Category: Health Insurance

“A stitch in time saves nine” is a most popular idiom which aptly matches to “Now insurance for health saves your wealth”. It has been paradoxical thinking that health insurance must be taken only for old people but the fact is Health Insurance should be taken in teens. It’s been thought that health insurance an expenditure but with continuous changes in the environment and economy, healthy living has become luxury and health insurance has become a major rescue. Here are four major reasons why this is the right time for health insurance:

Group Health Insurance Providers In India – Top Picks

“But there are thirty of those Aaliya”. Jaanvi was crying for help. She had finally convinced her management for a group health policy for her staff. But she had failed to anticipate the complexities involved with group health insurance. A simple google search left her overwhelmed. Selecting the right group health insurance is a complicated […]

Best Small Business Health Insurance: A Complete Guide

“What is your biggest headache?” I asked my elder brother, who had been running a small business for a couple of years now? “अच्छे लोग नहीं मिलते यार छोटे, और मिलते हैं, तो 3 महीने से ज्यादा रुकते नहीं”. This, I was realizing, was a common problem with most small businesses in India. I wanted […]

What is Group Health Insurance in India – The Ultimate Beginner’s Guide

Ram’s phone pinged. Two messages, one normal, another one on Whatsapp – both with the same text – Congratulations on joining Zeon. Welcome aboard!!! You have been added to Zeon’s Group Health Insurance Policy. Listed is a brief summary of your coverages under the policy. The detailed Terms and Conditions are available with your Human […]

Understanding Preferred Provider Network (PPN) Hospitals in India: A Comprehensive Guide

Anyone who has had to go through the painful process of hospitalization has indeed been asked the question if the hospital is a part of the PPN. In this blog lets take a closer look at what PPN is, how it has come about and where it is headed. The medical inflation in India is […]

International Health Coverage in your Domestic Health Insurance

In an increasingly globalized world, the way we travel and handle healthcare is evolving rapidly. Frequent international travel has become the norm for many, whether for work, leisure, or study. Consequently, health insurance providers are adapting to these changes, offering policies that include international health coverage as part of domestic plans. This shift means that […]

Five Proven Ways to Lower Premiums for Your Employee Health Scheme

Acko India Health Report 2024 pegs the year-on-year rise in health inflation in the country at a staggering 14%. This essentially means healthcare costs are doubling every five years. With such cost escalations how would your Employee Health Scheme fare in a couple of years? Wouldn’t your premiums double as well? Well, they might. But […]

How to Enrol in Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY)

The Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) now covers citizens aged 70 years and above irrespective of their income. So Should You Enroll? If So, How?For most folks who would be reading this, we are a country in our prime, a country on the cusp of reaping the fruit of its demographic […]

What are Reasonable and Customary Charges in your health insurance policy?

In 2019, Neelam Vohra filed a claim with National Insurance Company for ₹5.4 Lakh to cover a knee replacement surgery at a network hospital. Shockingly, the insurer approved only ₹2.2 Lakh, citing R&C charges as the reason for deducting the remaining ₹3.19 Lakh. In February 2023, Mayur Parmar underwent cataract surgery in Vadodara and submitted […]

Do you really need a Third party Administrator in health insurance?

As many as 43% of insurance policyholders had difficulties processing their health insurance claims in the past three years, says a survey, by localcircles.com, a social media platform for communities, governance, and urban daily life. That is why a Third Party Administrator (TPA) for processing health insurance claims is extremely essential. However, while TPAs have […]

Health Insurance Premiums Have Gone Up by 52% in 2024- 7 Ways to Reduce Your Health Premiums.

A recent survey by Local circles has mentioned that health insurance premiums have increased by 25% in the last 12 months as reported by the participant health insurance policyholders. This drastic increase in premiums could be traced back to 2022, a period when insurance companies faced huge losses due to Covid-19 claim settlements and heavily […]

Can pre-existing conditions be a reason for claim rejection, if it’s not the cause of the claim?

Pre-existing conditions can easily classify as a nightmare for most insurance policyholders. Insurers tend to use pre-existing diseases as one of their biggest allies to reject claims. The IRDA has to constantly come to the rescue of the policy holder, to ensure fair treatment. But can a claim be rejected, even when the underlying cause […]

When & How to Increase Your Health Insurance Cover?

Although most of us understand the need and relevance of a Health insurance policy in this century, we might still not have a clear understanding of how to plan the sum insured for our policy. One might argue that the sum insured in a health insurance plan should be chosen based on individual requirements, but […]

How to Avoid Health Insurance Claim Delays: 5 Out of 10 Patients Face Settlement Issues

The latest report from Pristyn Care highlights that 5 out of 10 patients face hospital discharge delays due to the time taken by the cashless claim settlement process in a health insurance plan. The study also points out that 40% of the delays are attributed to the administrative process in the hospitals. The major challenges […]

Is Group Health Insurance Mandatory for Employees in India?

Today, Group Health Insurance has become the cornerstone of employee benefits packages in India, offering financial protection and peace of mind to employees and their families. While not mandatory, the COVID-19 pandemic highlighted its importance, prompting many employers to continue providing this valuable benefit. Beyond fulfilling a sense of corporate responsibility, group health insurance offers […]

Health Insurance for Smokers: Impact of Tobacco Consumption on your Health Insurance

It is widely believed that people who consume tobacco and other related products would not get any life and health insurance coverage from insurance companies. This was the case a few years ago where the insurance companies used to deny insurance cover for people consuming tobacco and other related products. Insurance companies do offer health […]

How to Pick an Affordable Group Health Plan for Your Start-up?

Selecting an affordable group health insurance plan is crucial for startups aiming to attract and retain talent while managing costs effectively. A well-chosen plan not only provides financial security to employees but also fosters a sense of belonging and trust within the organization. In the fast-paced world of startups, offering a competitive edge is key […]

Tax Benefits in Personal Health Insurance

Personal health insurance is a type of insurance policy that provides hospitalization and other related expenses to the insured in case of treatment due to any illness or disease mentioned under the terms and conditions of the policy. The maximum amount of liability of the insurance company, in any case, would not exceed the sum […]

Individual Health Insurance Plans for Senior Citizens in India

With age comes an increased likelihood of health issues, making health insurance a critical safety net for senior citizens. A well-chosen plan not only offers financial protection against hefty medical bills but also ensures access to quality healthcare services when they are needed most. As healthcare costs continue to rise, securing adequate health insurance for […]

Does Group Insurance Cover Pre-Existing Conditions?

