Jyoti, a seasoned HR professional, found herself pondering over a question her colleague had posed – How has corporate insurance changed since Covid. Jyoti had been in the industry for about 15 years and the last 5 years had seen a dramatic shift on the human resource function.

Covid had changed the way people looked at insurance. The realization about their own mortalities had brought about a profound change.

But, Jyoti also wanted an expert opinion on how an insider looked at health insurance. So she called Prakash, her liaison from Ethika Insurance Broking.

As it turned out, Jyoti was right. Prakash told her that employee health benefits had undergone a sea change, over the last 5 years. Policies are now more inclusive, robust and optimally priced. But more importantly there has been a change in the way employers have started looking at employee health benefits. Today employee health benefits are used as a tool for

- Attracting and Retaining Top Talent: In a competitive job market, robust benefits packages serve as your key differentiator as a part of the Employee Value Proposition.

- Boosting Employee Morale and Productivity: When employees feel valued and cared for, they are more engaged and productive.

- Reducing Absenteeism: Access to preventive care and timely treatment can minimize sick days.

- Improving Employee Health and Well-being: Promoting a healthy workforce leads to a more vibrant and successful organization.

- Employer Branding: Smart employers use a good Employee Value Proposition (EVP) as a strong branding communication tool.

People ofcourse are a business’s biggest assets, but there are other assets that need protection. What if there’s a fire on the premises? What if there’s a legal liability claim? Questions like these led to the emergence of the other legs under Corporate Insurance like Property & Liability Insurance.

Ethika, over the last decade, has partnered with over 500 companies and helped them choose and fine-tune their corporate benefit offering.

We help clients understand the coverages that are important for them and then help them get these at a reasonable price. But most importantly, we help clients with their claims settlement journey.

With a 4.9* rating on Google Reviews, we ensure that our clients claims settlement journey is as painless as possible.

Give us a call for a free consultation today.

What’s on this page?

What is a Corporate Insurance Policy for Employees?

A Corporate Insurance policy is like a safety net that comes into play when your employees need it the most. It could be in case of hospitalization or accidents.

Definition and Scope

A corporate insurance policy for employees is a group insurance plan offered by employers to their employees. It provides financial protection and benefits to employees and their families in case of unforeseen events like illness, accidents, or death.

Difference Between Corporate and Individual Insurance

While a corporate insurance plan differs from an individual insurance plan in a variety of ways, some of the prominent areas of difference include

- The per person premiums are lower in case of corporate insurance

- The ability to customize a corporate insurance is much higher as compared to an individual insurance

- A corporate insurance generally gives you a dedicated SPOC

Types of Corporate Insurance Policies

Let us now look at the various types of corporate insurance policies in detail

1. Group Health Insurance

A Group health insurance can be thought of as the cornerstone of the employee benefits proposition. It allows the employee to avail comprehensive medical coverage without the need to pay money at the hospital.

Coverage Details

A group health insurance policy can be tailored to cover a wide range of medical expenses, including cost of

- Hospitalization: Inpatient care, surgery, room and board charges.

- Outpatient Care: Doctor’s visits, diagnostic tests, lab work, and therapies.

- Prescription Drugs: Coverage for medications prescribed by a physician.

- Mental Health Services: Coverage for therapy, counseling, and treatment for mental health conditions.

- Preventive Care: Wellness checkups, vaccinations, and screenings.

- Benefits for Employees and Employers – A group health insurance has potential benefits for both the employer as well as the employee. While the employee gets access to affordable healthcare, reduced out-of-pocket expenses, peace of mind, the employer sees improved employee morale and productivity – a win-win.

- Pre-existing Conditions and Maternity Coverage – While most group health insurance policies can be tailored to cover pre-existing diseases and maternity from Day 1, the employer also has the costs to contend with. It is generally advisable to balance these two aspects before deciding on the aspect of, when you want these coverages to kick in.

2. Employee Life Insurance

The employee life insurance provides a lumpsum amount to the family of the deceased employee in case of an unfortunate accident. This amount can take care of the employee’s financial liabilities in his physical absence.

- Term life vs. Whole Life Insurance in Corporate Policies – While term life is a pure risk hedging instrument which provides a lumpsum amount in case of an employee’s unfortunate death while in employment, a whole life insurance offers lifelong coverage and includes a cash value component. The whole life insurance is less common in corporate policies, but the term life is considered to be a must have.

- Group Term Life Insurance Benefits – A group term life insurance is a pure risk hedge for an employee. Imagine a scenario where an employee has bought a home and has a home loan liability of 20 Lakh; now in case of the unfortunate demise of the employee the group term life insurance ensures that the family of the employee does not have to bear this financial burden in the employee’s physical absence.

