Reeemaaaa, felt like a howl, let out by Akash.

Reema, who was just about to shut the main door behind her, was taken aback. But one look at Akash and she knew something was wrong. Akash had collapsed on his chair, his head barely hanging over his shoulders.

Reema rushed in, picked Akash up and bolted to the door. Fortunately a hospital was just across the road – she was thinking out loud.

At the hospital, the first question the staff asked was – Whether you have an insurance?

Suckers, she thought.

But fortunately, they had enrolled into a group health insurance, just a couple of weeks back. She and Akash had had a lot of heated debate over the price they would have to pay and whether their start-up actually had the funds to bear this cost.

Very fortunate, she reiterated, in her head.

Most startups go through the Cost Benefit Analysis of buying a Group Health Insurance for their employees. And rightly so. With the lean bootstrapping phase that a startup goes through, the Founders rightly question the costs. But stick with us till the end of the piece and we are sure, we will change your mind.

What’s on this page?

What Is Group Health Insurance and How Does It Work for Startups?

A Group Health Insurance is a health insurance policy that pays for your employees hospitalization bills, as long as they fit the terms and conditions of the policy. In that sense, the one major area of difference between a Group Health Insurance policy and an individual one is the fact that a group health insurance is bought for a group of people who share a common interest or are part of a common group.

The only restriction as imposed by IRDAI is that a group cannot be formed for the purpose of availing the benefits of a Group Health Insurance policy. And rightly so – a group health insurance policy can offer unparalleled benefits.

Some of the key features that make Group Health Insurance such an attractive product are:

- Day 1 coverage for hospitalizations

- No requirement of medical underwriting for the group

- Health Insurance Coverage of any amount for the group

- Cost effectiveness as compared to individual health insurance

- Coverage for dependent parents of any age

Given such exhaustive benefits, cases of misrepresentation for the formation of a group, just to avail benefits under a policy, run aplenty.

IRDAI, therefore defines a group as any association of persons who assemble together with a commonality of purpose or engage in a common economic activity like employees of a company. The most common example is an Employer-Employee group.

Even there, IRDAI prescribes a minimum of 7 members to issue a group health insurance policy. While initially, Insurers had lapped this offer up, very soon they were bogged with adverse claims – people formed namesake companies to enroll into a Group Health Insurance policy.

Why Startups Should Offer Group Health Insurance to Employees?

Every emerging economy needs startups. As does India. However given the rigorous nature of work at Startups, most people do not want to join them. That said, startups aren’t for everyone as well. Surviving a startup can take a physical and mental toll on the employees. But that precisely is the aspect that a Group Health Insurance can address.

A Group Health Insurance, if used right, can serve as a tool that can be used to attract and retain top talent, particularly at a startup. As a matter of fact, most startup managers have started using this employee benefit as one of their core Employee Value Propositions.

A group health insurance enables tailoring coverage to include parents/ in-laws. This has been another game changer, especially since Covid-19. During Covid days, the government had made it mandatory for Employers to offer health insurance to its employees. While this diktat has since been removed, the frequency and severity of pandemics is only set to rise. This factor alone has seen most startups adopt group health insurance as a permanent benefit.

Legal Requirements and Compliance Considerations

The Insurance industry in India is governed by the Insurance Regulatory & Development Authority of India. The legalities that govern a startup are not different from one for any other registered company in India.

But with the growing emphasis on startups in India, the scarcity of jobs and a keen government, we could soon see some framework that prescribes a minimum health cover for startup employees.

Ways to Improve Employee Retention and Job Satisfaction

An employee lifecycle consists of three main stages – recruitment, retention and retirement. The amount of time an employee spends in each of these stages varies from company to company, but the cycle is particularly stinted for a startup. And most employees and employers are aware of this fact.

Startup leaders therefore incorporate fringe benefits like employee wellness with the health insurance coverage to improve employee attraction and retention.

