“What is your biggest headache?” I asked my elder brother, who had been running a small business for a couple of years now?

“अच्छे लोग नहीं मिलते यार छोटे, और मिलते हैं, तो 3 महीने से ज्यादा रुकते नहीं”.

This, I was realizing, was a common problem with most small businesses in India.

I wanted to help these businesses in some way. But how, was the question, I did not have the answer to. Not yet atleast.

I had been hearing rave reviews about this new broker Ethika. I decided to give them a call, to see if they could help my brother and the lakhs of others who might be going through the same difficulties.

I called them as a prospective client and the first question I asked them was – Why do I need a group health insurance?

Prakash, on the other line – Answer these for me Sir

- Have you ever loaned an amount to an employee for their personal hospitalization need?

- Have you ever lost a good hire or a good existing employee and were unable to understand why, when your compensation has been good?

Prakash continues –

Sir, we are a startup ourselves. We understand the pain that small businesses have to go through. We understand how employers spend sleepless nights trying to save every penny, while also ensuring that their employees get what they deserve.

A good small business health insurance is an endeavor to ensure that the employees get the right set of coverages and the employer pays the right price for these.

And while the exercise may sound simple on paper, it involves a lot of deliberation and understanding of a subject that is infamous for its opaque nature.

We at Ethika have therefore endeavored to simplify health insurance, particularly for small businesses. We understand the needs of small businesses like the back of our hand. It is literally a part of our DNA.

We endeavor to understand what the employer needs and then benchmark it with what the market is offering. We then tailor a solution that would be beneficial to the employees of the organization and comes at the right price.

Contact us to get a free consultation today.

What’s on this page?

TL;DR- Best Small Business Health Insurance

Listed are the Government General Insurers

- National Insurance Company Limited

- The New India Assurance Company Limited

- The Oriental Insurance Company Limited

- United India Insurance Company Limited

Listed are the Stand Alone Health Insurers

- Aditya Birla Health Insurance

- Care Health Insurance

- Manipal Cigna Health Insurance

- Niva Bupa Health Insurance

- Star Health Insurance

Listed are the private sector general insurers who also offer health insurance

- Bajaj Allianz General Insurance Company Ltd.

- Cholamandalam MS General Insurance Company Ltd.

- Future Generali India Insurance Company Limited

- HDFC Ergo General Insurance Company Ltd.

- ICICI Lombard General Insurance Company Ltd.

- Magma HDI General Insurance Company Limited

- Navi General Insurance Company Limited

- Raheja QBE General Insurance Company Limited

- Reliance General Insurance Company Ltd.

- SBI General Insurance Company Limited

- TATA AIG General Insurance Company Limited

- Zurich Kotak General Insurance Company Ltd.

Why Small Businesses Need Health Insurance?

There is a general perception that small businesses do not need employee health insurance. But if you compare the cost of a group health insurance for small businesses with the cost of hiring, training & retraining employees who leave early, a health insurance will come across as a much cheaper alternative. Moreover a health insurance also helps –

Attracts and Retains Top Talent

As health expenditure keeps getting more expensive, employees start valuing employee health insurance. Today, employee health insurance has become one of the major deciding factors for job seekers. Moreover a good health insurance plan can be tailored to meet the needs of every category of workmen in the company.

Enhances Employee Productivity and Satisfaction

A healthy workforce is a productive workforce. When employees have access to quality healthcare, they’re healthier, happier, and more focused on their work. Having a health insurance reduces the employees’ stress and anxiety about the health emergencies for his family. This in turn translates into better productivity and satisfaction at workplace.

Protects Business Owners from Unexpected Medical Costs

Unexpected medical costs can wreak havoc on your business. How long can you or your business keep footing medical bills for your employees? Health insurance acts as a safety net, protecting you and your business from such costs. It acts as a risk management tool against such expenses.

Ensures Compliance with Legal Requirements

With the increased thrust on employee well being and the governments interest in developing small businesses, we might soon see government thrust on making health insurance mandatory for employers. Why wait?

Types of Small Business Health Insurance Plans

A small business has a variety of ways to cover their employees. Unlike large businesses they are not bound by rigidity about structure. The end goal is to ensure all of their employees are insured at the appropriate cost.

Toward that end, lets look at some of the ways a small business can insure its employees –

Group Health Insurance Plans

The most common and often most cost-effective option for small businesses is a group health insurance plan. These plans are designed specifically for groups of employees and their families, offering comprehensive coverage at competitive rates. Group plans typically cover a wide range of medical expenses, including hospitalization, out patient expenses, pre and post hospitalization expenses.

