Tag: Insurance Company

Money Insurance – Coverage, Add-ons, Exclusions, Benefits

Mr. Agrawal has a trading business wherein he deals with cash mainly. Most of his business is carried out in cash and he would transfer the cash to a nearby bank for deposit on a daily basis. One day when he was taking the cash to the bank in a secured vehicle, he was attacked […]

Read More

India’s Path to Universal Health Coverage: Challenges and Opportunities Explored

The goal of Universal Health Coverage (UHC), which aims to guarantee that all people and communities receive the health care they require without experiencing financial hardship, has become a global priority. This study compares India’s approach with other nations to see whether universal health care can be implemented. It explores the difficulties and possibilities involved […]

Read More

Beat The Heat With These 3 Insurance Plans This Summer

Summer is here and the mercury levels are rising with every passing day. Hyderabad has recorded the highest temperature of 44.2° C in May,2024 and it is further expected to increase in this May. One can find the streets and roads deserted in the afternoon when the intensity of the sun is at its peak. […]

Read More

HDFC Ergo Discontinues 4 Health Insurance Plans – Steps to Take if Your Policy is Withdrawn

Abhay Kapoor, 45, was surprised when he saw a mail in his inbox from HDFC Ergo stating that his health insurance plan “My Health Suraksha” is being withdrawn from the market and he has an option to migrate to “Optima Restore”. Abhay immediately dialed up his agent and was informed that the policy has been […]

Read More

Mitigation Of Risk Through These 51 Hacks By An Insurance Broker

Always keep the Emergency number as your screensaver on your mobile. In case of any accident and you are unconscious, the people nearby will know whom to call without even need of unlocking your mobile Always check the validity of your driver license number online before hiring. Incase of an accident, if the license is […]

Read More

How to Avoid Health Insurance Claim Delays: 5 Out of 10 Patients Face Settlement Issues

The latest report from Pristyn Care highlights that 5 out of 10 patients face hospital discharge delays due to the time taken by the cashless claim settlement process in a health insurance plan. The study also points out that 40% of the delays are attributed to the administrative process in the hospitals. The major challenges […]

Read More

Union Ministry Launched National Health Claims Exchange Platform to Simplify Claims Settlement

Mrs Anuradha, aged 30, married with two kids, working at an MNC, was admitted to a hospital for nerve-related issues. Upon diagnosis, it was found that she had brain tumours that had to be operated on immediately. Anuradha has a personal health insurance plan for Rs.5 Lakhs from XYZ company and a group health insurance policy provided by her […]

Read More

Health Insurance for Smokers: Impact of Tobacco Consumption on your Health Insurance

It is widely believed that people who consume tobacco and other related products would not get any life and health insurance coverage from insurance companies. This was the case a few years ago where the insurance companies used to deny insurance cover for people consuming tobacco and other related products. Insurance companies do offer health […]

Read More

Case Study: Should a Condition by Birth be Considered as Pre-existing?

An interesting case of a pre-existing condition has appeared recently in the news. The National Consumer Forum has directed an insurance company to settle the claim immediately. The consumer forum has also directed the insurance company to pay an additional Rs.80,000 for mental agony and Rs.20,000 towards the litigation charges in addition to the Rs.10,68,160/—medical […]

Read More

Planning to Travel Abroad? Here are The Countries That Mandate Travel Insurance

So, you’re packing up for your next adventure abroad—passport, playlist, and camera ready. But before you board that plane, have you thought about Travel insurance? Nope, it’s not just a boring requirement—it’s actually your ticket to a stress-free journey in case things don’t go as planned. In some countries, travel insurance is a must, and […]

Read More

Here is a Guide on How to Handle a Health Insurance Claim Rejection

Most of us buy a health insurance policy to come in handy in case of hospitalization, as the policy would pay our expenses. We buy a health insurance policy thinking that we should not use it, but it might happen that we should sometimes use it. This is the moment of truth that you had been waiting […]