Group health insurance offers a significant advantage when it comes to pre-existing conditions. Unlike individual plans, group policies often allow for immediate coverage of these conditions, providing a safety net for employees and their families. So, does group health insurance cover pre-existing conditions – Yes, it can. While pre-existing conditions typically involve waiting periods in […]

List of Medical Expenses Covered Under Group Health Insurance Policy

Group health insurance policies offer a variety of benefits covering specific medical expenses, providing valuable financial relief for employees and their families. But as important are the list of medical expenses covered under a group health insurance policy, so are the exclusions under the policy. Let’s go over the detailed inclusions and exclusions. Covered Medical […]

Here is a Guide on How to Handle a Health Insurance Claim Rejection

Most of us buy a health insurance policy to come in handy in case of hospitalization, as the policy would pay our expenses. We buy a health insurance policy thinking that we should not use it, but it might happen that we should sometimes use it. This is the moment of truth that you had been waiting […]

Decoding IRDA’s 65 Years Age Rule in Health Insurance

In a significant step towards inclusivity, the Insurance Regulatory and Development Authority of India (IRDAI) recently lifted the age limit for buying health insurance policies. Previously, insurers could set an entry age cap at 65, which limited many senior citizens from obtaining coverage. Now, the regulatory change allows people over 65 to buy health insurance. […]

AI Revolutionising Healthcare Coverage: Unleashing Innovation’s Potential

The Current Landscape of Health Insurance The landscape of health insurance is undergoing significant transformation, shaped by evolving demographics, rising healthcare costs, and technological advances. With an ageing population and increasing prevalence of chronic diseases, there’s a growing demand for accessible and affordable healthcare coverage. Furthermore, regulatory changes and market factors push insurers to reinvent […]

Health Insurance Claim Rejected? Here are the Possible Reasons for Rejection.

Assume, you were admitted to the hospital due to an accident and at the time of admission you have submitted your health insurance card at the hospital. But, you were shocked to see a rejection mail from the insurance company regarding your claim. Now the entire burden of claim payment has fallen on you as […]

Claim Settlement Ratio in Group Health Insurance

Group health insurance claim is the claim raised by the members of the group health insurance policy. The claim under group health insurance policy can be raised on a cashless basis or reimbursement basis. In case of cashless claim settlement, the insurance company would directly settle the claim with the hospital whereas in case of […]

Maternity Benefits in Group Health Insurance Policy

In the competitive landscape of employee benefits, maternity coverage has become a standout feature in group health insurance plans. This valuable benefit not only supports new parents with critical healthcare but also helps companies attract and retain talent. In this guide, we’ll dive deep into what maternity coverage entails, its benefits for employees and employers, […]

Artificial Intelligence in Health Insurance: The Final Frontier

AI’s impact on health insurance has been profound. From its beginnings as an automaton for repetitive tasks to its current use in personalised risk assessments and proactive healthcare efforts, AI has positioned itself as a key component in modern operations. Insurers can now offer customised insurance plans, more effectively detect fraud, and predict individual health […]

How to Cover Parents in Group Health Insurance?

It is important to know whether the group mediclaim policy for parents is available in your organization. Parents’ health insurance premiums would depend on the age of the parents and the coverage required. Parents can be added at any point of time during the policy period. The premium can be paid by the employer or the employee.

How Can Self-funded Group Health Insurance Help Your Business?

Self-funded group health insurance is emerging as a popular choice for Indian companies seeking greater control over their healthcare costs. Rather than paying a fixed premium to an insurance provider, self-funded plans allow businesses to directly cover employees’ healthcare expenses as they arise. Here’s how self-funded group health insurance can support business growth, manage costs, […]

How to Pickup an Affordable Group Health Plan for your Startup?

It’s an acknowledged fact that hiring for a start-up is a challenge that every entrepreneur’s (especially first-time ones’) headache is centered around. Attracting a settled and performing individual to leave all behind and jump ship (more like jump ship to the boat) is hard enough. Fortunately, there are means and instruments, such as group health […]

Gift yourself and family with a health insurance on this World Health Day

The World is experiencing rapid changes in the medical field which is contributing to the increased life expectancy. On the other hand, modernization, changing lifestyle and industrialization is leading to new challenges which is increasing the chance of suffering from multiple conditions. Most of the conditions we have today were very common in our previous […]

A Deep Dive into the Importance of Employee Benefits Insurance

In today’s rapidly evolving workplace, employee benefits insurance is no longer a luxury—it’s a strategic necessity. As organizations adapt to hybrid and remote work models, offering tailored benefits has become essential to meet the needs of a diverse workforce. Beyond traditional health coverage, modern benefits now include mental health support, financial wellness programs, and flexible […]

Best Cancer Health Insurance Plans in 2022

Aditya Birla Health Insurance- Activ Secure- Cancer Secure Plan: Key Highlights: All 3 stages of cancer are covered- Early, Major and Advanced stages. Coverage for up to 150% of the sum insured 10% cumulative bonus for every claim free year Sum Insured Options: Rs. 5 Lakhs to Rs. 1 Crore Cancer Care Cover: Early : […]

Health Insurance Policies Which Cover Obesity

Obesity is increasingly becoming a critical health issue worldwide, and India is no exception. The rise in sedentary lifestyles, unhealthy eating habits, and stress has led to a surge in obesity-related health problems, such as diabetes, hypertension, and cardiovascular diseases. These conditions not only affect physical well-being but also impose significant financial burdens on individuals […]

Best Health Insurance Plans for Diabetic Patients in 2022

Have you thought about the disease “Diabetes”? Do you know that there are separate and comprehensive health insurance for diabetic patients? The most common disease these days is diabetes in India which has become common after you cross 40 years of age. If we go back a decade or two, the common age of diabetes […]

Navigating the Maze of Infertility Insurance in India: A Comprehensive Guide

Infertility, affecting roughly 70 million couples in India, throws a wrench into couples’ dreams of parenthood. While technology offers solutions through Assisted Reproductive Technology (ART), the associated costs can be daunting. Thankfully, some health insurance plans now offer infertility coverage, albeit with significant variations. This guide demystifies the intricacies of infertility insurance in India, empowering […]

Importance of Health Insurance on Holi

Holi is one of the major festivals celebrated in India which symbolizes the victory of good over evil. Holi is celebrated at the start of the spring after a long cold winter in all parts of the country. Holi is celebrated in various forms among various groups of people. There are many poems documenting the […]

Your Comprehensive Guide: How to Successfully Claim Health Insurance Benefits?

Health insurance is a comprehensive policy that carries many benefits that are to be utilized to their full potential to get the maximum benefits out of it. Gone are those days when health insurance plans used to cover only hospitalization expenses such as room rent, surgery costs, surgeon fees, anesthesia fees, etc. Earlier, there used […]

Can a Preliminary Hospital Note Affect Your Health Insurance Claim?

Navigating health insurance claims can sometimes feel like walking through a minefield. One of the most overlooked aspects is how a simple hospital note can influence the fate of your claim. A single preliminary note can spark debates, as seen in a real-life case involving Mr. Shishir Bhatnagar and IFFCO Tokio General Insurance. In this […]

What is Preventive-Care Health Insurance

Preventive-care health insurance plans are gaining traction in the market as they encompass a wide range of services targeted at preventing illnesses or detecting them very early so that they can be acted upon effectively. As the saying goes, “Prevention is better than cure.” The adage not only suits health insurance plans but also has […]

What Impacts Your Premium in Group Health Insurance?