Individual Health Insurance Plans

Small businesses could also allow for individual employees to get their own health insurance plans. Individual plans however are comparatively more expensive as compared to group health insurance plans. The coverage often is relatively lesser as compared to a group plan. But in case of a very small business that employees lesser number of individuals but still wants to provide health insurance for its employees, an individual plan, could be the way to go.

Family Floater Health Insurance

A family floater plan is a type of health insurance that covers the entire family under a single policy. The sum insured is shared among all family members, meaning that any member can utilize the coverage up to the total limit. Generally a family floater is also an option that is allowed under a group health insurance. Family floater plans, just like group plans typically cover spouses, children, and parents/ in-laws.

Top-Up and Super Top-Up Plans

These plans offer additional coverage over and above the existing health insurance policy. A top-up plan covers expenses exceeding the deductible (for every claim), which is a pre-defined amount the insured must pay before the top-up coverage kicks in for each claim. A super top-up works like a top-up, except for the fact that the deductible has to be paid once a year unlike for every claim as in case of a top-up plan.

Critical Illness Plans

Critical illness plans provide a lump-sum payout upon diagnosis of a covered critical illness. These could be cancer, heart attack, stroke, or similar specified illnesses. The payout can be used for any purpose, including medical expenses, debt repayment, or other living expenses. While uncommon, they do add a layer of security to the employee’s well-being.

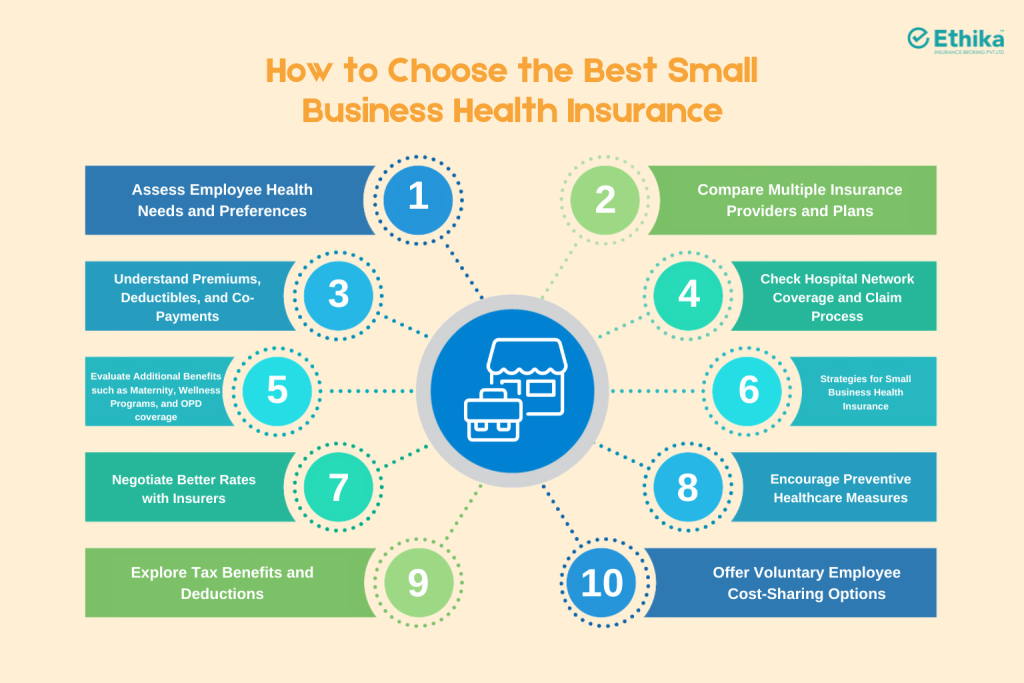

How to Choose the Best Small Business Health Insurance

Okay, so you have made the decision of buying a group health insurance for your employees. But, now what? What next? How do you choose a policy that gives your employees the best coverage at an optimal cost?

Here’s how:

Assess Employee Health Needs and Preferences

Doing a primary assessment of your employee age profile should be your starting point. This will help you understand and finalize the coverages that would be important for your employees. If most of your employees are young, you need not provide the coverage for pre-existing conditions from Day 1. Maternity coverage from Day 1, might however be an important cover.

Compare Multiple Insurance Providers and Plans

Never settle for the first plan you come across. Compare multiple insurance providers and plans to find the best value and coverage. Look at different insurers, including public sector, private sector, and standalone health insurers. Look at the option of consulting a broker. A broker can help you identify the right plan at the right price.

