“But Manju is my star employee Sunita. Please, try and understand. There are a lot of dependencies on her. Please retain her.” That was Sunil, pleading with Priyanka, the Head of HR.

“Sunil, we have tried everything. Manju just does not want to stay back”, Priyanka whispered, as if under her breath. She knew the reason Manju was leaving. The company Manju was joining wasn’t paying offering a great raise, but they had medical insurance which was much better than the one at the current company.

As an HR professional, Priyanka understood the importance of a good medical insurance policy. In fact, she pitched a benefits upgrade to the management at the time of her policy’s renewal. However, she was unable to justify the increased costs, and the management asked her to sit on the proposal for a year.

This time, however, Priyanka was determined to push the proposal through. She was upbeat primarily because:

- Her HR analytics team had shared insights about one of the main reasons for increased attrition was the employee benefits package

- She had undertaken a benchmarking study and had realized that her benefits offerings were below average as compared to what the market was offering

- Priyanka had gotten in touch with Ethika, an insurtech startup broker changing how business was done. She was particularly impressed with the benefits that Ethika assured of tailoring to her needs and at the appropriate pricing. Moreover, she did some basic checks, and Ethika’s claims support was excellent.

She had scheduled a call with Ethika’s team to learn about the benefits they could offer and how she could enhance her pitch to management.

Listed in the piece are extracts from Priyanka’s conversations with Ethika.

What’s on this page?

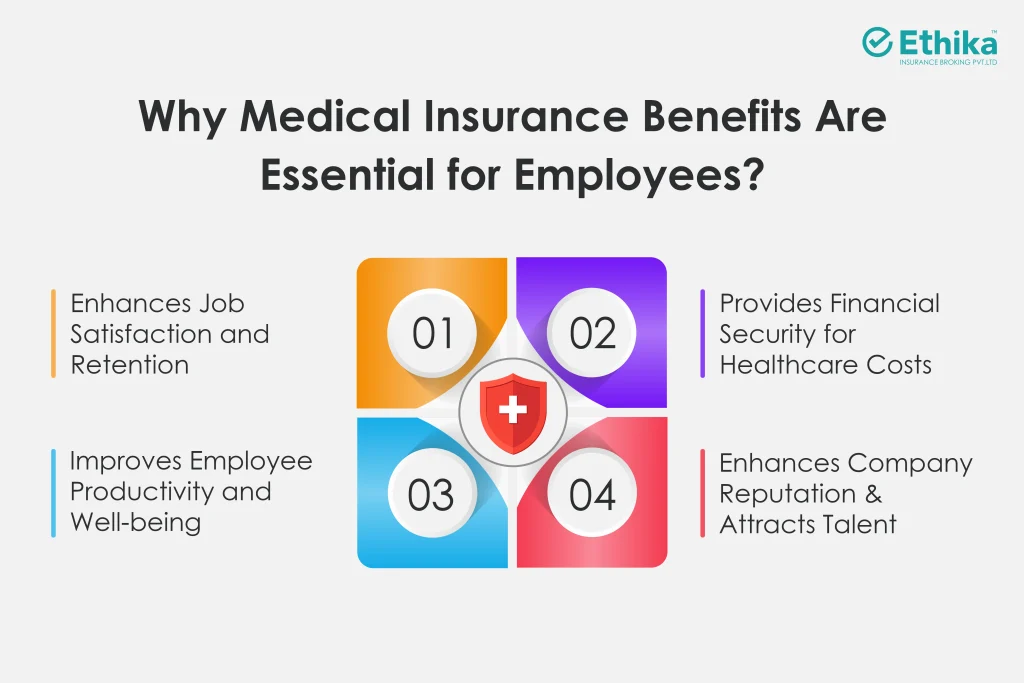

Why Are Medical Insurance Benefits Essential for Employees?

The call with Ethika proved to be an eye-opener, reinforcing Priyanka’s belief in the power of comprehensive employee benefits. Ethika’s team highlighted medical insurance’s critical role in attracting, retaining, and motivating top talent.