3. Group Personal Accident Insurance

Accidents aren’t as uncommon as we think they are. Just like a term life insurance, a group personal accident insurance ensures that your family remains financially stable in case of the employee’s death or disability.

- Accidental Death and Disability Coverage – A lump-sum payment is made to the beneficiaries if an employee dies due to an accident. The disability coverage ensures that the employee gets an amount in case of his physical disability that leads to his inability to work.

- Difference from Life Insurance – A group personal accident policy, unlike a term life insurance policy, is triggered only in case of an employee’s accidental death or disability.

4. Property Insurance

Property Insurance covers any damage to your property by perils like Fire, mechanical-electrical breakdown, and burglary, among others.

- Legal Requirements – While property insurance is not a legal requirement in our country yet, business owners are slowly realizing the value that such insurance provides and warming up to property insurance.

- Benefits for Both Employers and Employees –Property insurance policies generally cover the property that is owned by the business.

5. Liability Insurance for Employers & Employees

Liability Insurance policies protect the Employer from any liability that may arise on them by virtue of the work done by employees or the business itself

- Worker’s Compensation Insurance – Covers an employer’s legal liability towards its employees due to work-related injuries or illnesses while on the job.

- Professional Indemnity Insurance – Protects employers and employees against claims of negligence, errors, or omissions in their professional work. It is extremely useful for professionals like Doctors, Lawyers, and Architects. An Errors & Omissions policy, which is a tailored version of the same policy, is also available for companies.

- Directors & Officers (D&O) Insurance – Protects the personal assets of a company’s directors and other employees from lawsuits alleging wrongful acts in their management capacity.

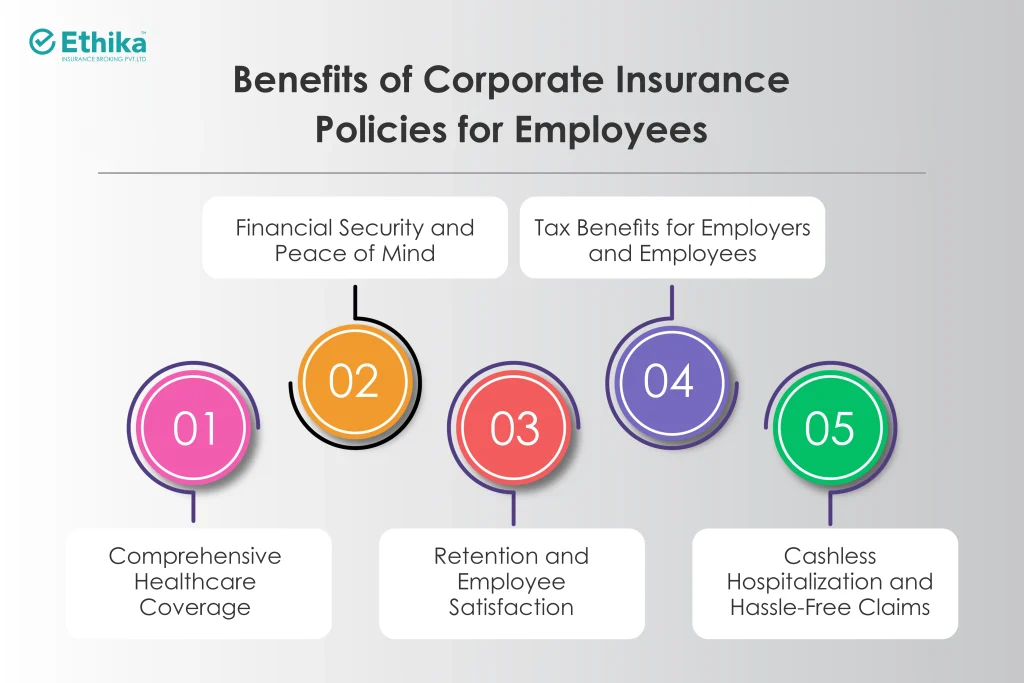

Benefits of Corporate Insurance Policies for Employees

Corporate insurance isn’t just about mitigating risk; it’s about investing in your most valuable asset: your employees and protecting your business. A comprehensive insurance plan provides many benefits beyond just a paycheck, contributing to employee well-being, financial security, and a positive work environment.

Let’s explore these benefits:

1. Comprehensive Healthcare Coverage

Comprehensive Healthcare Coverage is no longer a luxury. Today, it has become a basic necessity, so much so that smart employers use it as their Employee Value Proposition. With Comprehensive Healthcare Coverage, employees do not have to worry about

- Hospitalization and medical expenses, which would otherwise eat into their personal expenditure.

