of all the waiting periods under the policy. Pre-existing waiting period is the waiting period for the conditions that exist prior to the inception of the policy. The specific waiting period in which certain illnesses would be covered only after a certain period of time. An initial waiting period of 30 days where no illness or disease related expense would be covered except for accident related hospitalization expenses.

- Group health insurance policy also covers maternity expenses. The expenses incurred by the insured members for maternity and other related would be covered under the policy up to a certain sum insured limit. The maternity sum insured would be over and above the basic sum insured under the policy.

- Group health insurance policy also covers the newborn baby. All the vaccination and other related expenses incurred by the newborn baby would be covered under the policy. The newborn baby cover would include the sum insured either from the basic sum insured or the maternity sum insured.

- Cashless claim settlement service at any of the network provider hospitals. Network provider hospitals are the hospitals that are tied up with the insurance company to offer cashless claim settlement to the insured customers.

- No requirement for pre-policy medical checkup under the group health insurance policy.

- The policy can also be extended to cover the family members of the insured employee on payment of additional premium.

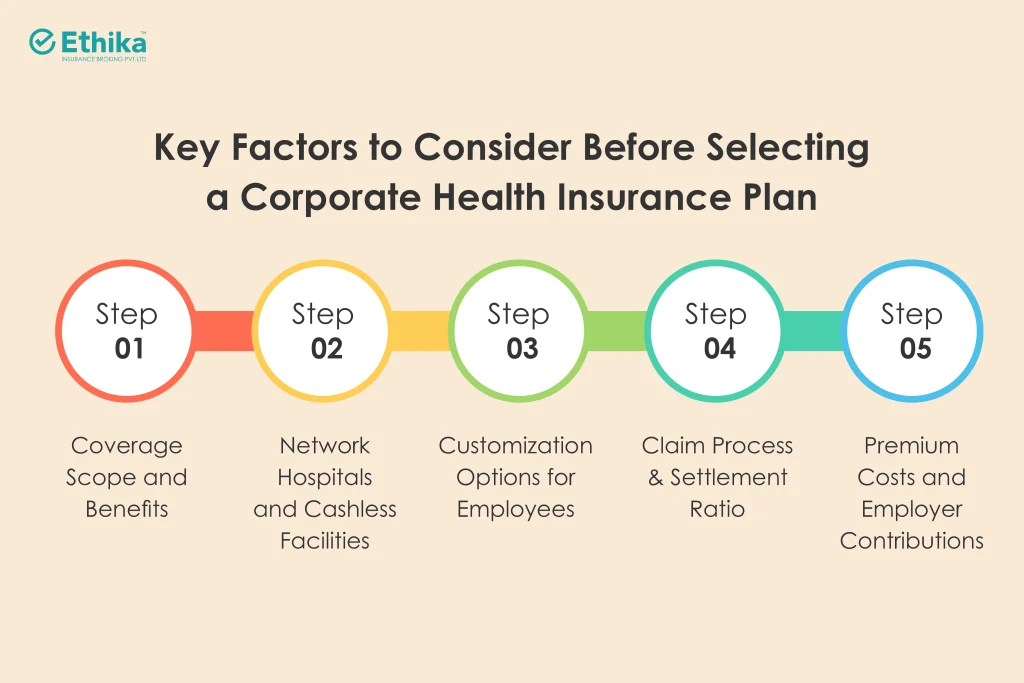

Key Factors to Consider Before Selecting a Corporate Health Insurance Plan

Choosing the right corporate health insurance plan is a crucial decision for any business. It’s essential to carefully evaluate various factors to ensure the plan aligns with your employees’ needs and your company’s budget. Here are some of the key factors to consider before you take the plunge –

Coverage Scope and Benefits

The plan should offer comprehensive coverage, including in-patient hospitalization, day-care procedures, pre- and post-hospitalization expenses, maternity benefits, and coverage for modern treatments. Look for plans with value-added benefits like wellness programs to increase the scope and the benefits under the program.

Network Hospitals and Cashless Facilities:

A wide network of hospitals ensures that your employees have access to quality healthcare without the hassle of paying money out-of-pocket. Check for maximum hospital coverage in cities where your employees are centered.

