“But there are thirty of those Aaliya”. Jaanvi was crying for help.

She had finally convinced her management for a group health policy for her staff. But she had failed to anticipate the complexities involved with group health insurance. A simple google search left her overwhelmed.

Selecting the right group health insurance is a complicated task. What makes it even more challenging is the fact that there are about 30 group health insurance providers in the country. Some of these are government owned, some are solely health insurers and others are general insurers who also write health policies.

Moreover, the nature of coverages could vary as could the extent of coverage. Some insurers might be more tech driven as compared to others, which could elongate the claims settlement journey for your employees. While some insurers might be aggressive with their pricing, they might not be as reliable when settling claims. While some insurers might be financially stable, their Customer reviews might dissuade you from purchasing their policy.

How then, do you go about finalizing on the Insurer? This one aspect will not only reflect on the perception of the policy in your organization, but could also anchor or disroot your position in the eyes of the senior management.

When working on a complicated product like a group health insurance, it is advisable to seek the help of an industry expert. Someone who can advise you on the operational and administrative aspects of a group health insurance. How then, do you go about finalizing on the Insurer? This one aspect will not only reflect on the perception of the policy in your organization, but could also anchor or disroot your position in the eyes of the senior management.

When working on a complicated product like a group health insurance, it is advisable to seek the help of an industry expert. Someone who can advise you on the operational and administrative aspects of a group health insurance.

At Ethika, with a decade of experience, we have been doing just that. We have helped over 500 businesses to identify and integrate the right group policy. Not just this but our speciality lies in our claims servicing. Our claims management experts make sure that your claims are settled within 5 minutes with the least amount of effort. In this piece, we will walk you through some of the statistics about the Group health insurance providers in India and focus on a selected few top insurers and if it is still overwhelming, feel free to reach out to Ethika.

What’s on this page?

What Is Group Health Insurance?

A health insurance policy pays for your hospitalization expenses when these expenses fit the terms and conditions of the policy. The terms and conditions are mutually agreed by the Insured (you) and the Insurer (the Company issuing the policy) before getting into the agreement (the policy).

A Group Health Insurance is conceptually the same policy, but for a group of people.

But does that mean that anyone can form a group and get Group Health Insurance?

No. IRDAI guidelines prohibit the issuance of a Group Health Insurance policy to a group that has been formed solely to avail a Group Health Insurance policy.

Some of the prominent features of a group health insurance policy include :

- No waiting periods for any ailments

- Coverage without the hassles of medical checks

- Coverage for ageing parents

- Coverage for most hospitalizations from Day 1

- Ability to customize coverage any way you want

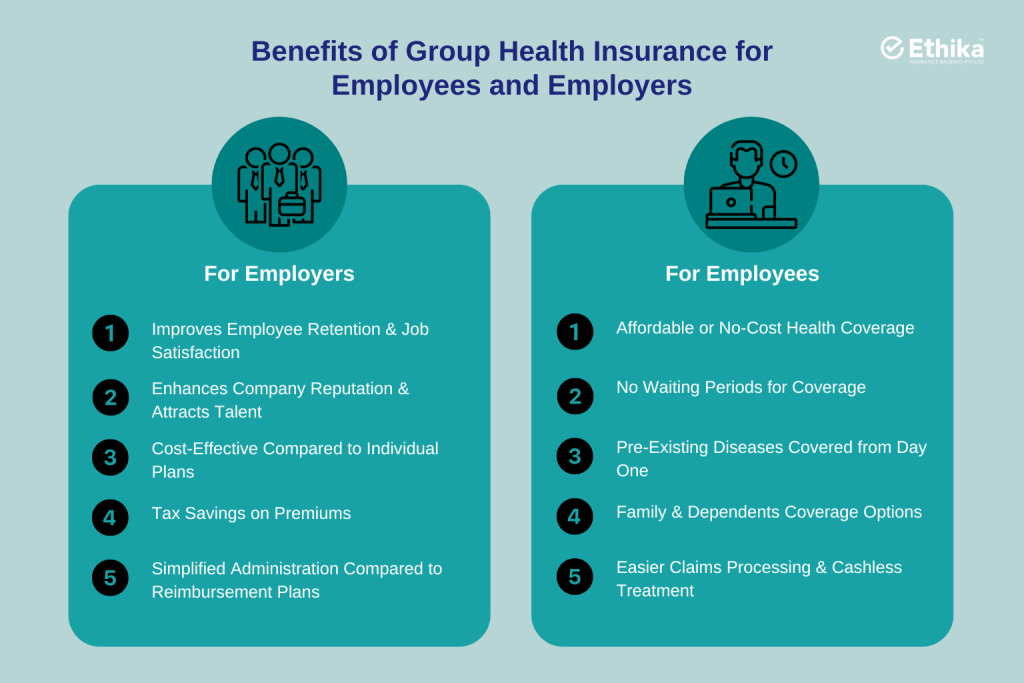

Benefits of Group Health Insurance for Employees and Employers

The Group Health Insurance policy is an instrument that is beneficial for both the Employer & the Employees alike. But who benefits more? In this section, let’s explore:

For Employers:

- Improves Employee Retention & Job Satisfaction – Offering comprehensive health benefits demonstrates a commitment to employee well-being, boosting morale, fostering a sense of loyalty, and reducing turnover. Employees feel valued and are more likely to stay with the company.

- Enhances Company Reputation & Attracts Talent – One of the main challenges that an HR manager goes through is the problem of attracting talent. A good group policy can be used as the right vehicle to achieve this objective. A good policy not only enhances the company’s brand image, but can be used as a strong employee attraction tool. It can be used to position the company as an Employer of choice.