Understand Premiums, Deductibles, and Co-Payments

Health insurance jargon is complex and can be confusing. It’s essential to understand some important terms.

- Premium is the cost you pay to get the insurance cover. Insurance laws prohibit inception of coverage before payment of premium – the Insurer will not cover you unless you have made the premium payment.

- Deductible is the amount you must pay before the insurance coverage kicks in. It is generally expressed as a fixed amount.

- Co-payments are amounts that you pay for every claim. These are generally expressed as a percentage of the claim amount.

A plan with a lower premium might have a higher deductible/ co-payments and visa versa.

Check Hospital Network Coverage and Claim Process

Generally speaking, the more the number of network hospitals in your area, the better it is for your employees. Because this ensures that they can get cashless coverage and do not have to bear out-of-pocket expenses. Equally important is understanding the claim process. How easy is it to file a claim? How long does it typically take for claims to be processed? A smooth and efficient claim process can make a significant difference in employee satisfaction.

Evaluate Additional Benefits such as Maternity, Wellness Programs, and OPD coverage

Depending on the kind of benefits you want to offer, you could look at providing additional benefits in your policy. While benefits like maternity coverage are extremely common, you could also tailor the number of months after which such benefits should kick in. Similarly OPD coverage and wellness programs are quite a rage amongst today’s employees. Balancing the cost for these benefits alongwith the value they would provide to your employees can help you decide which additional benefits to opt for.

Strategies for Small Business Health Insurance

Okay so now that you have identified the right set of coverages you need, lets get on with some strategies that will help you sweeten the deal.

Negotiate Better Rates with Insurers

Don’t be afraid to negotiate with insurance providers. Just like any other business transaction, there’s room for negotiation when it comes to health insurance premiums. If the average age of your workforce is less than 35, leverage this to negotiate for better premiums. Get quotes from multiple insurers. If you have an asset policy, leverage it to get better discounts.

Encourage Preventive Healthcare Measures

Investing in preventive healthcare is a win-win for both your employees and your business – Your employees stay healthy and therefore more productive. Encourage employees to get regular check-ups, screenings, and vaccinations. Promote wellness programs that focus on healthy lifestyles. This will lead to lesser claims in your policy and therefore lesser premiums at renewal.

Explore Tax Benefits and Deductions

Take advantage of the tax benefits and deductions available for small businesses that provide health insurance to their employees. Premiums paid for group health insurance are tax-deductible as a business expense.

Offer Voluntary Employee Cost-Sharing Options

While the aim of a group health insurance is to help provide quality health plans for employees at affordable rates, there might be times when you might be unable to afford the cost. Even then, you can act as a facilitator for the program with the option of either sharing the premiums with employees or just acting as a facilitator without sharing the premiums. A group health plan is still a better option as compared to an individual health plan.

Common Challenges and How to Overcome Them

Even with the best planning, small businesses often face challenges when it comes to health insurance. Understanding these common hurdles and knowing how to overcome them is key to maximizing the value of your health insurance plan.

High Costs Of Premiums and Ways to Reduce Them

While premiums might seem costly, you should look at the value they deliver. You are paying this premium for the peace of mind that should there be an eventuality, the health insurance will take care of it. That said, some ways to reduce premiums include:

- Negotiating with insurers

- Raising deductibles

- Opting for co-pays

- Focusing on employee wellness programs

- Working with an insurance broker

Find the Right Balance Between Affordability and Coverage

Striking the right balance between affordability and comprehensive coverage is a delicate act. You want to provide your employees with adequate protection without breaking the bank. Conducting detailed employee need assessment before you embark on the journey will ensure you are top of your requirements and can thereafter find the right price which is affordable.

Handle Employee Turnover and it’s Impact on Insurance Plans

Turnover is a sad reality for every small business. But handling it particularly in the context of your group health insurance becomes important because of the costs involved. Ensure that you have a mechanism to share the additions & deletions of employees with your insurer on a regular basis. This ensures that you do not end up bearing the cost of premiums of an employee who has quit.

Navigate Complex Policy Terms and Conditions

Health insurance policies are often filled with complex jargon and fine print. Understanding the terms and conditions is crucial to avoid surprises and ensure you’re getting the coverage you expect. Your health insurance broker can help you understand all of these whenever need be. You also have the option of approaching the Insurer directly to get all of your doubts cleared as and when they arise.