Customization Options for Employees

Customization is one of the key benefits of a group policy. Look for plans that allow you to choose the add-ons that suit your employee needs. This flexibility enhances employee satisfaction while also ensuring that the plan caters to diverse needs.

Claim Process and Settlement Ratio:

A smooth and efficient claim process is crucial for employee satisfaction. Choose an insurer with a high claim settlement ratio, indicating their efficiency in processing claims and providing timely support to your employees during a medical emergency.

Premium Costs and Employer Contributions:

While costs are important, they should not be the anchor that you base your decision on. Balance the cost of premiums with the coverage offered. Explore the option of sharing the cost with employees if need be. Never compromise on the quality of a plan because of the low premium structure.

Difference Between Corporate Health Insurance and Group Health Insurance

While the terms corporate health insurance and group health insurance are often used interchangeably, there are subtle differences:

Coverage Differences

Corporate health insurance plans, often also called Tailor made group health insurance plans, may offer a wider range of benefits and higher coverage limits compared to standard group health insurance plans. They may also include additional features like wellness programs, international coverage, and mental health support.

Customization Flexibility

Corporate health insurance plans often provide greater flexibility in customizing coverage for different employee groups within the company.

Premium Costs and Employer Contributions

Premium costs for corporate health insurance plans may be higher due to the enhanced coverage and flexibility.

Advantages of Buying Corporate Health Insurance for Startups and SMEs

Corporate health insurance offers several advantages for startups and SMEs; let us look at some of them in detail –

Affordable Premiums for Small Businesses

Corporate health insurance plans generally offer affordable premiums compared to individual plans, making them a cost-effective option for small businesses.

Tax Benefits for Employers

Premiums paid for corporate health insurance are often tax-deductible as a business expense, providing financial benefits for employers.

Employee Well-Being and Retention

Offering health insurance is a valuable benefit that can enhance employee well-being, improve morale, and increase employee retention. It can also be a powerful tool for attracting top talent in a competitive job market.

Top Corporate Health Insurance Companies in India:

Listed are the top corporate health insurance companies in India

- ICICI Lombard group health insurance policy can be purchased online from here.

- Bajaj Allianz group health insurance policy can be purchased online.

- IFFCO Tokio general insurance group health insurance policy can be purchased from here.

- New India assurance group health insurance policy can be purchased from here.

- Royal Sundaram group health insurance policy can be purchased online.

- TATA AIG group health insurance policy can be purchased online.

- Oriental insurance group health insurance policy can be purchased online.

- New India group health insurance policy can be purchased from here.

- Go Digit group health insurance policy can be purchased from here.

- HDFC Ergo group health insurance policy can be purchased from here.

- Star group health insurance policy can be purchased from here.

- Care group health insurance policy can be purchased from here.

- Aditya Birla group health insurance policy can be purchased from here.

Top Corporate Health Insurance Companies for Large Enterprises

Large enterprises have unique healthcare needs, requiring comprehensive coverage and tailored solutions for their diverse workforce. Several leading insurance companies in India specialize in providing corporate health insurance plans designed for large enterprises. These plans typically allow for

Plans Designed for Big Organizations

These plans cater to the specific needs of large companies, with flexible options for coverage levels, premium structures, and employee enrollment.

Comprehensive Coverage Options

They offer a wide range of coverage, including in-patient hospitalization, day-care procedures, coverage for modern treatments, and maternity benefits.

Employee Wellness Programs

Many plans include wellness programs that focus on preventive healthcare, health check-ups, and employee assistance programs to promote a healthy work environment.

How to Choose the Best Corporate Health Insurance Company for Your Business

Selecting the right corporate health insurance company is crucial for ensuring your employees receive the best possible care and your business remains protected. Let us look at some key factors that one should consider when choosing the best corporate health insurance company –

Compare Claim Settlement Ratios

Choose an insurer with a high claim settlement ratio (CSR). A high CSR indicates better efficiency in processing claims and providing timely support to your employees.

Evaluate Add-Ons and Riders

Insurers can file for specific add-ons with IRDAI. While most add-ons available in the market are similar, some insurers might file for add-ons that are more beneficial for Customers. Consider the availability of such add-ons that can enhance coverage. Your Insurance Broker should be able to help you with details of Insurers who have filed for such add-ons.