Understanding the factors that impact your premiums in group health insurance could not only save you a lot of money, but they could also affect your entire Employee Value Proposition. For organizations, ensuring employees are well-protected while managing budgets can be a tightrope walk. Therefore understanding the factors influencing premiums can help you strike the […]

Revolutionising Health Insurance in India, One AI Brick at a Time

India’s health insurance landscape is undergoing a dramatic transformation. The integration of Artificial Intelligence (AI) in health insurance sector promises to redefine affordability, accessibility, and efficiency for millions of people across the country. From personalized policy offerings to streamlined claims processing, AI is reshaping how insurers operate. Cutting-edge algorithms and data analysis tools are driving […]

Cashless Everywhere: A Game Changer for Healthcare in India

The “Cashless Everywhere” initiative, introduced by the General Insurance Council in January 2024, has brought a paradigm shift in the Indian healthcare landscape. By enabling cashless treatment at any hospital – even those outside the insurer’s network, this initiative eliminates the hassles of upfront payments and reimbursement claims. It is a game-changer for policyholders, ensuring […]

What is the Difference Between Employee Compensation and Employee Benefits?

In the world of talent management, employee compensation and employee benefits are two critical components that play a vital role in attracting and retaining top talent. While both are key elements of a comprehensive employment package, they serve different purposes. Compensation refers to the direct monetary payments employees receive for their work, such as salaries, […]

How to Negotiate Hospital Billing Without Insurance

The commercialisation of health care is a burning agenda today. There is no regulation on hospitals and hence we don’t have anything like MRP or say standard rates for hospital procedures. Negotiating with the art of negotiation under the assumption that there is no medical insurance.

What to Look for in a Group Health Insurance Provider: Key Features and Benefits

In today’s competitive business environment, offering robust health insurance is essential for attracting and retaining top talent. Choosing the right group health insurance plan safeguards employees’ well-being. It also enhances overall job satisfaction and productivity. But more importantly, choosing the right group health insurance provider can ensure that your employees have a claims experience that […]

The Cost of Waiting: Understanding the Risks of Not Having Personal Health Insurance

India’s rising healthcare costs and the growing prevalence of lifestyle diseases make personal health insurance a necessity rather than a luxury. Not having personal health insurance can lead to unsurmountable costs. Unfortunately, many individuals risk the decision of buying a personal health insurance until it is too late. They rely solely on employer-provided policies, assuming […]

Co-payment in Health Insurance

What is Co-payment? Co-payment refers to the amount of claim that should be borne by the insured during the settlement of a claim. The co-payment amount depends on the co-payment clause mentioned in the policy. Irrespective of the claim amount, the insured has to settle their part before the insurance company makes the final payment. […]

Personal Accident with Life Insurance or as Stand-alone. Which One is Better?

A personal accident policy is designed to provide compensation to the insured in case of bodily injury, such as disability and death arising out of accidental means. It would usually cover death and various forms of disability such as permanent total disability, permanent partial disability, temporary total disability and temporary partial disability. Even though the […]

Understanding Group Health Insurance for Large Companies: Self-Funded vs Employer-Funded Plans

When you are a large company, one of the biggest costs for you is the employee cost. Employee cost is not just the salary that you pay employees. One of the bigger employee costs is also the cost of employee health and welfare. In this piece, let us examine what is the appropriate way to […]

Have You Considered These Things Before Making a Health Insurance Claim?

The most important part of the insurance utilization process is claim settlement. Claim settlement can be considered as the last stage in the process and is the core stage for which the policy is taken. Health insurance claim settlement arises once the patient is hospitalized due to an accident, disease, or illness. Health insurance claim […]

Difference Between Life, Health and Personal Accident Insurance

Many people think of life insurance when they hear the word insurance. That was the kind of impact life insurance has created on people, but in reality, life insurance is not the only insurance available in the market. Insurance can be life or non-life. Life insurance covers the life of individuals against death, whereas general […]

How to choose the right group health insurance plan for your business?

Group health insurance is a customized policy that can be designed as per the needs and requirements of the Customer. Choosing the right group health insurance plan for your business, however, can be a tricky affair. The offerings vary from one insurance company to another. For instance, one insurance company might cover the robotic treatments, […]

Group Health Insurance vs. Individual Health Insurance: What’s the Difference and Which is Best for Your Business?

Health insurance plays a vital role in safeguarding against financial risks associated with medical emergencies. Businesses and individuals alike often face the dilemma of choosing between group health insurance and individual health insurance. Understanding the differences between these two types of plans can help you make an informed decision that aligns with your needs and […]

The Hidden Benefits of Personal Health Insurance

Customers should explore many hidden benefits in personal health insurance plans to avail of benefits during the policy period. These benefits would be hidden in plain sight for the customers, and most would not pay heed to these benefits in the first instance. Insurance intermediaries would also not explain these benefits to the customer while […]

The Impact of Group Health Insurance on Employee Wellness and Productivity

Employee wellness today, has become a cornerstone for successful organizations. Group health insurance plays a pivotal role in fostering employee wellness. Group Health Insurance and Employee Productivity, as well, can be said to be intertwined. Providing comprehensive health coverage not only improves physical and mental well-being but also creates a supportive workplace culture. Healthy employees […]

Personal Health Insurance vs Employer-Sponsored: Which is Right for You?

Personal Health Insurance The personal health insurance policy, which is also referred to as retail health insurance or individual health insurance, pays for medical expenses of an insured client because of an accident, sickness, or illness in excess of the sum insured maximum in exchange of a small fee. The insured customer would completely own […]

The Advantages of Having Personal Health Insurance in Retirement

Retirement refers to when one leaves an active profession and working life behind, often after age 60 or when no longer capable of work. People generally retire due to various reasons, including health conditions, relaxation, or aging in general – such as retiring due to incapacity. People typically enjoy peaceful retirements to focus on maintaining […]

Employee Retention, Attraction, and Satisfaction: The Benefits of Group Health Insurance

Employee attraction and retention is a top priority for businesses in today’s competitive landscape. Offering group health insurance has proven to be an effective way to attract, retain, and satisfy employees while enhancing organizational reputation. The connection between health insurance benefits and employee loyalty cannot be overstated. Comprehensive coverage assures employees of financial and healthcare […]

How to Save Money on Personal Health Insurance Coverage

Today, any minor surgery can cost you anywhere between 2-5 Lakh Rupees. Health inflation in India is rising at about 14% per annum. If you are a white-collar worker, your salary hike might have been lower than 14% per annum, especially over the last few years. Without basic health insurance, it is increasingly difficult for […]

Common Misconceptions About Personal Health Insurance

Personal health insurance misconceptions are common among people intending to purchase health insurance. Misconceptions about personal health insurance could be due to various reasons like the influence of past events or bad experiences with the insurance provider. Such events create a strong negative feeling towards personal health insurance and prevent you from buying a policy. […]

A Healthy Bottom Line: How Group Health Insurance Can Boost Your Business’s Financial Health

A strong financial foundation is essential for any thriving business, and investing in employee well-being plays a critical role. But did you know that you could actually improve your financial health through Group Health Insurance? Yes that is correct, Group health insurance is not just a benefit for employees; it’s a strategic tool that can […]

How to Maximize Your Personal Health Insurance Benefits?