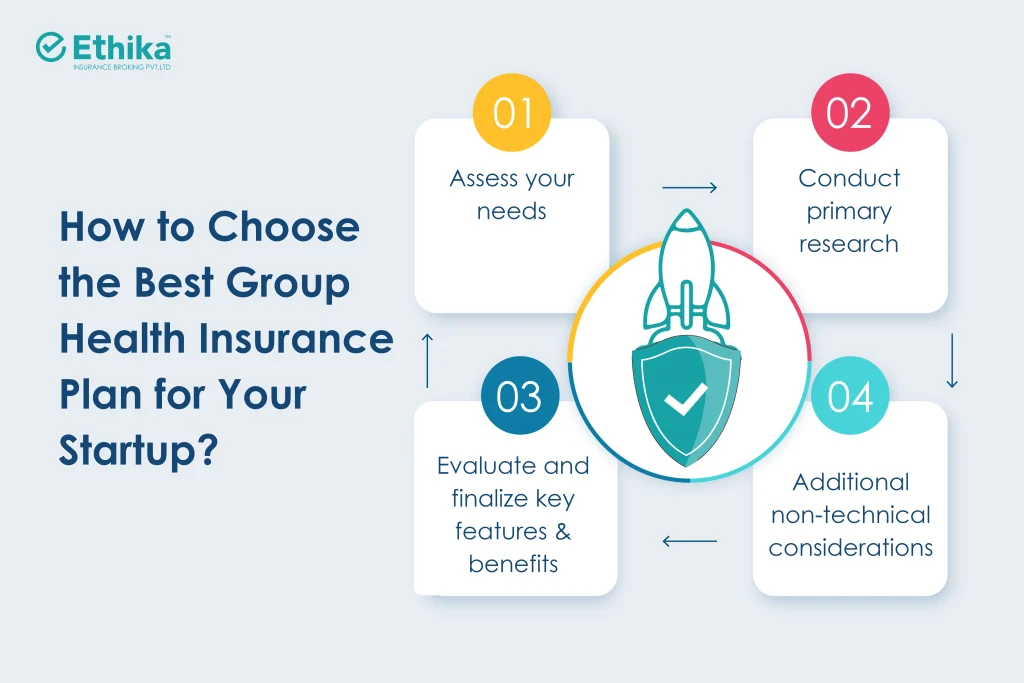

How to Choose the Best Group Health Insurance Plan for Your Startup

Choosing the best group health insurance plan can, at times, be the difference between hiring an A+ player and settling for an A one. The decision not only impacts your employees’ well being, but your companies’ financial health as well.

Here’s a step-by-step guide to help you navigate this process:

1. Assess your needs

A group health insurance is a customizable product. You can practically cover everything under the policy. That said, you will have to walk the fine line between the coverages you want and the cost you are willing to pay. Some of the other factors that are important when buying the policy are your employee demographic, the coverages you want, the sum insured under the policy and the limits and sublimits you opt for.

2. Conduct primary research

Another important step, where you decide on how would you want to buy a group health insurance for yourself, is by conducting some first hand research. This is the point where you assess if you would want to shoulder the entire responsibility of conducting market research on the kinds of products available, the depth of offerings, the pricing, the quality of claims settlement.

But if you think, all of this is out of your area of expertise, you can conduct some basis research on who you can partner with, to get your health insurance.

Ethika, over the last decade has partnered with over 500 companies and helped them choose and fine tune their employee benefit offering. Most companies that Ethika started out with were startups themselves and have contributed to Ethika’s growth story, alongwith their own. Our client retention ratio hovers around 90% where the industry average is south of 50-60%. But the most credible feat in all of this, remains the fact that Ethika has done it, without raising any external funding, bootstrapping its way, right up until this point.

Our unique Red Carpet Assistance program sets us apart. We know that when your employees or their loved ones need medical care, time is of the essence. Our team of dedicated professionals works round the clock to minimize wait times and enhance the quality of delivery.

3. Evaluate and finalize key features and benefits

Ideally, once you have identified a broker, all you will need to do is make decisions based on the coverages you might want based on the cost structure.

In case you have decided to go on your own, you would need to do a detailed study on the coverages that are available in the market and the costs associated with these coverages. Some of the other factors that you should consider before you finalize on the insurance are

- Network Hospitals: Check if the plan has a wide network of hospitals and healthcare providers in your employees’ locations.