Read More

Variable Annuity Products Set to Hit the Indian Market this Year

Annuity plans are a kind of financial product that provides guaranteed regular payments to policyholders for the rest of their lives or a certain period as decided by the policyholders in return for making a lump sum or staggered payment over a period of time. The annuity market is picking up pace in India and […]

Read More

IRDA’s All-In-One Insurance Product Bima Vistaar Details Revealed: Starts From Rs.1500 Per Policy

Insurance penetration in India decreased to 4% in FY-23 compared to 4.2% in FY-22, whereas the global insurance penetration stood at 6.8%. On the other hand, the insurance density, measured as the ratio of premiums collected to the total population, increased from $91 in FY22 to $92 in FY23. This could be attributed to various factors such as Covid-19, […]

Read More

Factors a Policyholder Should Keep in Mind Before Approaching a Court for Insurance Claim

Claim rejection is one of the most difficult things to handle, particularly when it is a cashless health insurance claim involving you or your family members who are in the hospital and are forced to adjust the amount for hospitalization in a very short period of time. Every policyholder takes an insurance policy expecting it to come in handy in […]

Read More

AI Revolutionising Healthcare Coverage: Unleashing Innovation’s Potential

The Current Landscape of Health Insurance The landscape of health insurance is undergoing significant transformation, shaped by evolving demographics, rising healthcare costs, and technological advances. With an ageing population and increasing prevalence of chronic diseases, there’s a growing demand for accessible and affordable healthcare coverage. Furthermore, regulatory changes and market factors push insurers to reinvent […]

Read More

Health Insurance Claim Rejected? Here are the Possible Reasons for Rejection.

Assume, you were admitted to the hospital due to an accident and at the time of admission you have submitted your health insurance card at the hospital. But, you were shocked to see a rejection mail from the insurance company regarding your claim. Now the entire burden of claim payment has fallen on you as […]

Read More

IRDAI’s Vision 2047 for Viksit Bharat

Insurance regulatory and development authority of India (IRDAI), watchdog of the Indian insurance industry has committed to “Insurance for all” by 2047 in such a way that every citizen would have appropriate insurance coverage in terms of life and non-life insurance. IRDAI plans to achieve this commitment by strengthening the three basic pillars of the […]

Read More

How to Pickup an Affordable Group Health Plan for your Startup?

It’s an acknowledged fact that hiring for a start-up is a challenge that every entrepreneur’s (especially first-time ones’) headache is centered around. Attracting a settled and performing individual to leave all behind and jump ship (more like jump ship to the boat) is hard enough. Fortunately, there are means and instruments, such as group health […]

Read More

Importance of Health Insurance on Holi

Holi is one of the major festivals celebrated in India which symbolizes the victory of good over evil. Holi is celebrated at the start of the spring after a long cold winter in all parts of the country. Holi is celebrated in various forms among various groups of people. There are many poems documenting the […]

Read More

Your Comprehensive Guide: How to Successfully Claim Health Insurance Benefits?

Health insurance is a comprehensive policy that carries many benefits that are to be utilized to their full potential to get the maximum benefits out of it. Gone are those days when health insurance plans used to cover only hospitalization expenses such as room rent, surgery costs, surgeon fees, anesthesia fees, etc. Earlier, there used […]

Read More

Underwriting the Policy at the Time of Claim Settlement

National Consumer Disputes Redressal Commission (NCDRC) has held that once verification of property and policy issuance is done by the insurance company, it cannot raise objections of non-disclosure or misrepresentation of material facts by the Insured. Underwriting at the time of claim settlement is not an option for the Insurer. Let’s Look at the Case […]

Read More

Group Term Life Insurance in Lieu of EDLI: Enhancing Protection for Your Employees

Employees are a company’s most valuable asset, and their well-being is paramount. As an employer, it’s your responsibility to provide them with financial security in unforeseen circumstances. The mandatory EDLI scheme offers a basic level of life insurance coverage. However, employers can enhance employee benefits by opting for Group Term Life Insurance in lieu of […]