A personal health insurance policy is typically used to pay for the costs of medical treatment for the insured if they are hospitalized due to illnesses or accidents. But other benefits can be derived from personal health insurance plans that are unknown to many users. Health insurance plans come with many benefits, some of which […]

The Cost of Doing Business: How Group Health Insurance Can Help You Save Money

Running a successful business requires balancing costs with investments that yield long-term returns. There are numerous costs involved in conducting business in India. These include startup costs, sunk costs, and employee expenditures such as salaries, employee benefits etc. The major costs apart from the initial investment would be the operational and employee benefits costs. Any […]

Beyond the Basics: Uncovering the Hidden Advantages of Group Health Insurance

Group health insurance is often viewed as a standard employee benefit. However, its advantages extend far beyond basic medical coverage, impacting employee well-being and organizational success in unexpected ways. In this piece let us uncover some of the hidden advantages of a group health insurance. From boosting morale to fostering loyalty, group health insurance creates […]

Navigating the World of Group Health Insurance: Tips for Choosing the Right Plan

Group Health Insurance covers the medical expenses of the insured members up to the sum insured mentioned under the plan in return for a premium amount that the insured customer pays. But, choosing the right group health insurance plan can be tough, especially with the plethora of choices available in the market today. In this […]

5 Benefits of Investing in Personal Health Insurance

When a person is hospitalised as a result of an accident or illness, personal health insurance can be helpful. Personal health insurance policy can be purchased for oneself as well as someone you have an insurable interest in. Insurable interest in simple terms is your interest in the person you are insuring. You can therefore […]

Understanding the Important Cost Considerations of Personal Health Insurance

Ever wondered how Insurers cost their Persona Health Insurance Products? While many statistics and related sciences are used. Let us Understand Some Factors Behind Deciding Premiums. Age: Age is an important factor in deciding the health insurance premium. All insurance corporations base their top rate calculations on the age of the eldest member within the […]

10 Reasons Why Group Health Insurance is a Game-Changer for Small Businesses

Small businesses often face the challenge of attracting and retaining talent while managing tight budgets. Group health insurance offers a strategic solution that benefits both employers and employees, making it a game-changer for startups and small enterprises. In this piece lets explore how group health insurance can be a game changer for small businesses. Offering […]

How to Choose the Right Personal Health Insurance Plan for You?

Tips to Choose the Right Personal Health Insurance Plan Personal Health Insurance Plans are those in which the insured pays the premium to cover their financial expenses in case of any hospitalization. It is essential to choose the right personal health insurance plan as it would be difficult to change the health insurance policy every […]

The Importance of Personal Health Insurance: A Guide for Young Persons

Personal Health Insurance Covid -19 has accentuated the need to have health insurance. Health insurance not only gives financial stability to the policyholder by safeguarding their hard-earned money, but also protects the policyholder’s monies, which she would have otherwise had to bear due to hospitalization. Personal health insurance also known as retail health insurance can […]

Things You Must Ask from Your Insurance Broker before taking a Group Health Insurance Plan

Choosing the right insurance plan can be a daunting task, especially with the variety of options available. This is where an experienced insurance broker plays a crucial role. He can guide you through the process. But even an Insurance Broker needs to be questioned above his advices. He might be the technical expert, but it […]

How to Choose Cheap Group Health Insurance? (₹ 50 Lacs cover at ₹ 500)

A group super top-up plan is a type of health insurance plan which can be taken in addition to the base group health insurance plan at the lowest possible premium. Cheap group health insurance in India is available online from Ethika insurance broking here.

Group Health Insurance: How to Demystify Room Rent and ICU Limits?

Room rent in group health insurance is the per-day room charges or bed charges the hospital charges the insured patient in case of hospitalization.

What is a Cash Deposit Balance in Health Insurance?

In health insurance, a cash deposit balance account is like a bank account where the insured can put his premium money. This money will be used in the future to cover employees’ health insurance costs.

How and Why to Switch From ESI To Group Health Insurance?

To switch from ESI to group health insurance, you need to enroll in the ESIC scheme twice a year and go through the group health insurance purchase process once a year. The minimum requirement of group health insurance is 7 lives, which is less than that of ESI.