This also revealed that a good employee benefits plan is actually a powerful tool in the hands of the employer, used the right way, it can lead to an astounding Employee Value Proposition. Listed are some of the reasons why medical insurance benefits employees and, therefore, employers.

- Enhances Job Satisfaction and Retention – A 2023 study by Glassdoor found that 57% of employees consider benefits among their top considerations before accepting a job offer. A robust benefits package, with medical insurance at its core, demonstrates an employer’s commitment to employee well-being. This translates directly into increased job satisfaction and reduced turnover.

- Provides Financial Security for Healthcare Costs – Unexpected medical expenses can cripple an employee’s finances. Medical insurance acts as a crucial safety net, protecting employees from the potentially devastating costs of healthcare. This financial security allows employees to focus on their work without the constant worry of potential medical debt.

- Improves Employee Productivity and Well-being – Healthy employees are productive employees. Access to quality healthcare allows employees to address health concerns immediately. This in turn, prevents minor issues from becoming major problems. Constant apprehension about how one would manage their health costs in case of a hospitalization can be a constant worry and a group policy helps alleviate such fear.

- Enhances Company Reputation & Attracts Talent – A robust benefits package enhances a company’s reputation, making it more attractive to prospective employees in a competitive job market. It positions the company as an employer of choice.

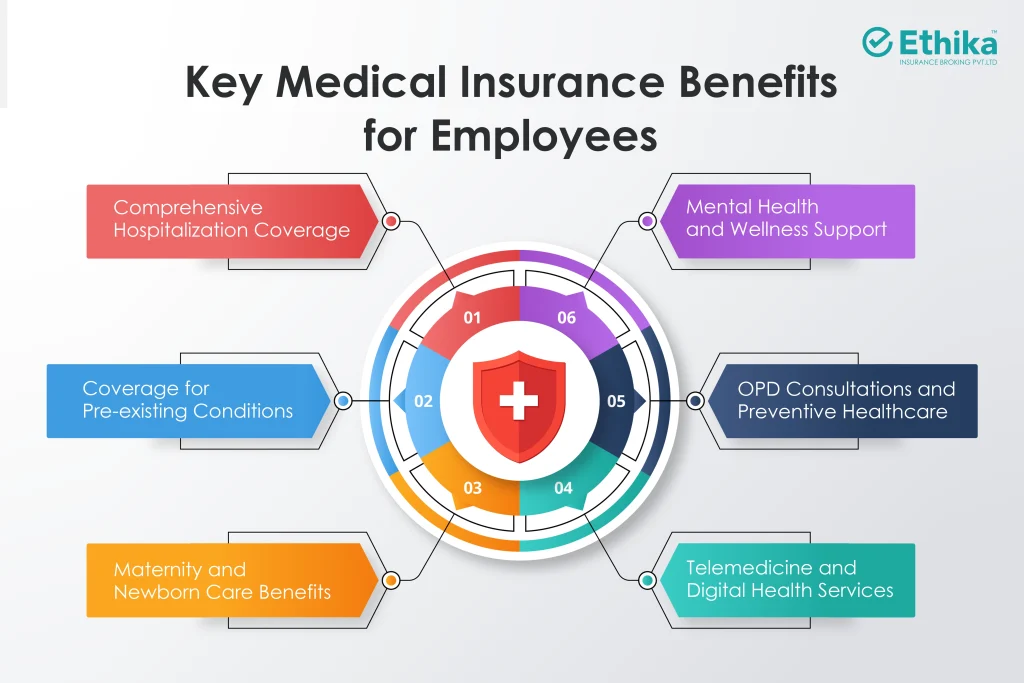

Key Medical Insurance Benefits for Employees

Next, Ethika helped Priyanka understand some of the key insurance benefits for employees. A group health insurance policy allows you the leverage to ask for any benefit under the Sun, the only aspects that you might need to make note of are the cost and benefits such coverages offer. Listed are some of the benefits that are common to most policies.

- Comprehensive Hospitalization Coverage – A medical insurance allows for coverage of a wide range of inpatient expenses, including room rent, ICU charges, surgery charges, doctor’s fees, and diagnostic tests. It provides financial protection against the high costs of hospitalization, ensuring employees can access necessary medical care without having to dip into their savings.