- Preventive care benefits ensure that the employee is physically and mentally fit and can avoid tertiary care treatment to the maximum extent possible.

2. Financial Security and Peace of Mind

Corporate Insurance policies ensure that employees do not have to worry about their financial security constantly and can have peace of mind with

- Reduced Out-of-Pocket Expenses – Which reduce the stress of hefty medical bills.

- Security for Employees and their Families – Policies like life insurance and accident insurance provide crucial financial protection for families in case of unforeseen circumstances.

3. Retention and Employee Satisfaction

Smart employers use a good corporate policy as a strong attraction and retention tool.

- Impact on Hiring and Retaining Top Talent – As the job market gets more competitive, a good corporate insurance policy becomes the tipping point for employees to decide on current and prospective employers.

- Boosting Employee Morale and Productivity – Employees who feel valued and cared for are more likely to be engaged and productive. Knowing they can access quality healthcare and financial protection contributes to a positive and motivated workforce.

4. Tax Benefits for Employers and Employees

Many employees today are reeling under heavy tax burdens, and corporate insurance policies can immediately help ease some of this burden for both the employer and employees.

- How Corporate Insurance Helps Reduce Tax Liability: Employers and Employees can claim exemption to the extent of the premiums they bear.

- Legal Compliance Benefits – Insurance policies like liability policies ensure that employers and employees are prepared to face any legal challenges that may arise during the course of running a business or employment.

5. Cashless Hospitalization and Hassle-Free Claims

The beauty of a corporate insurance policy is that employees can avail themselves of cashless facilities, even when the hospital is a non-network hospital. Even reimbursement claims in corporate policies are settled within reasonable TATs.

- Network Hospitals and Direct Billing: Most of the time, employees can walk out of the hospital without paying anything.

- Simplified Claim Process: Corporate Insurance policies have dedicated SPOCs who make the claim settlement process simpler for employees.

Drawbacks and Limitations of Corporate Insurance Policies

While Corporate Insurance policies tend to offer superior coverage, there are certain areas where the coverages under a corporate policy might be inferior to those under an individual policy.

1. Limited Coverage Post-Employment

A corporate insurance policy covers its employees only while they are employed. This is by design. However, there might be cases where employees who retire from a company on superannuation are offered coverage until life:

- What Happens When an Employee Leaves? – When an employee leaves the company, his coverage terminates. Most of the time, he is given the option to port into individual health insurance.

- Options for Portability and Conversion – Most policies offer the benefit of porting into an individual health policy for employees when they leave a company. But it is advisable to have these terms agreed to beforehand.

2. Coverage Caps and Exclusions

Most corporate insurance policies tend to have cappings and exclusions. If you are new to the corporate policy arena, it is advisable to avail yourself of the services of a broker. Because, more often than not, cappings, as well as exclusions, are brought to light only at the time of a claim.

- Common Limitations in Corporate Health Policies – Some of the common limitations of a corporate health policy are the exclusions and cappings under the policy. And while employers can ask for inclusions, more often than not, the additional premiums might be hefty.

- Understanding Policy Exclusions – More often than not, exclusions under the policy are brought to light at the time of a claim. Incidents like these can not only hamper the employee’s claim experience but can cause a ripple effect that hampers the entire image of your organization.

It is always advisable to avail yourself of the services of an intermediary if you lack the expertise required to deal with the operations of a corporate insurance policy. The intermediary can make good their cost by virtue of the technical know-how during claim settlement, which can help settle many claims that would otherwise remain closed.

3. Dependency on Employer’s Plan

While the benefits of corporate insurance outnumber the ones offered by an individual health plan, one of the major drawbacks from an employee’s perspective is that these plans are employment-dependent and cease the moment you switch jobs.

- Why Employees Should Consider Personal Insurance Too – Your personal insurance is like your personal safety net. Irrespective of whether you work with a certain employer or don’t, it will always be available for you. Moreover, it can complement the gaps that remain uncovered in your corporate insurance.

- Mixing Corporate and Personal Health Insurance – Having both corporate and personal health insurance can create a powerful combination. Your corporate plan serves as the primary coverage, while your personal plan acts as a backup, filling in any gaps and providing additional benefits. This approach ensures you have comprehensive protection and greater financial security in the face of unexpected medical expenses.

How to Choose the Best Corporate Insurance Policy for Employees

Choosing the right corporate insurance for your employees is a strategic decision that can either augment or hamper your employee value proposition. So, how do you make the decision?

Here’s how:

1. Assess Business Needs:

What your corporate needs as insurance might differ greatly from what your closest business competitor needs. Therefore, it is very important to first sit and deliberate on what you are targeting. What business objective should your corporate insurance achieve? Is it just employee health? Is it cost-saving? Is it employee welfare? Or do you plan to make your corporate insurance a part of your Employee Value Proposition (EVP)?