- Premium Costs: Compare premium costs across different plans. Factor in any deductibles, co-pays, and co-insurance.

- Claim Process: Understand the claim process and how easy it is for employees to file claims and receive reimbursement.

- Wellness Programs: See if the plan offers wellness programs or initiatives that can promote employee health and potentially lower healthcare costs in the long run.

- Flexibility: Consider whether the plan allows for customization or add-on options to meet the specific needs of your startup.

4. Additional non-technical considerations

Apart from the technical considerations that you make before choosing your group health insurance, there are certain other considerations that you should also look at. These include

- Employee Feedback: Involve your employees in the decision-making process. Gather their feedback on their healthcare needs and preferences.

- Scalability: Choose a plan that can scale with your startup as you grow and hire more employees.

- Technology: Look for plans that offer digital tools and resources, such as online portals or mobile apps, for easy access to policy information and claim filing.

How Much Does Group Health Insurance Cost for Startups?

Finally, well, not the end of the piece, but the most important part in it – the cost. Unfortunately there is no formula that decides on the premium for your group health insurance. But, there is a science to it. Listed are the crucial factors that affect the premiums you would have to pay for your group health insurance policy –

- Geographical Location: Healthcare costs change with regions. A cataract surgery in Bengaluru might cost different than one in Mumbai. Startups in areas with higher medical expenses might generally face higher premiums.

- Employee Demographics: The age, health status, and family composition of your employees significantly impact costs. A younger, healthier workforce typically results in lower premiums.

- Plan Design: The level of coverage you choose directly affects the cost. More comprehensive plans with lower deductibles and co-pays will be more expensive.

- Group Size: While smaller groups might seem cheaper initially, insurers often spread risk across larger groups, sometimes making smaller groups relatively more expensive per person.

- Industry: Certain industries with higher risk levels (e.g., construction) might face higher premiums.

- Claims History: While less relevant for brand-new startups, as your company grows, the claims history of your employees can influence future premiums.

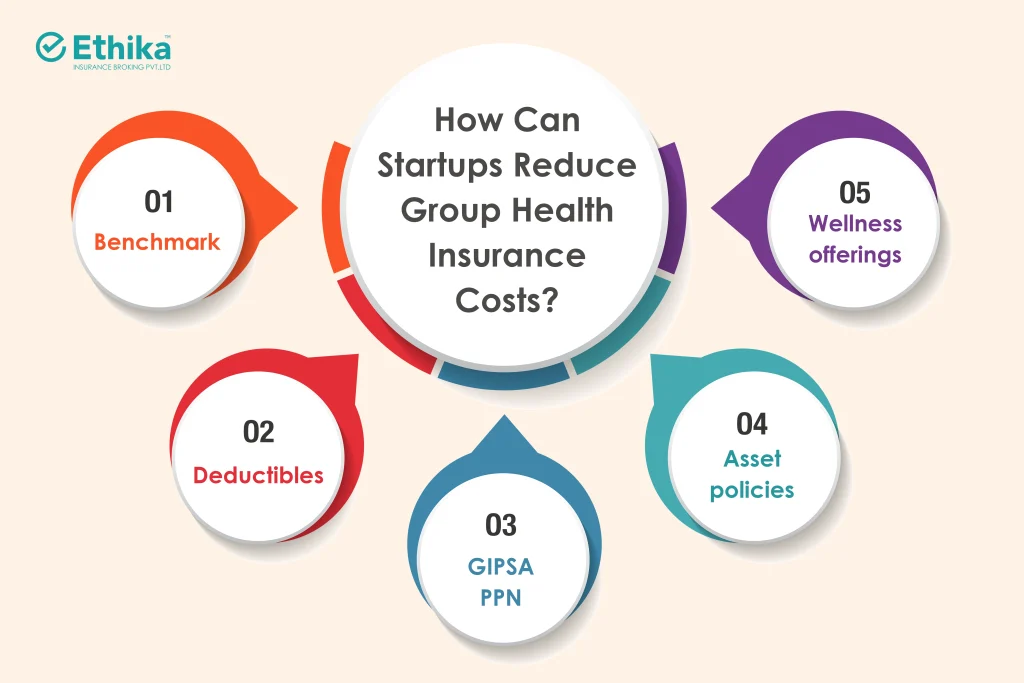

How Can Startups Reduce Group Health Insurance Costs?