Read More

Karnataka Government Strengthens Employee Benefits: Compulsory Gratuity Insurance Rules Take Effect

The Government of Karnataka has enacted a landmark legislation that significantly benefits employees across the state. The Karnataka Compulsory Gratuity Insurance Rules, 2024, introduce a mandatory insurance requirement for employers to secure their gratuity obligations. Let’s break down what this means for employers, employees, and insurance brokers within the state. Understanding Gratuity Gratuity is a […]

Read More

Unpacking AI’s Transformation of Property Insurance in India

The Indian property insurance landscape, long reliant on traditional methods, is experiencing a rapid shift propelled by artificial intelligence (AI). This disruptive technology promises increased efficiency, personalized protection, and proactive risk mitigation, redefining the industry for both insurers and policyholders. Let’s explore how AI is revolutionizing key aspects of property insurance in India. Fraud Detection: […]

Read More

Bima Sugam: Revolutionizing Insurance in India

India’s insurance landscape is undergoing a significant transformation, and at the heart of this change lies Bima Sugam, an ambitious initiative promising to simplify and democratize access to insurance for all. Let’s delve into this game-changer, exploring its essence, evolution, and potential impact. What is Bima Sugam? Bima Sugam, translating to “easy insurance” in Hindi, […]

Read More

All About Liability Insurance

Liability insurance is a type of insurance coverage that protects businesses and individuals against third-party claims of negligence, errors, or omissions that result in bodily injury or property damage. Let’s explore liability insurance, why it’s important, and how Ethika Insurance Broking can help you get the right coverage. What is Liability Insurance? At its core, […]

Read More

How to Choose the Right Insurance Broker?

Insurance brokers play a key role, sourcing policies and assisting with claims. Experience, capabilities, relationships, response times, and recommendations all factor into choosing the right broker.

Read More

Group Term Insurance Claim Settlement Process

Group term insurance usually refers to the term life insurance plan offered to members. Companies take group term insurance plans to cover their employees under a single policy. The policy is designed to provide financial compensation to the family of the nominee of the insured employee in case of his/her untimely death. The group term […]

Read More

What is a Material Fact in an Insurance Contract?

In the complex landscape of insurance contracts, grasping the significance of material facts is crucial. As a policyholder with Ethika Insurance Broking, comprehending these facts is pivotal for making informed decisions about coverage. The Crucible of Clarity: Material Facts in Insurance Contracts Unraveled Defining Material Facts Material facts are key information influencing an insurer’s decision […]