2. Compare Insurance Providers:

Once you understand your needs well, it’s time to shop around and compare insurance providers. Look for providers with a strong reputation and a proven track record. At this stage you might want to decide on whether you want to avail the services of an insurance broker. If you do decide on a broker, he should take care of the comparison and recommendation of the insurance provider.

3. Customization Options:

When it comes to corporate insurance, flexibility is key. One size rarely fits all. Look for providers that offer customization options, allowing you to tailor the plan to your specific requirements. Your broker should be able to help you with this. You will need to work closely with him to make him understand what you want to offer your employees. But this would be a one-time investment because he can take it independently from the next year onwards.

4. Compliance with Legal Regulations:

While there aren’t many micro aspects regarding compliance, one of the macro aspects that you will need to be aware of is whether your insurer is abiding by the legal regulations set forth by the regulator. You can avail of the list of Insurers servicing the Indian market on the regulator’s website.

Ethika, over the last decade, has partnered with over 500 companies and helped them choose and fine-tune their corporate insurance offering.

We help clients understand the coverages that are important for them and then help them get these at a reasonable price. But most importantly, we help clients with their claims settlement journey.

With a 4.9* rating on Google Reviews, we ensure that our clients claims settlement journey is as painless as possible.

How Employers Can Optimize Their Corporate Insurance Plan

While a corporate insurance plan is one of the best Employee Value Proposition (EVP) tools available, how you optimize it will define its success. Choosing the right corporate insurance, while the first step, is the most important one. Here’s how employers can make the most of their corporate insurance plan

1. Educate Employees About Insurance Benefits:

A well-informed employee is an empowered employee. Explain the coverage details, how to access the services, and the claims process. Your insurance broker can take care of most of these responsibilities. When your employees understand the benefits they are eligible for, they can use them proactively and will not feel lost when need be.

2. Negotiate Better Terms with Insurers:

Never settle for the first quote. Always negotiate. Negotiate for better premiums, coverages, and a better Third-Party Administrator. Staying informed about market trends and competitor offerings can put you in a good negotiating position. If you use an insurance broker, he will take care of the negotiation aspect for you.

3. Periodic Policy Review and Updates:

The world of insurance is constantly evolving. As is the world of business. Your employees needs may simultaneously change over the years. Keeping abreast with the changing times and needs will help you review your policy and update it at renewals. Always maintain a proactive approach toward policy reviews. This will ensure that your policy remains positioned as a good Employee Value Proposition (EVP) tool.

Frequently Asked Questions (FAQs):

What is the Best Corporate Insurance Policy for Small Businesses?

While no one size fits all, the best corporate insurance policy will provide the best coverage at an optimum cost. Factors to consider include the size and demographics of your workforce, industry risks, and employee preferences. A comprehensive plan typically includes health, life, and accident insurance.

Can Employees Add Family Members to their Corporate Health Plan?

Yes, most corporate health plans allow employees to add family members to their corporate health plans. Members that are generally allowed are spouse, children, and parents/ in-laws.

How Does Corporate Insurance Differ From Personal Health Insurance?

Employers offer corporate insurance as a group benefit, while personal health insurance is purchased individually. Because of the number of people covered, per-head premiums could be lower in corporate plans.

What happens if an Employee Resigns, can they Continue their Insurance Plan?

Coverage ends when an employee resigns.

However, some plans offer the option of portability, allowing employees to convert their group coverage to an individual policy.

Are there any Tax Benefits for Employees under Corporate Insurance Policies?

Yes, employees can claim for tax exemptions to the extent of the premium borne by them.

Conclusion

Corporate insurance is a vital component of a comprehensive employee benefits package. It provides financial protection, peace of mind, and many other advantages for both employees and employers. Careful assessment of your needs, a good benchmarking exercise and staying informed of new developments in the market can help you create a corporate insurance plan that can help you attract and retain top talent. It can also boost employee morale and contribute to the success of your business.

Ethika has, over the years, helped countless employers, create and fine tune their Employee Benefit structure. Ethika, over the last decade, has partnered with over 500 companies and helped them choose and fine-tune their corporate insurance offering.

We help clients understand the coverages that are important for them and then help them get these at a reasonable price. But most importantly, we help clients with their claims settlement journey.

With a 4.9* rating on Google Reviews, we ensure that our clients claims settlement journey is as painless as possible. Ethika’s unique Software & its Red Carpet Assistance program sets it apart.

We know that when your employees or their loved ones need medical care, time is of the essence. Our team of dedicated professionals works round the clock to minimize wait times and enhance the quality of delivery.