Now that you understand what affects the costs of a group health insurance policy, let us look at ways you can reduce the premiums for your policy.

- Benchmark Benchmark Benchmark : Get quotes from multiple insurance companies. Don’t settle for the first quote you receive – an insurer anticipates you would bargain and therefore does mark up his price. Use online comparison tools. Consider working with a broker.

- Deductibles : Consider various permutations of deductibles and co-pays to arrive at an overall price that you are comfortable with. A higher deductible plan can come at a cheaper price and visa versa.

- GIPSA PPN : Government Insurers empanel a vast network of hospitals and can therefore bargain for cheaper rates with the Hospitals. They can pass on this benefit to you as a Customer. Negotiate with them.

- Asset policies : An insurer can increase the amount of discount offered on a policy if you also insure your asset policies with them. Asset policies, like Fire & Engineering, are deemed to be low risk policies and therefore profitable for Insurers.

- Wellness offerings : You could negotiate with your Insurer for some add on benefit alongside your basic insurance policy. While this might not reduce your cost, it can add to the amount of benefit you get out of your insurance policy.

Cost-Sharing Options for Startups to Balance Expenses and Employee Benefits

How you structure your policy is one of the important considerations that you would have to make. You could either bear the entire cost of the policy, or share it with employees. A standard industry practice by employers is to bear the entire premium of the policy. But, if you cannot do so, sharing the cost with your employees is better than not having any policy. When deciding the amount of contribution you get the employees to make, you can couple it with the sum insured you offer them or their basic salary or a combination of both.

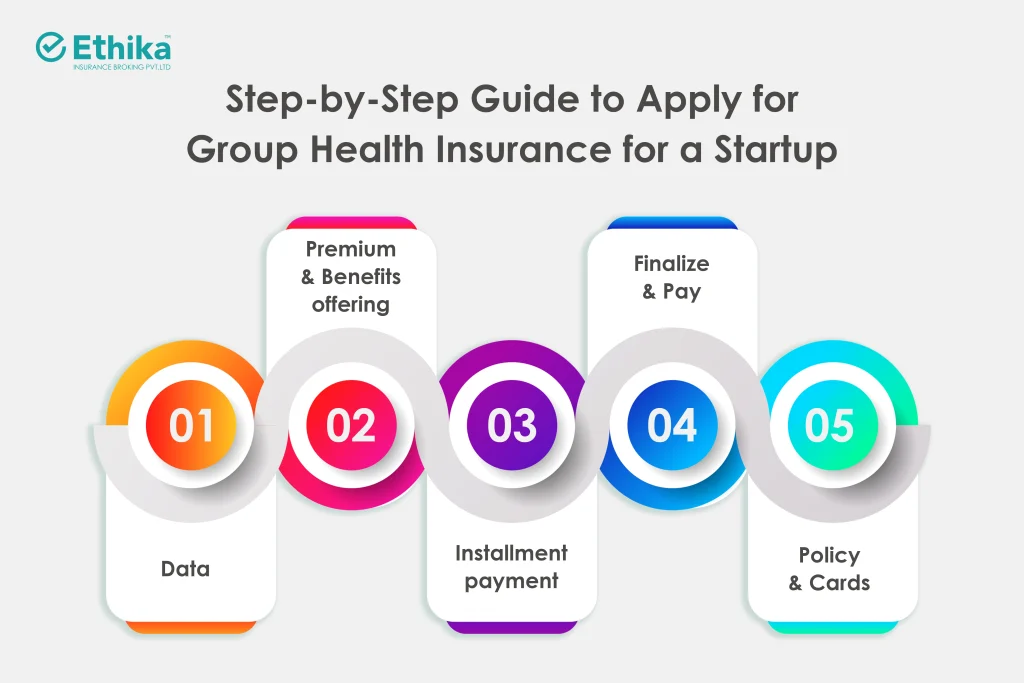

Step-by-Step Guide to Apply for Group Health Insurance for a Startup

Structure is the essence of life. In the absence of structure, no one can get anywhere. While we have been discussing about the importance of a group health insurance policy, its costs implications, the benefits it offer, it is now time to look at how you can apply for the policy, the considerations you need to make and the data you might need to exchange with the Insurer.