Best Small Business Health Insurance Providers

Choosing the right health insurance provider is crucial for small businesses. With so many options available in the Indian market, it’s essential to understand what each insurer offers and how their plans align with your specific needs. Here’s a look at some of the leading health insurance providers in India and key factors to consider when making your decision:

- Leading Insurers and their Offerings

- Star Health and Allied Insurance: A standalone health insurer with a wide range of plans, including comprehensive coverage, critical illness plans, and family floater options. Known for its strong customer service and claim settlement record.

- Care Health Insurance: Offers a variety of health insurance plans, including group health insurance, individual plans, and top-up options. Focuses on preventive healthcare and wellness programs.

- Niva Bupa Health Insurance: Provides comprehensive health insurance plans with a focus on customer-centric services. Offers a wide network of hospitals and a digital-first approach to claims processing.

- ICICI Lombard General Insurance: A leading private sector insurer with a diverse portfolio of health insurance plans, including group health insurance, individual plans, and critical illness coverage. Known for its strong brand reputation and wide network of hospitals.

- Reliance General Insurance: Offers a range of health insurance plans, including group health insurance, individual plans, and family floater options. Focuses on affordability and accessibility of healthcare services.

- Magma HDI: Provides comprehensive health insurance plans with a focus on customer wellness. Offers a wide range of benefits, including preventive health check-ups and wellness programs.

- Aditya Birla Health Insurance: Offers a variety of health insurance plans, including group health insurance, individual plans, and critical illness coverage. Focuses on personalized healthcare solutions and a customer-centric approach.

- Key Factors to Consider When Choosing a Provider

- Network Hospitals: Ensure the provider has a wide network of hospitals and healthcare providers, especially in your locality.

- Claim Settlement Ratio: Choose an insurer with a high claim settlement ratio, indicating their efficiency in processing claims.

- Premiums and Coverage: Balance affordability with the coverage offered. Compare premiums, deductibles, and co-payments.

- Customer Service: Look for a provider with excellent customer service and support, especially during claim settlements.

- Additional Benefits: Consider value-added benefits like wellness programs, maternity coverage, and OPD coverage.

- Policy Features: Understand the policy terms and conditions, including exclusions, limitations, and waiting periods.

- Financial Stability: Choose an insurer with a strong financial track record, ensuring their ability to honor claims.

- Technology and Innovation: Consider providers that offer digital solutions for a seamless customer experience, such as online policy management and claims processing.

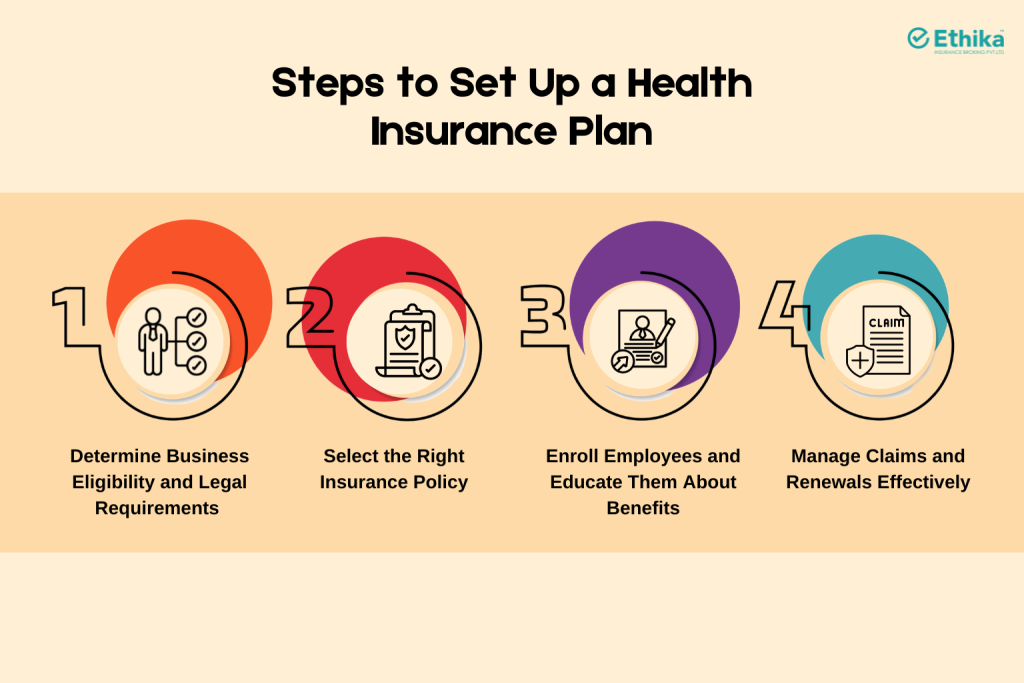

Steps to Set Up a Health Insurance Plan

Finally, lets now look at the steps that you would need to look at while setting up your health insurance plan. Remember, a structured approach towards setting up your plan ensures the success of the plan.

