What could be the worst situation other than getting your health insurance claim rejected when you are admitted to a hospital? Yes, such situations are not uncommon in the insurance industry and happen very frequently with policyholders. While the reasons for claim rejection could be many, some include wrong declarations made in the proposal form, pre-existing and other waiting period exclusion, policy expiration and not renewal, insufficient details submitted at the time of claim, etc.

Cashless claim settlement requires claim approval from the insurance company for the treating hospital to proceed. If the hospital denies the cashless facility once, it would be practically impossible for the insured policyholder to appeal again for reconsideration of the claim. If you encounter such situations, understand that the situation is temporary and can be resolved by going for an appeal.

What’s on this page?

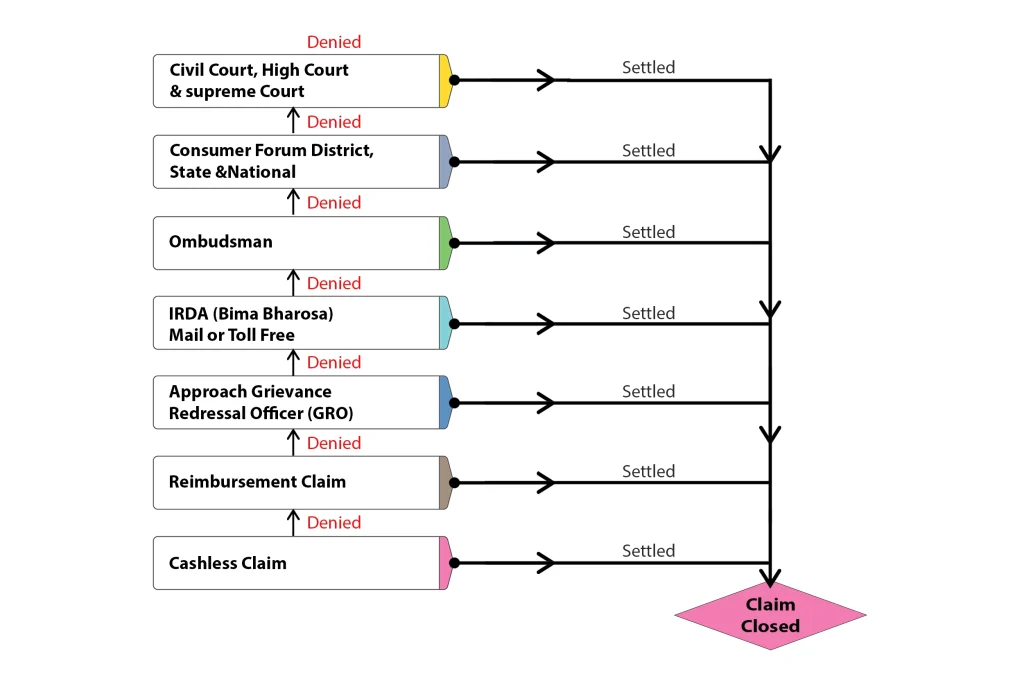

Let’s Discuss the Step-by-Step Process to Follow in Case of Cashless Claim Rejection.

Step by Step to Follow the Process in the Standard Group

- Go for Reimbursement: The first thing to do after a cashless claim is rejected is to go for a reimbursement claim. In case of a reimbursement claim, you would have all the time to argue with the insurance company and submit your claim request. On the other hand, in the case of a cashless claim, you might need to be able to argue with the insurance company and escalate the claim to the higher-ups for processing, as it would take time.

The main advantage of reimbursement claims is that you have ample time to respond to the insurance company’s queries and submit all your supporting documents for claim processing. However, there could be instances when the insurance company rejects your claim even after you submit all the required documents. In such cases, you should follow the next step of approaching a grievance redressal officer of the insurance company. - Approach Grievance Redressal Officer: Once the insurance company rejects your claim in cashless and reimbursement mode, you may approach the grievance redressal officer. When approaching the grievance redressal officer, you should submit all the required documents so that the claim will be considered for settlement. If any documents need to be included and you still need to submit them in previous stages, here is your chance.

Once all the documents are submitted, the grievance redressal officer will try to settle your claim. If you face a claim rejection or no satisfactory reply from the grievance redressal officer within 15 working days, you may escalate your case to IRDA. - Escalate to IRDA: Once you receive a claim rejection from the insurance company’s grievance redressal officer, you may escalate it to the Insurance Regulatory and Development Authority of India (IRDAI) through their online portal.

You may contact IRDA through the toll-free number 155255 or email complaints@irdai.gov.in with all the proofs attached or courier a written complaint to IRDA’s office. In addition, you may choose to escalate your case through Bima Bharosa– an online portal from IRDA to register the claims. Once you register a claim with IRDA, it will be forwarded to the insurance company for resolution. The insurance company would either settle the claim or reject the claim based on the merits of the case.

If you face rejection even after escalating it to IRDA, you may approach the insurance ombudsman if the case falls under their purview. - Approach the Ombudsman: The next step in the appeal process is to approach the insurance ombudsman. The ombudsman would either ask the insurance company to settle the claim or agree with the insurance company and reject the claim. The judgment passed by the ombudsman is not final, as the policyholder may decide to approach the courts for claim settlement.

You may approach the civil or consumer court if you are still unsatisfied with the claim settlement. - Approach Consumer Commission: As a policyholder, you may approach the consumer or civil court. However, it is advisable to approach the consumer court as you are a consumer of a product, and moreover, the time taken by consumer courts is far less than that taken by the civil courts. Consumer courts operate in a hierarchy and have 3 levels: district consumer forum, State Consumer forum, and National consumer forum.

The other advantage of approaching a consumer court is the cost of the process. Consumer courts are cheaper than civil courts. Most cases should be settled at this level, as the insurance companies will settle the claim once the National Consumer Forum upholds it. If you are still unsatisfied with the outcome, you may finally approach a civil court at the High court level. - Finally Courts: The final option for a policyholder is to approach the civil court, and it should be kept in mind that it is a lengthy process. Once a civil court takes up the case, it would be dragged for a long period of time, and the claim may or may not be in your favor. Moreover, the process could be more convenient and involve spending hefty money on lawyer fees.

The ruling of the Supreme Court would be final and binding on both parties. The Supreme Court is the last step in the appeal process.

FAQs:

What could be the reasons for health insurance claim rejection?

There are various reasons for health insurance claim rejection, such as:-

1) Improper declaration in the proposal form regarding the material facts that could have influenced the underwriting process.

2) Claims made during the waiting period, such as those made during the pre-existing period.

3) Claims made with an expired policy.

4) Insufficient funds in the health insurance policy.Can I go for an appeal if I accept the partially settled claim?

Yes. If the insurance company pushes you against the wall, you may accept the partial settlement of the claim and then approach either the ombudsman or the court for a complete settlement.

What are the documents to be submitted for a cashless claim?

For cashless claim settlement, you should submit the original policy copy or the health insurance card and KYC documents. You should also complete the claim form completely before submission.

Within how many days should a grievance redressal officer respond?

A grievance redressal officer of the insurance company should respond within 15 days from the claim’s submission date. If you do not get any response within 15 days, you may approach the IRDA.

What is Bima Bharosa of IRDA?

Bima Bharosa is an online portal from the Insurance Regulatory and Development Authority where you can register complaints against your insurance company.