- Data : The Insurer needs the demography of the employees you need to insure. They will typically ask for the date of births, gender, location, pre-existing ailments and your claims ratio. This is the first step towards getting a quote from the Insurer.

- Premium & Benefits offering : The Insurer would then quote a price for a set of benefits offering. You could ask for addition or deletion of the benefits being offered. Such additions/ deletions would lead to changes in the price.

- Installment payment : You can request the Insurer for the option of making payments in installments. If the Insurer agrees, he will share the payment terms with you.

- Finalize & Pay : Once you have agreed to the premium, benefits and installment payment offerings, you will need to give your final confirmation and make the payment to the Insurer. Any last minute changes to the data set of employees will have a simultaneous effect on the premium. It is also advisable to maintain some additional amount with the Insurer to take care of Day 1 coverage for new joiners.

- Policy & Cards : Your insurance coverage starts from the date you have made the payment to the Insurer. Administratively it might take the Insurer a week to ten days to issue your policy document, but that does not mean that your employees cannot make a claim in the interim.

The Insurer will share a Third Party Administrators contact with you for liaising for all of your employees hospitalization queries. You should share this number with all of your employees. You should also request the Insurer for an orientation on the procedure to follow for claims.

What Documents Are Required to Buy a Group Health Insurance Policy?

All set to get your health insurance? Great!!! Listed are the documents that the Insurer would ask of you before they can issue your policy:

- Certificate of Incorporation: Proof of your startup’s legal existence.

- PAN Card of the Company: Tax identification number.

- Address Proof of the Company: Documents verifying the company’s registered address.

- Employee Details: This is information about your employees, including their names, ages, contact details, and sometimes family details if dependent coverage is included. It is often provided in Excel format.

- Cancelled Cheque: For future claim settlements.

- KYC documents of the authorized signatory: Your company’s representative who is authorized to deal with the insurance company.

How Long Does it Take to Set Up a Group Health Insurance Plan for Employees?

The amount of time that it generally takes to set up a plan could vary from a week to a month, depending on your readiness for the process.

Listed are the general timeframes

- Your data exchange with the Insurer: 2-3 days – This is based on how thorough and accurate your data is

- Quote and Plan Selection: 1-2 weeks – This is based on the number of iterations you and the Insurer have to go through to agree on the price and the benefits

- Application and Document Submission: 2-3 days – When you submit the final data to the Insurer.

- Policy Issuance & Health cards: 1 week to 10 days

Best Practices for Handling Employee Claims and Benefits Efficiently

Claims are the final frontier where all of your hard work pays. Your employees take home the impression of the policy based on how their claim settlement was handled. It is therefore extremely important that this final frontier is channeled well. Listed are some best practices that ensure your employees have a good experience

- Clear Communication: Educate employees about the claim process, required documents, and timelines.

- Designated Point of Contact: Assign a person within your company to handle employee queries and claims.

- Online Claim Portal: If available, encourage employees to use online portals for claim filing and tracking.

- Timely Processing: Ensure prompt processing of claims to avoid delays and employee frustration.

- Regular Follow-ups: Follow up with the insurer on pending claims and keep employees informed about the status.

- Employee Feedback: Gather employee feedback on the claim process and identify areas for improvement.

- Benefits Communication: Regularly communicate details about the benefits covered under the plan and how to access them.

What are the Tax Benefits of Offering Group Health Insurance to Startups?

One of the last but, of course, extremely important benefits of a group health insurance policy is the taxation benefits it offers.

- Employer: Premiums paid by the employer for group health insurance are generally considered a business expense and are generally tax exempt.