- Determine Business Eligibility and Legal Requirements – Before diving into plan options, it’s crucial to determine your business’s eligibility for group health insurance. While IRDAI says that a group plan can be issued to a business with atleast 7 employees, Insurers might have their own underwriting guidelines. Your Insurance broker works with Insurers day in and day out and can help you with these complexities.

- Select the Right Insurance Policy – Once you’ve determined your eligibility, the next step is to select the right insurance policy for your employees. This involves carefully evaluating your employees’ needs, your budget, and the various plans offered by different insurance providers. Consider factors like the types of coverage offered, network hospitals, premiums, deductibles, co-payments, and additional benefits. Assess your employees’ demographics, such as age, and health conditions, to determine the right insurance policy.

- Enroll Employees and Educate Them About Benefits – After selecting the insurance policy, the next step is to enroll your employees and educate them about the benefits of the plan. Clearly communicate the coverage details, including the types of medical expenses covered, network hospitals, claim process, and any additional benefits like wellness programs. Provide employees with access to policy documents and resources that explain the plan in simple terms.

- Manage Claims and Renewals Effectively – Managing claims and renewals efficiently is essential for maintaining the smooth operation of your health insurance plan. Establish a clear process for employees to file claims, providing them with the necessary forms and guidance. Maintain accurate records of employee enrollment, policy details, and claim history. Ensure that the process of renewal is initiated well in advance so that you are not rushed into choosing a plan that you might not want.

Your Insurance broker can help you deal with all of these aspects.

Ethika, has over the last decade, helped hundreds of small businesses initiate and manage their group health insurance plans.

Conclusion

A small business has to deal with a lot of complexities – changing regulations, delayed vendor payments, delayed client payments. To top it all, manpower shortages and skilled workforce are problems that are nightmares for every business owner.

But, a good health insurance policy can reduce the business owner’s headache. He can use it as a tool to attract and retain talented employees. Moreover, a health insurance also ensures that the owner does not have to spend money on hospitalizations – these are monies that would have acted as expenses to the business.

Investing in a good health insurance policy helps businesses attract & retain quality people as well as minimize expenses.

Ethika has helped more than 500 small businesses create and fine tune their Employee Benefit offering. Being a bootstraooed startup itself, we understand the pain points for small businesses.

Our solutions are therefore tailored to perfection and without any frills. Our biggest USP however is helping clients with claim settlement.

With a 4.9* rating on Google Reviews, we ensure that our clients claim settlement journey is as painless as possible.

We at Ethika have therefore endeavored to simplify health insurance, particularly for small businesses. We understand the needs of small businesses like the back of our hand. It is literally a part of our DNA.

We endeavor to understand what the employer needs and then benchmark it with what the market is offering. We then tailor a solution that would be beneficial to the employees of the organization and comes at the right price.

Contact us to get a free consultation today.

Frequently Asked Questions (FAQs):

How Can Small Businesses Save Money on Health Insurance?

Small businesses can save money on health insurance by negotiating with insurers, comparing quotes from multiple insurers, considering options like deductibles or co-payments and working with an insurance broker who knows the appropriate price points for coverages.

Are there Tax Benefits for Offering Health Insurance to Employees?

Yes, premiums paid for group health insurance are tax-deductible as a business expense.

What Is the Difference Between Group and Individual Health Insurance?

Group health insurance is designed for groups of employees and their families, offering comprehensive coverage at competitive rates. Individual health insurance is purchased by individuals directly from insurance companies and typically has higher premiums and less comprehensive coverage.

What Additional Benefits should I Look For In A Small Business Health Plan?

Consider value-added benefits like wellness programs, maternity coverage, and OPD coverage to enhance employee well-being and provide comprehensive care.

How does Employee Health Insurance Affect Retention and Satisfaction?

Offering health insurance demonstrates that you value your employees’ well-being, leading to increased job satisfaction and reduced turnover. It also helps in attracting top talent in a competitive job market.

What are the Legal Requirements for Small Business Health Insurance?

IRDAI specifies the minimum number of employees that you need, in order to issue a group health insurance. Currently the number stands at 7. But Insurers might have their own underwriting guidelines. Your Insurance Broker, who deals with Insurers, day in and day out, should be able to help you with these.