Read More

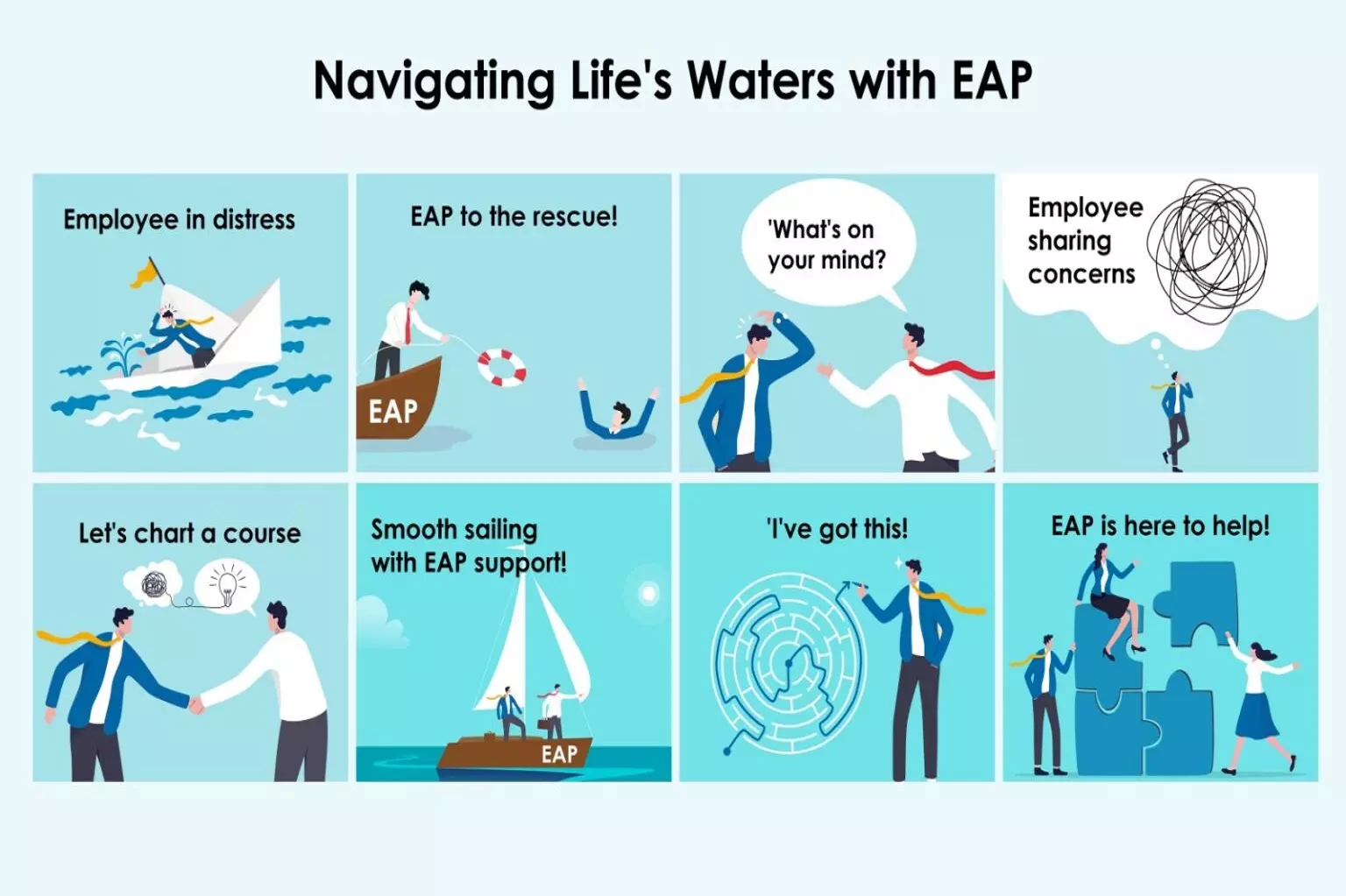

Navigating Life’s Waters with EAP: What Can You Share?

Navigating life’s unpredictable journey presents challenges ranging from stormy weather to sunlit horizons. Employee Assistance Programs (EAPs), like those offered by Ethika Insurance Broking, act as reliable lifebuoys, providing a secure harbor for individuals to address a myriad of concerns openly. The Significance of EAPs in Addressing Various Facets of Our Lives Are:- 1. Stress […]

Read More

Rethinking Global Mandates in Insurance Broking: A Case for Local Expertise

In the dynamic realm of insurance broking, a noteworthy trend is emerging—the prevalence of global mandates. These agreements, forged between clients and brokers, commit clients to exclusively availing services from a designated broker globally. While such arrangements often rely on international relationships between brokers and their clients’ head office personnel, a critical question arises: Can […]

Read More

Embedded Insurance: Bridging Convenience and Awareness

In the dynamic realm of insurance, a groundbreaking concept has emerged, taking centre stage and transforming the way we perceive risk protection – embedded insurance. This innovative approach endeavours to seamlessly integrate insurance into the customer’s purchase journey, promising accessibility and convenience. However, as we delve into the landscape of embedded insurance, a critical consideration […]

Read More

Co-payment in Health Insurance

What is Co-payment? Co-payment refers to the amount of claim that should be borne by the insured during the settlement of a claim. The co-payment amount depends on the co-payment clause mentioned in the policy. Irrespective of the claim amount, the insured has to settle their part before the insurance company makes the final payment. […]

Read More

Insurance Bill (Amendment) – 2023

Insurance in India was introduced by the establishment of the Oriental Life Insurance Company in Calcutta in the year 1818. The first insurance company was regulated by the British and was according to British laws. In the years following India’s independence, an insurance regulator and Development Authority for India (IRDAI) was set up to manage […]

Read More

Have You Considered These Things Before Making a Health Insurance Claim?