- Employee: Employees can similarly avail tax benefits on the premiums that they pay towards their health insurance policies. These could be

- Their own premium contribution to the total premium paid for the group health insurance policy

- Premiums they pay for their individual health policies

Common Mistakes to Avoid When Choosing Group Health Insurance for Startups

As we close this journey, it is important to recognize the common mistakes that you might make before choosing your group health insurance policy.

- Do not choose a health insurance plan just because it is cheap, so might the coverage and the quality of service delivery be.

- Do not finalize on the first plan you come across – benchmark and compare the various offerings out there.

- The ultimate beneficiary of your health plan is your employee – understand what they need; do not go by what a couple of employees say or want.

- Understand how the claims process works – do not buy the policy without having understood this crucial element.

- Reviewing the policy document once you have received it ensures you understand and agree to the coverages under the policy – do not brush through the covers, ensure you have reviewed each one of them thoroughly.

- The success of a group health insurance policy is a game of perception. Ensuring the appropriate communication to your employees is crucial. Do not think that once you have bought the policy, everything else will fall in place. You have to ensure you communicate the terms and conditions of the policy to your employees, effectively.

Frequently Asked Questions (FAQs):

1. What is the best group health insurance for startups with a small team?

The best plan depends on your specific needs and budget. However, for small teams, consider these factors:

- Flexibility: Look for plans with lower minimum member requirements and the ability to easily add or remove employees as your team grows.

- Cost-Effectiveness: Balance comprehensive coverage with affordability.

- Wellness Programs: Even small startups can benefit from wellness initiatives to promote employee health and potentially lower long-term costs.

- Ease of Administration: Choose a plan with a simple claims process and online tools for easy management.

2. How can startups get affordable group health insurance for employees?

- Shop around and compare quotes: Don’t settle for the first offer.

- Consider high-deductible plans

- Negotiate with insurers: Leverage your growing company size for better rates. Use asset policies to get a discount on the health insurance policy.

- Explore GIPSA PPN: Government insurers often have wider networks and potentially lower costs.

- Wellness programs: Promote employee health to potentially reduce long-term costs.

3. Do startups need a minimum number of employees to qualify for group health insurance?

Yes, IRDAI has prescribed a minimum of 7 members to form a group for health insurance. However, some insurers might have their own slightly higher minimums.

4. What happens if a startup cancels its group health insurance policy?

Employee coverage will cease. Unused premiums, if any, will generally be refunded under pre-agreed terms and conditions.

5. How to add or remove employees from a group health insurance plan

You can decide on the date of the month that you will exchange this data with the Insurer and then share this data on a monthly basis. The format is generally provided by the Insurer, but you can also use your own format.

Since startups generally do not have huge volumes, you could work on a lower frequency like exchanging data daily/ weekly.

Conclusion

Investing in group health insurance is a strategic decision every startup should consider seriously. It’s not merely an expense, but an investment in your most valuable asset: your team. The right insurance plan provides a safety net for employees, offering financial protection against unexpected medical costs and promoting their overall well-being. This, in turn, leads to increased employee satisfaction, improved retention, and a more productive workforce.

For employers, group health insurance is a powerful tool for attracting and retaining top talent in a competitive market. It demonstrates that you prioritize your employees’ health and financial security, fostering a positive company culture and enhancing your employer brand. Moreover, the tax benefits associated with group health insurance can provide significant financial advantages for both the company and its employees.

In today’s dynamic startup environment, where attracting and retaining talent is crucial, group health insurance is no longer a luxury, but a necessity. It’s a win-win investment that benefits both employers and employees, paving the way for a healthier, happier, and more successful startup journey.

Ready to explore the best group health insurance options for your startup?

At Ethika, we’ve walked in your shoes. We’ve helped numerous startups like yours navigate the complexities of choosing and implementing the right group health insurance plan. Our 90% client retention rate speaks volumes about the trust our clients place in us.

With our unique Red Carpet Assistance program, you can rest assured that your employees will receive prompt and efficient support when they need it most. We’re committed to minimizing wait times and enhancing the quality of service delivery.

Partner with Ethika and experience the difference of working with a group health insurance expert that truly understands the startup journey.