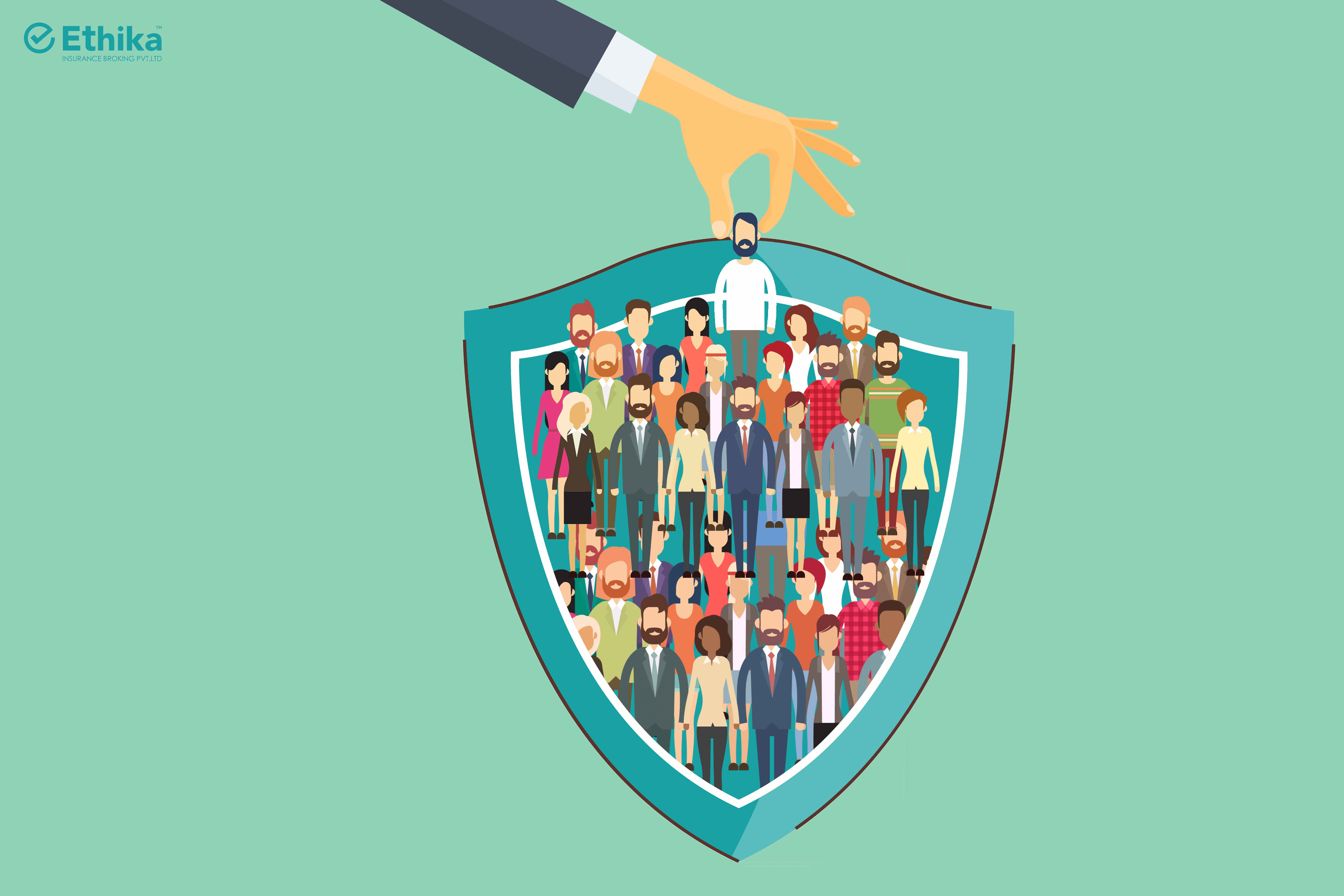

Risk Pooling: Reduce Risk in Group Health Insurance Selection

The insurance company acts as an intermediary between a group of people who would like to hedge their risk by taking the insurance and paying the premium. A health insurance policy should be taken by healthy people as well as unhealthy people so that the loss ratio could be maintained by the insurance company.

How Can Group Health Insurance Reduce Employee Attrition? How to Reduce Employee Turnover?

In developed countries such as America, Canada, and Europe most employees check the health insurance coverage offered by the employer before deciding on joining. When a company has the best group health insurance plan that its competitors don’t have, it will be able to keep more of its employees.

How Corporate Health Insurance Transfers While Job Change?

Corporate health insurance is a form of group health insurance that has an employer-employee relationship. Corporate health insurance is a form of group health insurance that has an employer-employee relationship.

Your Guide to Voluntary Top-Up in Group Health Insurance

The group health insurance voluntary top-up option is one such way in which insurance companies provide flexibility in their group plans. Earlier, group plans used to be highly rigid and one-size-fits. However, these days, insurance plans have become much more sophisticated and better at solving the needs of users.

Is Group Health Insurance Becoming More Affordable and Accessible?

The digital revolution has transformed the landscape of group health insurance, making it more affordable and accessible than ever before. Specialized software streamlines administrative tasks, leading to cost savings for insurers, which are passed on to companies in the form of lower premiums. This technological shift, combined with increased competition and a wider range of personalized products, empowers businesses of all sizes to prioritize employee well-being without straining their budgets.

Five Reasons to Offer Group Health Insurance to Your Employees

In this article, we’ll discuss five of the best reasons to buy group health insurance for your company

Things to Consider While Buying Group Health Insurance for an IT Services Company

IT services companies face unique challenges in choosing the right group health insurance plan. With a geographically dispersed and predominantly white-collar workforce, factors like 24/7 support, family coverage, a wide network of hospitals, and coverage for pre-existing conditions become paramount. Finding a plan that caters to these specific needs is crucial for attracting and retaining top talent in a competitive industry.

Things to Consider While Buying Group Health Insurance for the Manufacturing Company

Purchasing group health insurance for your employees can be a complicated process. Every company is unique and its requirements and needs are different. The health insurance needs of a white-collar advertising company will be different from a primarily blue-collar manufacturing company. If you run a manufacturing company, then there are certain key aspects that you […]

Personal Health Insurance Glossary

Insurance involves a lot of technical terms that a layperson may not be aware of. However, it is important to be familiar with these terms as it helps you to understand the terms and conditions of a health insurance policy. Further, it helps to choose the right insurance policy for your needs. We’ve covered some […]

How are Group Health Insurance Premiums Calculated in India?

Calculating group health insurance premiums is a multifaceted process involving various factors, from the total sum insured and claims history to the age and occupation of the employees. Understanding these factors empowers companies to make informed decisions about their coverage and potentially take proactive steps to manage costs.

5 Reasons to Offer Group Health Insurance to Your Employees

Group health insurance refers to health insurance that can be availed by a company for its employees. Group health insurance plans can have several advantages over personal health insurance plans. Further, providing group health insurance to employees can also benefit a company in a variety of ways. Nowadays, almost every company is getting on the […]

Group Health Insurance Glossary:

The insurance industry has a lot of jargon that people need to know about. These terms are commonly used by industry insiders, however, most people outside the industry don’t know what it means. If you’re looking for group health insurance, then you should know about the following group health insurance glossary before deciding on a […]

Things to Consider While Buying Group Health Insurance for a Construction Company

Every type of company has its own requirements when it comes to health insurance. Some companies are relatively high risk when compared to other companies. A high-risk company is a company whose employees operate under less safe working conditions when compared to other companies. A construction company is considered to be relatively high-risk because accidents […]

Sum Insured vs. Sum Assured in Group Health Insurance

Before you choose a group health insurance for your company, it is important to research the difference between insurance policies. Insurance policy documents contain several technical terms that a policyholder needs to understand. Two commonly used terms are “sum insured” and “sum assured”. Understanding what the two are and the difference between sum insurance and […]

Top Healthcare Benefits in Group Health Insurance

As the name suggests, a group health insurance policy is a policy that covers several people. A group health insurance policy can be availed by companies for their employees or by organizations for their members. Usually, companies offer health insurance to their employees as one of the perks and benefits of working with them. Group […]

What is Corporate Buffer in Group Health Insurance?

A group health insurance policy can be availed by companies for their employees. It is one of the most common benefits offered by corporates to their staff. Availing of a group policy has several benefits and advantages which are not available in an individual or family policy. The corporate buffer is one such benefit. In […]

How to Add or Delete Employees in Group Health Insurance?

Group health insurance is usually provided by companies as a benefit of employment to employees. Depending on the company, the employees may pay a discounted rate for their insurance or get health insurance completely free of cost from their employer. After opting for group health insurance, companies and employers can have several questions about how […]

What is Capping or Sub-Limit in a Group Health Insurance Policy?

Before opting for a group health insurance policy, employers need to be aware of and familiar with the terms and conditions of the policy. There are several details in a policy which may seem minor but can have far-reaching consequences. It is better to go through the policy document carefully so that there are no […]

What are the Types of Endorsement Scales in Group Health Insurance?

An insurance policy is not set in stone. There are several circumstances in which the terms and conditions of an insurance policy may need to be changed. Some of the reasons may include a change in the relationship between the proposer and the insured, a change in the details of the nominee, an addition or […]

Top Reasons Why Employees Don’t Use Group Health Insurance

As an employer, you may be considering offering a group health insurance to your employees as a benefit. Why is group health insurance important? There are several advantages of offering group health insurance such as better employee retention, higher goodwill in the market, improved productivity of employees, and so on. A group health insurance is […]

Top 20 Reasons You Must Invest in Group Health Insurance for Small Businesses

If you’re a company, start-up, small business, or large organization of any kind, it is important to consider opting for group health insurance. A group health insurance, as the name suggests, is a health insurance policy that covers several people together. Hence, the entire staff or members of an organization can be covered within a […]

Organ Transplants and Health Insurance

The past few centuries have witnessed great strides in medical science with revolutionary medical breakthroughs. Be it the invention of vaccines and antibiotics or the more recent developments in artificial intelligence, advancements in the field of medicine have not only increased life expectancy but also helped improve the overall quality of human life. Organ transplantation […]

Policy and Checklist for Claiming Group Health Insurance Refund in India

A group health insurance policy compensates the members up to the sum insured limit mentioned under the policy in case of hospitalization due to an accident, illness, or disease. A group health insurance policy is usually taken out by the employer for his or her employees to provide health insurance coverage in case of hospitalization. […]

Health Insurance Policies Which Cover out-Patient (OPD) Benefit

1. Aditya Birla – Activ Health Platinum Enriched Insurance Plan: i) Coverage: The policy will cover the costs incurred for medically necessary consultations, diagnostic tests, and pharmacy expenses on an outpatient basis up to the amount specified under the policy. The appointments can be scheduled through the website or through the mobile application or call […]

How to Cancel a Group Health Insurance Plan?