Check Employee Feedback and Satisfaction

Check for other employees feedback on the quality of claims servicing rendered by the Insurer. Your Insurance Broker should be able to help you with these intricate details.

How Corporate Health Insurance Supports Employee Retention and Satisfaction

Corporate health insurance plays a vital role in employee retention and satisfaction by providing a bunch of advantages, some of the prominent ones being:

Impact on Workplace Productivity

A healthy workforce is a productive workforce. Health insurance ensures that employees have access to quality healthcare, leading to better health, reduced absenteeism, and improved productivity.

Wellness and Preventive Healthcare Benefits

Many corporate health insurance plans include wellness programs that promote preventive healthcare, health check-ups, and employee assistance programs, contributing to a healthier and more engaged workforce.

Long-Term Retention Advantages

Offering health insurance as a benefit demonstrates that the company values its employees’ well-being, leading to increased loyalty, higher retention rates, and a stronger employer brand.

Limitations of Corporate Health Insurance Plans Employees Should Know

While corporate health insurance offers valuable benefits, employers should also be aware of the potential limitations of such plans. Some of these limitations include :

Lack of Portability After Job Change

While most insurers do offer portability at the time of employee separation, you should have this documented before buying the policy from the Insurer. Since most employers do allow for portable plans, an employer not being able to provide such a plan can adversely affect the employers brand image.

Coverage Restrictions And Exclusions

Like any insurance policy, corporate health insurance plans have coverage restrictions and exclusions. Employers should carefully review the policy documents to understand the limitations and what is not covered.

Dependency on Employer’s Policy Decisions

The employer ultimately decides on the policy and its features. Employees may have limited control over the coverage options. This can act as a drawback if the employee needs change overtime.

Exclusions in Corporate Health Insurance:

While corporate health insurance plans offer a wide range of benefits, it’s equally important to understand the exclusions. You or your employees should not be caught off guard at the time of claim settlement. Listed are some of the common exclusions under corporate health insurance:

- Group health insurance policy doesn’t cover the injuries arising out of war or war like situations.

- The policy would not cover the expenses related to dental treatments.

- Group health insurance policy would not cover the cosmetic related treatments.

- The policy also doesn’t cover the medical expenses arising out of intentional self-injury or attempt to suicide.

- Experimental treatments are generally excluded from Group Health Insurance.

Conclusion

Today, corporate health insurance is no longer a luxury that can be afforded by rich corporates. It has become a necessity. A lot of smart corporates also use it as an employee attraction and retention tool. Still others make it an integral part of their Employee Value Proposition.

A corporate health insurance is also an advantageous instrument for employees who feel a sense of safety and security under the aegis of a good corporate insurance plan.

It is however important to understand the intricacies of a corporate health insurance before one enrolls into one. Aspects like who to cover, what to cover and how much to cover are important considerations before you onboard a health insurer.

Frequently Asked Questions (FAQs)

What are the Key Benefits of Corporate Health Insurance for Businesses?

Corporate health insurance offers a multitude of benefits for businesses, both large and small. It helps attract and retain top talent by demonstrating a commitment to employee well-being. It boosts employee morale and productivity by reducing stress related to healthcare costs.

How do Corporate Health Insurance Premiums Vary Based on Company Size?

The premium under the group health insurance policy depends on the number of members in the policy, the age of the employees, and the sum insured required. The higher the overall sum insured under the policy, the higher would be the premium to be paid under the policy.

Can Employees Customize their Corporate Health Insurance Plans?

Corporate health insurance plans often provide greater flexibility in customizing coverage for different employee groups within the company. Look for plans that allow you to choose the add-ons that suit your employee needs.

What is the Difference Between Corporate and Retail Health Insurance Policies?

Corporate and retail health insurance differ in several key aspects. Corporate plans, held by employers, offer standardized coverage with potential customization, often at lower premiums due to group discounts.

The most significant difference however is the capping of pre-existing ailments – while corporate plan employees can have coverage from Day 1, retail health insurance policy holders need to wait atleast for a couple of years for such coverage.