The most important part of the insurance utilization process is claim settlement. Claim settlement can be considered as the last stage in the process and is the core stage for which the policy is taken. Health insurance claim settlement arises once the patient is hospitalized due to an accident, disease, or illness. Health insurance claim […]

Read More

Difference Between Life, Health and Personal Accident Insurance

Many people think of life insurance when they hear the word insurance. That was the kind of impact life insurance has created on people, but in reality, life insurance is not the only insurance available in the market. Insurance can be life or non-life. Life insurance covers the life of individuals against death, whereas general […]

Read More

Pre-existing Condition in Travel Insurance

What is Travel Insurance? If you have a health insurance policy in India, you could claim for any hospitalization anywhere in India, but while travelling abroad, the same policy might not cover everything. Then, taking a travel insurance plan that could cover all your medical expenses in a foreign location would be advisable. The other […]

Read More

The Hidden Benefits of Personal Health Insurance

Customers should explore many hidden benefits in personal health insurance plans to avail of benefits during the policy period. These benefits would be hidden in plain sight for the customers, and most would not pay heed to these benefits in the first instance. Insurance intermediaries would also not explain these benefits to the customer while […]

Read More

What to do After a Car Accident? A Guide to Filing a Vehicle Insurance Claim

Accidents in India: As per the Ministry of Road Transport and Highways, every year, approximately 1.5 lakh people die on Indian roads, with an average of 47 accidents and 18 deaths every hour. There could be many reasons for road accidents, such as high speed, improper roads, drunk driving, etc. In all these cases, there […]

Read More

Personal Health Insurance vs Employer-Sponsored: Which is Right for You?

Personal Health Insurance The personal health insurance policy, which is also referred to as retail health insurance or individual health insurance, pays for medical expenses of an insured client because of an accident, sickness, or illness in excess of the sum insured maximum in exchange of a small fee. The insured customer would completely own […]

Read More

Indian Finance Budget 2023 – Impact on Insurance Sector

The Indian Finance Budget 2023 has brought about significant changes poised to shape the landscape of various sectors in the country. One such sector that has garnered attention is the insurance sector. In this article, we will delve into the implications of the budget on the insurance sector, focusing on Ethika Insurance Broking, the impact […]

Read More

5 Common Mistakes to Avoid When Buying Vehicle Insurance

Vehicle insurance compensates the financial loss incurred by the insured due to an unforeseen incident causing damage to the vehicle and third-party liability, which includes bodily injury and property damage to third parties due to the insured vehicle. Motor insurance comes in two parts. The first part covers the insured’s liability towards bodily injury and […]

Read More

The Impact of Blacklisted Hospitals in Insurance Industry

What is Blacklisting of Hospitals in the Insurance Industry? Blacklisting is placing a hospital in a position where there would be no further dealing with it in any case. Once blacklisted, Insurers do not empanel or engage with such hospitals. Customers should consult their insurance companies before making a claim. They should ensure their preferred […]

Read More

Understanding the Important Cost Considerations of Personal Health Insurance

Ever wondered how Insurers cost their Persona Health Insurance Products? While many statistics and related sciences are used. Let us Understand Some Factors Behind Deciding Premiums. Age: Age is an important factor in deciding the health insurance premium. All insurance corporations base their top rate calculations on the age of the eldest member within the […]

Read More

How to Choose the Right Personal Health Insurance Plan for You?

Tips to Choose the Right Personal Health Insurance Plan Personal Health Insurance Plans are those in which the insured pays the premium to cover their financial expenses in case of any hospitalization. It is essential to choose the right personal health insurance plan as it would be difficult to change the health insurance policy every […]

Read More