Group health insurance plans can be canceled due to various reasons from the customer’s end as well as the insurance company’s end. Group health insurance cancellation can be done during the free look period, for which the insurance company would pay the complete refund of premium subject to nil claims before the cancellation of the […]

Top 10 Cashless Health Insurance in India

Cashless health insurance is a type of health insurance claim settlement facility provided by the health insurance companies in which the health insurance claims would be settled directly to the hospitals without any customer intervention. The claim amount would be paid directly to the hospital in which the insured is getting treated. A cashless claim […]

Corporate Health Insurance Companies – Top Providers in India

Corporate Health Insurance has garnered a lot of attention, especially over the last 5 years. The onset of Covid has sent the world into a tailspin and health was the top priority on everyone’s mind. Corporates who were not offering health insurance as a benefit adopted it in haste, while the ones who were already […]

How to Write a Personal Health Insurance Cancellation Letter?

Personal health insurance cancellation letter is the letter written to the insurance company by the insured customer to cancel his/her personal health insurance policy due to any of the reasons whatsoever. The personal health insurance cancellation sample letter is provided in this article which can be used to intimate the insurance company regarding your personal […]

How to Write a Group Health Insurance Cancellation Letter?

Group health insurance cancellation letter is the letter written to the insurance company to cancel your group health insurance policy due to any of the reasons whatsoever. The group health insurance cancellation sample letter format is provided in this article for ready reference. The same format can be used to write the group health insurance […]

Group Health Insurance Exclusions – List of Things Not Covered for Employees

Group health insurance compensates the hospitalization and other related expenses of the insured members up to the limit mentioned under the policy terms and conditions in return for an amount known as premium. The premium under the group health insurance policy is mostly paid by the employer and employee gets to avail of the health […]

What to Do If Health Insurance is Not Affordable?

Let’s think deeply about whether it’s easy to pay yearly premiums or an uncertain, massive medical bill at the hospital, which can affect your lifestyle for a very long time. A lung cancer surgery can cost you around ₹ 3 lakhs and, in addition to that around ₹ 27000- ₹42000 per cycle. Similarly, the average […]

When Should You Get a Group Health Insurance Policy for Your Employees?

Group health insurance is the best form of providing health insurance coverage to employees by any employer. The group health insurance policy would be taken by the employer of the organization to provide health insurance coverage to their employees in case of hospitalization due to the illness, disease or accidents. The maximum liability of the […]

4 Reasons to Buy Personal Health Insurance Over Group Health Insurance Plan

Personal health insurance policy compensates the insured in case of hospitalization due to illness, disease or accident up to the sum insured limit mentioned under the policy in return for a nominal amount known as a premium. Personal health insurance is also known as a retail health insurance policy. Personal health insurance can be taken […]

Checklist for Employers Before Buying Group Health Insurance

Group health insurance is the most preferred form of health insurance policy among employers as a single policy would cover all their employees. The group health insurance policy can also be extended to cover the family members of the employees. The sum insured under the group health insurance can be offered on a floater basis […]

Who is not Eligible for Group Medical Insurance in India?

Group medical insurance is a form of health insurance taken by a group of members under a single master policy. The group medical insurance would compensate the members in case of any hospitalization due to illness or disease up to the limit mentioned under the policy. The eligibility for group health insurance differs from one […]

Which one is better to opt – Retail Health Insurance or Group Mediclaim

Look at the this comparison that will help you understand the difference between group and retail health insurance.

How Easy is it to Port your Group Health Insurance Policy?

Ravi Kumar, an IT professional in his late forties walked into the office of a general insurer. He was not happy with the way his current insurer had treated his health claim; they had kept dilly-dallying the processing for a couple of months, asking for additional documents every time he submitted the previous ones, and […]

Are Legal heir and Nominee the same?

Sheena is late for the meeting with her lawyer Imran. Imran had sounded anxious over the phone, she recalls. When she finally reaches Imran’s office, Imran’s secretary hands her a judgment that Imran has asked her to. As she reads it, her eyes well up in grief and she cannot help but tumble in the […]

The Gift of Insurance

The blind date you had gifted your friend, on her last birthday, hadn’t turned out the way you had anticipated. This year being her 30th, you are under added pressure of choosing a gift that would be commensurate to the occasion. As you relentlessly reject one gift after another, browsing through Amazons, Lenskarts, Ferns & […]

Health Insurance Premium for Healthy people should cost zero!!!

Imagine you are a healthy adult of forty. You exercise regularly, and work hard towards maintaining a healthy lifestyle, despite your demanding work schedule. Do you ever wonder why you have to bear the same premium as someone who smokes, leads a sedentary lifestyle and doesn’t believe in the idea of exercising? Well, the good […]

Is treatment for Mental Health covered by Group Health Insurance policies?

Psychometrics refers to the field of psychology devoted to testing, measurement, assessment and related activities. Psychometric testing in psychology assists doctors in evaluating a patient’s learning, social, behavioral, and personality development. The results of the tests can help in treatment of the psychometric conditions of the patients. Psychometric treatment is the treatment for mental illness […]

List of Common Surgeries covered under Group Health Insurance for Employees and Their Parents

Surgery insurance coverage is a health insurance plan that covers the medical expenses of surgery. It is also known as operation insurance, which covers the cost Surgeries Covered Under Group Health Insuranceof surgical procedures required for the treatment of a medical condition or illness. Surgery is a medical or dental specialty that uses operative manual […]

Endoscopic Sinus Surgery in Group Health Insurance

Sinusitis is a condition in which the cavity around the nasal passage becomes inflated. Sinusitis is caused due to inflammation or swelling of the tissue lining the sinuses. Sinuses are the hollow spaces within the bones between the eyes, and behind the cheekbones in the forehead. These sinuses make mucus which helps in keeping the […]

Group Health Insurance Portability

Health Insurance Portability:: Health insurance porting refers to the process of switching the health insurance policy from one insurance company to another without losing the accrued benefits such as waiting period credit, no claim bonus, free medical check-ups etc. Health insurance porting provides the customers with freedom to switch to a better insurance company in […]

Sum Insured in Health Insurance Policies: Compare Personal and Group Health Insur