- Coverage for Pre-existing Conditions – This remains one of the most crucial benefits of a group medical insurance. It ensures that employees and their family members (if covered) can avail Day 1 coverage for pre-existing conditions. This becomes a crucial element for employees with aging parents or dependent family members with adverse medical histories.

- Maternity and Newborn Care Benefits – Welcoming a newborn is of course a landmark event in any parents life. A lot of would-be parents have this consideration in mind when switching jobs or sticking to them.

- Mental Health and Wellness Support – Employers are increasingly recognizing the importance of mental health. Coverage for therapy, counseling, and mental health conditions is gaining acceptance and therefore becoming common. This benefit acknowledges that mental well-being is just as important as physical health and helps employees access the support they need.

- OPD Consultations and Preventive Healthcare – Outpatient department (OPD) coverage includes doctor’s visits, diagnostic tests, and prescription medications. This benefit is increasingly becoming important for Employees and a lot of Employers have started offering it. Insurance companies are also realizing the importance of preventive care and have started offering health checks and other similar benefits as a part of this offering.

- Telemedicine and Digital Health Services – Telemedicine offers convenient and affordable access to healthcare without the need of physical presence. Today it has become a convenient benefit that not only saves time for employees but also costs for Insurers – a doctors consultation at a Tertiary Care facility costs twice as much as one over a call.

Challenges in Offering Medical Insurance Benefits

Benefits are aplenty, and Priyanka is worried about the challenges that a group policy brings. She knows that her management would grill her on this aspect and seeks Ethika’s help to allay some of her fears.

Having gone through such apprehensions with over 500 Corporations, Ethika is aware of the challenges and clarifies –

- Manage Cost and Premiums for Employers – While cost is a consideration, it cannot be looked at in a vacuum. Think of the cost of not being able to attract or retain talented individuals – that is the cost you end up bearing in the absence of good medical insurance for your employees. Moreover, with significant expertise, Ethika ensures that costs are kept in check.

- Educate Employees About Insurance Coverage – This is extremely important. A policy is only as good as it is perceived to be. And therefore good brokers help employers formulate the right communication for employees and deploy SPOCs.

- Customization Limitations in Group Plans – While customization does cost, one need not go for every bit of customization available. Say you have not had any claims for procedures like cataract/ hernia in the past, you can think of allowing for a waiting period for such hospitalizations.

If the median age group of your employees is less than 30, you can think of allowing for a waiting period for pre-existing conditions as well. Customization can be used as a tool to optimize costs. A good broker can help you do it efficiently.