Group health insurance can be defined as a health insurance policy that provides financial compensation to the insured in case of hospitalization due to any of the illness or disease mentioned in the policy in return for a nominal amount known as a premium. The premium can be paid in one go or in installments. […]

Working model of Employee Funded (or Self Funding) Health Insurance in India

Health insurance is an agreement between the insurance company and the insured customer in which the insurance company agrees to settle the hospital bills of the insured customer up to the sum insured limit mentioned in the policy, in return for a nominal amount known as Premium. Insurance companies provide the insured customer with health […]

Tax Benefits in Group Health Insurance

Group health insurance offers health insurance coverage to a group of members under a single master health insurance policy, usually a group of employees of an organization. Group health insurance providers cashless or reimbursement claim settlement facility to the members of the policy in case of hospitalization due to any illness or disease. The major […]

Annual Medical Check-up in Group Health Insurance for Employees

Group health insurance policy provides insurance protection to the employees of an organization enrolled under the same group health insurance policy. The medical checkup is a medical examination in the prospective applicant is required to undergo to provide an understanding to the insurance company regarding the acceptance of risk. A pre-policy medical checkup is a […]

Why Should You Invest in Group Health Insurance?

For an average human being, investment and insurance might strike as two ends of a pole. But not for your typical Human Resource Manager. An intelligent Human Resource Manager knows that he has to indeed invest in a group health insurance plan. Especially if he intends to attract and retain talent. As Gen Z starts […]

How Technology is Changing Group Health Insurance?

Do you still use telegrams when you need to deliver urgent messages? Do you use a bullock-cart pool to work? When was the last time you plugged in a cassette or backed up your laptop on floppy discs? Better still, how about a dial-up connection for all your internet needs? No no don’t worry I […]

The Next Big Thing in Group Health Insurance for Startups

Before we talk about Group Health Insurance for startups, let’s talk about existing times. This is both one of the best and, ironically, one of the worst times to be alive. Wealth and health are faltering and building up at alarming paces, uncertainty is widespread. But you know what else is widespread – the spirit […]

The Biggest Problem with Group Health Insurance- Advantages and Disadvantages, and How You Can Fix It?

If you are looking for a group health insurance plan, we hope you have read our guide to the pros and cons of different types of health insurance plans available on the market today at Health Insurance Company (HIC).

11 Reasons Why You Should Invest in Group Health Insurance

Have you ever noticed how inadvertently the word ‘Group’ and all its applied implications, connotations, make such a huge part of our lives? No matter how you look at things whether you identify as an individualist or a conformist. We are all at the end of the day a part of something or the other […]

Should You Consider the Health Insurance Provided by Banks Under Group Health Insurance?

What, according to you, is the most valuable thing that is secured by banks? The answer surprisingly is “our Health”. Other than securing our valuables, banks also secure our health. But does this bank health insurance policy provide enough features and coverage? Let’s understand this, through a real-life incident that happened with Mr. Prateek and […]

What are the Benefits of Super Top Up Health Insurance Plan?

A super se bhi upar health insurance plan! Once a 5 year old kid asked a gentleman, ‘Uncle what do you call super se bhi upar in English. The gentleman promptly replied, ‘Super- Top up’ because that gentleman was an insurance broker. Well, jokes apart, a Super- Top Up health insurance plan can come to […]

Best Health Insurance Policy in India

‘He who has health has hope; and he who has hope has everything’- Thomas Carlyle The above quote holds even more true in today’s world. People, especially after the corona pandemic have realized that the best investment to put in, is our own health. The best health insurance policy depends holistically on every individual’s needs […]

How to structure the right employee benefits package?

With employment opportunities galore and an open war for talent, employers are trying to find innovative ways to win over the 60% of the population that is under the age of 25. Indian companies historically have provided employee benefits such as health coverage, leave benefits and statutory retirement programmes. These were fairly standard in old […]

Personal Health Insurance: How to make it Affordable?

The personal health insurance premium is the amount paid by a policyholder to the health insurance provider. Other charges, such as deductibles and co-payments, can increase the cost of your overall health coverage premium.

6 Steps to Reduce Group Health Insurance Premium Cost

Cost-cutting is a hard reality, especially in the post-pandemic era. As an employer, you want to do what is best for your employees while not losing sight of your company’s long-term goals. For your company to run smoothly and have a sustainable future, you must look at all possible ways to reduce your costs. Your […]

Gift Your Spouse “Health Insurance” this Karwachauth

I walked into my bedroom, after my dinner and a stroll. It is already past 8 PM. My wife, Sharada (Saru, as I lovingly call her) also would have retired by now. As I entered, I saw my Saru standing at the fully open French window, gazing at the moon, with wide-open arms, as if […]

How Should Start-ups get Group Health Insurance?

This is the most frequently asked question by startup founders. Though it is not mandatory to offer Group Health Insurance to the Employees for white-collar Employees, the organizations provide this as a benefit to the Employees as every other organization is doing so. Employees expect to get Health Insurance benefits from the Employer, as it […]

Why is Health Insurance Important?

The pandemic has made the world realize that medical emergencies are unpredictable and can cause a financial catastrophe so huge that it would be impossible to bear the burden without the aid of insurance. Treatment in a private hospital can derail your finances, and it becomes more difficult if the breadwinner of the home suffers […]

What are the Tips to Choose the Best Health Insurance?

Choosing a well-suited health insurance policy from the many options available in the market could feel like a herculean task. You need to take into consideration many factors before making a purchase. But with so many confusing details, it is easy to get bogged down, and you may make a hasty decision and end up […]

How does Group Health Insurance Work?

A Group Health Insurance policy is a single umbrella policy that is offered to Companies and covers the health insurance needs of their employees. Most often this policy is offered as a benefit to the Employees by the Employer. The policy can be extended to the Employees’ Spouses, Dependent children & Dependent Parents / In-laws […]

How a super top-up health insurance plan can help you?

How a super top-up health insurance plan can help you? The only cost-effective way to protect against the current medical inflation and meet medical requirements is to have a Super top-up Health insurance policy. Serious medical emergencies can ruin our finances at any time, this can be only avoided with adequate insurance cover for our […]

Have you Noticed this Condition in your Health Insurance Policy?

All you need to know about pre-existing diseases in Health Insurance. Pre-existing diseases are diseases that the policyholder already suffers from before purchasing a personal health insurance policy. This policy condition determines playability in a majority of health insurance claims. Must Read – What are the Benefits of Super Top Up Health Insurance Plan? As per […]

Death claim in Insurance – Execute A Will For Your Nominee To Get The Proceeds Of Your Insurance Claim After Your Death

Like thousands of people, do you think that the Nominee will get the proceeds of your Insurance Claim after your death? Then you are mistaken. The nominee is just a custodian of the claim amount. He can’t spend the amount. He will have to give the proceeds to the legal heir as per the succession […]

Group Mediclaim to Personal Health Insurance Portability

The insurance regulator has permitted the porting of health insurance. Here are the guidelines for converting group health insurance to individual health insurance: If an employee wants to port the policy to a personal health insurance policy from the group policy, he can do so, at the time of exit from the company. The employee […]

Why Insurance claims of accidental deaths caused by drunk and drive are denied?