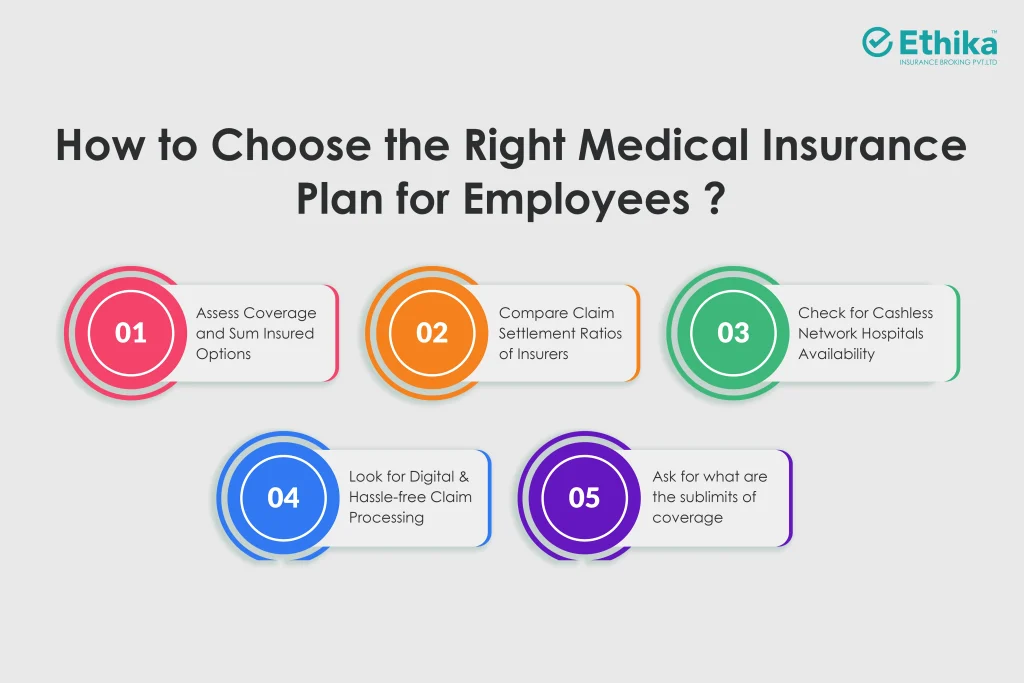

How to Choose the Right Medical Insurance Plan for Employees

“Finally, How do I choose the right insurance plan?”, Priyanka questions. “Well, ma’am, even if you do not avail of our services, the listed checklist can help you freeze on the right plan,” replies Abhijeet, the Ethika exec.

- Assess Coverage and Sum Insured Options – Carefully evaluate the coverage offered by different plans and choose a sum insured that provides adequate protection. Keep in mind the aspect that while you are not looking to splurge, the Employee who needs coverage should not be left hanging for more.

You can also give employees the option of opting for additional coverage by paying for the extra coverage. There are various combinations you could choose. Choose wisely. - Compare Claim Settlement Ratios of Insurers – A high claim settlement ratio indicates a reliable insurer promptly processing claims. This is a crucial factor to consider when choosing an insurance provider. A good claim settlement ratio ensures employees can access their benefits when needed. A little bit of research can help you understand these figures.

- Check for Cashless Network Hospitals Availability – A vast network of cashless hospitals provides convenient access to care and reduces out-of-pocket expenses for employees. An extensive network ensures employees can find convenient and affordable healthcare options.

You should also not rely on the broad statements made by Insurers about network hospitals, but check for the list of hospitals in cities where your employees are – If your employees are in a Tier II city, a 100% network hospital coverage in a Tier I city is of no use to your employees.

- Look for Digital and Hassle-free Claim Processing – This Digital allows your employee to be in control. The employee can track the status of their claims and push for early closures. A user-friendly platform ensures lower employee time loss for filing and follow-up.

- Ask for the coverage sub-limits- This will be your clincher. Always ask the insurer what will not be covered under your policy and what the coverage limitations are.

The answer to these questions plugs gaps in your understanding of the policy and gives you a perspective on whether these aspects are essential for you. If they turn out to be, you can always ask for the cost of covering them and take a call.

Conclusion

Priyanka is satisfied and confident that she will be able to convince her management to enhance the coverage for their health policy this time around. She now realizes that the benefits that medical insurance offers go beyond health and psychological ones.

She knows that using medical insurance correctly can be one of the pivotal legs of her Employee Value Proposition. She always knew that health insurance should not be looked at like a cost; it is an investment you make in your employees; she just needed to bounce this idea off of an insider who could also vouch for it.

How about you? What is your most decisive leg in the Employee Value Proposition?

Frequently Asked Questions (FAQs):

What Happens to an Employee’s Medical Insurance if they Leave the Company?

Generally, coverage for the employee ends, but the Insurer might allow the employee to port his policy into an individual health policy.

Are Pre-Existing Conditions Covered Under Employer-Provided Medical Insurance?

Pre-existing conditions can be covered under Employer-Provided Medical Insurance, but it might cost you extra money.

How Can Employees Check if a Hospital is Part of the Insurer’s Cashless Network?

The list of hospitals is available on the Insurers website, but you can also call your Insurance Broker or Third Party Administrator to check these.

Does Employer-Provided Medical Insurance Cover Outpatient Consultations and Preventive Care?

Employer-provided medical Insurance can cover Outpatient Consultations and Preventive Care, but it might cost you extra money.

Can Employees Upgrade or Customize their Medical Insurance Coverage Under a Group Plan?

Once a policy has been underwritten, the coverages under the policy cannot be changed through the year, but you can ask for upgrades or customization at the time of renewal.