I was having an interesting chat with one of the corporate hr leaders yesterday. His question was: “Why in Accidental Deaths, if the person died is found drunken driving, he is denied the insurance claim ” He continued “the proceeds of the claim are meant for his family members. Why punish family members for the mistake […]

Modern Treatment methods and your Health Insurance

With rapid advancements in the field of medicine, every year, we see many new and modern methods of treatment being made available for the benefit of the people. Listed below are a few such Modern Treatment Methods: A. Uterine Artery Embolization and HIFU B. Balloon Sinuplasty C. Deep Brain stimulation D. Oral chemotherapy E. Immunotherapy- […]

20 Lakhs Health Insurance At Just 2k For Your Family

20 Lakhs Health Insurance At Just 2k For Your Family Recommended Post Best Health Insurance Policy in India

How to be prepared to have hassle free treatment & claims process in personal health insurance

An insured purchases a personal health insurance policy after a thorough understanding and comparison. But the job does not end there. A health insurance policy is a good deal only if you get your claim settled hassle-free. But the insurance company alone is not responsible for getting this done for you. There are a couple […]

Get a Health Insurance cover of 1 Cr at just Rs. 12K for Self , Spouse & 1 child.

There are a lot of new inventions in the health care sector with developments in science & technology. Robotic surgeries are soon going to be a common process of treatment in the future. It will be possible that the doctor or the specialists need not be physically present with the patient. There will be less […]

Better alternatives for Optional Covers in Insurance Policies:

Better alternatives for optional coverage in insurance policies: Term Life Insurance-Return of Premium policies:The return received as a survival benefit is less when compared to the return under FD for the same term for the extra premium paid under this policy. PA is covered as a rider in various policies: It is good to buy […]

Terms & conditions in Health Insurance Policy Should not be used for Marketing Tactics

When it’s a question of simply pooling the money for one who would actually incur a loss, then why are there so many terms and conditions? Why can’t it be as simple as that? In the case of hospitalization, the total bill amount up to the sum insured is payable? All I want to say […]

Health Insurance for Healthy people should cost zero

Nowadays health insurers are providing benefits to the insureds not only by bearing the medical expenses but also by adding options to the policy for their better health. Like a health coach Discount in the renewal premium for following any healthy habit and making a difference to their health. Especially in India, it’s difficult to […]

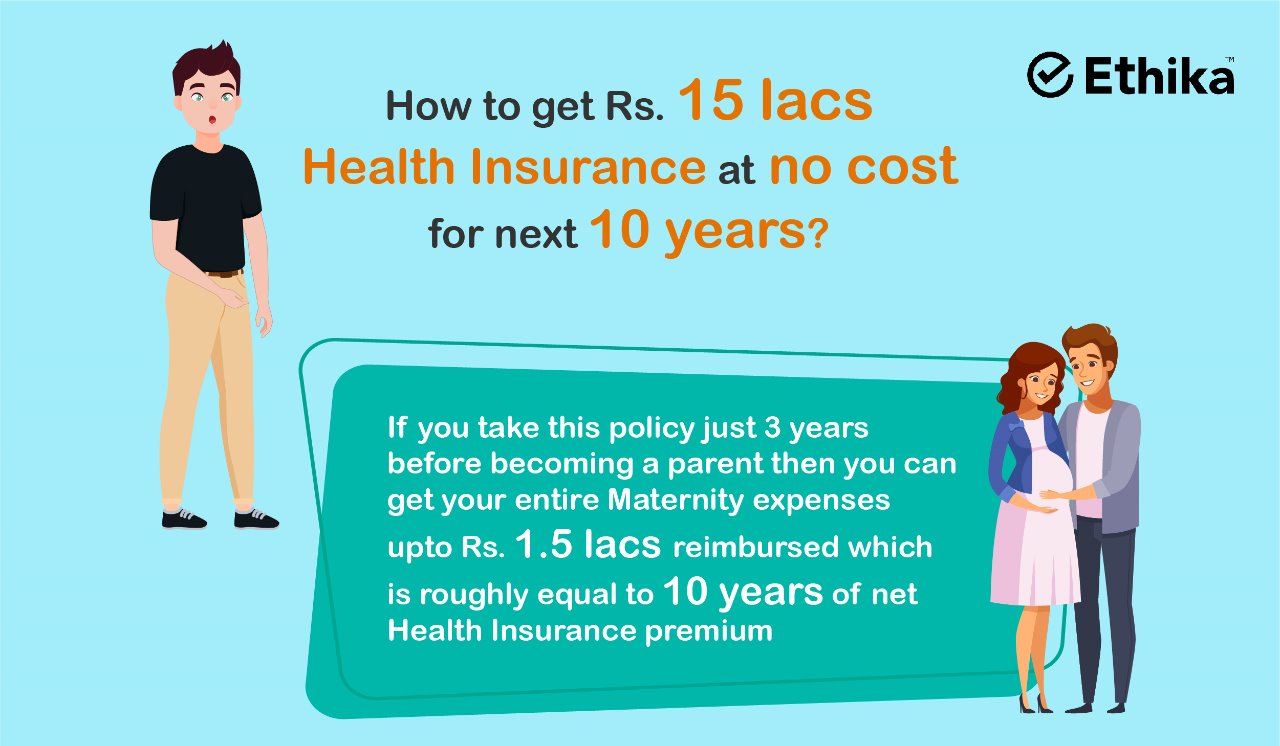

How to get your 15 lakh Health Insurance at no additional cost for the next 14 years?

Are you planning to get married? Are you prepared for the roles and responsibilities that come with it? Every milestone in your life brings more responsibilities. Manage them well with a beautifully designed health insurance policy that covers Maternity expenses up to Rs.1.5 lacs. If you take this policy just 3 years before becoming a […]

Covering Employees Parents under group health insurance- 3 different cases

Covering Employees’ Parents under group health insurance- 3 different cases The premium payable is decided based on many factors and the most important among those is the previous year’s claims. With people who are aged and with a pre-existing disease it is very natural that the frequency of claims will be high and most of […]

Framework for Structuring the Group Health Insurance Plan for your Employees

Framework for Structuring the Group Health Insurance Plan for your Employees Let’s see the basic point to consider when designing an efficient plan: Focus on preventive health checks: Healthy employees make for a healthy workplace. Timely health screenings of employees are important not just for the wellness of the employees but also for the growth […]

How to Control the Claims in Group Health Insurance?

How to exercise claim control measures in group health insurance Group Health Insurance premiums in the Indian market are very competitive compared to the world market and have been driven more by prior year premiums than claims experience. As a result, organizations and employers have had a good ride, as they were able to pass […]

Do You Really Need Insurance Broker for Group Health Insurance ?

Finding a well-planned and comprehensive Employee Benefits Program for the employees can be a real challenge and that’s why insurance helps in designing a well-structured benefits program so that the right people continue to work for an organization. Furthermore, the whole customer experience in group health insurance or group mediclaim is driven by a triad […]