- Cost-Effective Compared to Individual Plans – Group health insurance premiums are often lower than individual plans due to the risk being spread across a larger pool of individuals. This makes it a more affordable option for both employers and employees.

- Tax Savings on Premiums – Employers are allowed a tax exemption to the extent of the premiums they bear for a group health insurance policy. Employees as well can claim an exemption to the extent of premium that they bear for the policy.

- Simplified Administration Compared to Reimbursement Plans – The average turnaround time for settlement of a reimbursement claim is between 30-45 days if the paper work is in order. These are days where your employee is constantly running helter skelter gathering papers and sharing these with the TPA. Not only is this a loss of productive time, but can cause a lot of mental trauma for the employee.

For Employees:

- Affordable or No-Cost Health Coverage – Employees often receive health coverage at subsidized cost or free. This makes healthcare more accessible and affordable for employees. With health inflation rising at about 15% per annum, that is 15% of money that an employee saves.

- No Waiting Periods for Coverage – Unlike individual plans, group health insurance often waives waiting periods for pre-existing conditions, providing immediate coverage and peace of mind. This becomes particularly important in case of an existing ailment history.

- Pre-Existing Diseases Covered from Day One – In most cases, pre-existing diseases are covered from the first day of enrollment in a group health plan, offering crucial protection for employees with existing health conditions. Add to it the fact that if you have an ailing family member, most of your employment considerations might be dictated by this consideration.

- Family & Dependents Coverage Options – Employees can often extend coverage to their family members, including spouses, dependent children, and sometimes even parents, providing comprehensive healthcare protection for the entire family.

- Easier Claims Processing & Cashless Treatment – Group health insurance facilitates easier claims processing and access to cashless treatment at network hospitals, reducing the hassle and financial burden associated with medical emergencies.

As you might have observed, both the parties are equal beneficiaries in the transaction. It is indeed a win-win for both the parties.

Top Group Health Insurance Companies in India

While there are about 30 insurers who can offer you group health insurance policies in India, most of the benefits offered by all of them might look like the same to the unseasoned eye. It is therefore important to avail the services of a professional who can help you separate the grain from the chaff.

Let us look at some of the features and add-ons offered by some of the leading insurers in the country:

ICICI Lombard Group Health Insurance

Key Features and Benefits

Highly customizable plans to suit diverse corporate needs.

Extensive network of hospitals, particularly strong in urban centers.

Focus on financial stability and comprehensive coverage.

Digital integration for policy management and claims.

Premium and Coverage Details

Wide range of sum insured options.

Premium flexibility based on coverage choices and group demographics.

Add-ons and Customization Options

Maternity coverage enhancements.

OPD coverage.

Zone upgrades.

Star Health and Allied Insurance

Coverage and Benefits

Extensive network, especially in tier 2 and 3 cities, with a strong presence in South India.

Focus on providing comprehensive coverage at competitive premiums.

Streamlined claim process, particularly for cashless claims.

Waiting Periods and Exclusions

Standard waiting periods for pre-existing conditions and specific treatments.

Clearly defined exclusions in policy documentation.

Claim Process and Customer Support

Emphasis on quick and hassle-free claim settlement.

Wide network of brick-and-mortar branches for customer support.

Care Health Insurance

Key Features and Coverage Details

Aggressive pricing options

Comprehensive coverage with options for health check-ups and wellness programs.

Rich customized coverage options.

Premium Structure and Flexibility

Premiums are based on the group’s size, age profile, and chosen coverage.

Flexible plan options to meet varying budget and coverage needs.

Additional Perks for Employers

Wellness programs and health initiatives.

Dedicated relationship managers.

Easy administration of group policies.

HDFC ERGO Group Health Insurance

Unique Benefits and Features

Trusted brand image.

Comprehensive coverage with customizable options.

Extensive network of hospitals.

Value added services like wellness care.

Premium and Plan Flexibility

Flexible plan options with varying sum insured and coverage levels.

Premiums are determined by the group’s demographics and chosen plan.

Claim Settlement Ratio and Process

Generally maintains a good claim settlement ratio.

Streamlined claim process with online and offline options.

Reliance General Insurance

Coverage Details and Custom Plans

Strong brand.

Increased focus on health insurance in the last two years.

Comprehensive coverage, including hospitalization, daycare, and pre/post-hospitalization.

Employee Wellness Benefits

Focus on employee wellness through health checkups and wellness programs.

Initiatives to promote healthy lifestyles.

Network Hospitals and Cashless Claims

Wide network of hospitals for cashless treatment.

Efficient claim processing and customer support.

Digit General Insurance

Key Features and Benefits:

Digital-first approach

Transparency and simplicity of policy wordings

Premium and Coverage Details:

Extremely Competitive premiums

User friendly interfaces for understanding coverages

Add-ons and Customization Options:

Wide range of add-ons

Employer dashboard for easy customization

Aditya Birla Group Health Insurance

Key Features and Coverage Details:

High claims settlement ratio

Strong financial background

Great wellness offerings

Premium Structure and Flexibility:

Equated Monthly Options for premium payments

Additional Perks for Employers:

Great Customer friendly app for ease of use

Dedicated customer support

Magma HDI Group Health Insurance

Key Features and Benefits:

Offers greater flexibility as compared to some of the other plans

Good value-added services like homecare and fitness rewards.

Premium and Coverage Details:

Good cost sharing options for employers & employees

Claim Process and Customer Support:

Great platforms for online tracking of claims

Great customer support

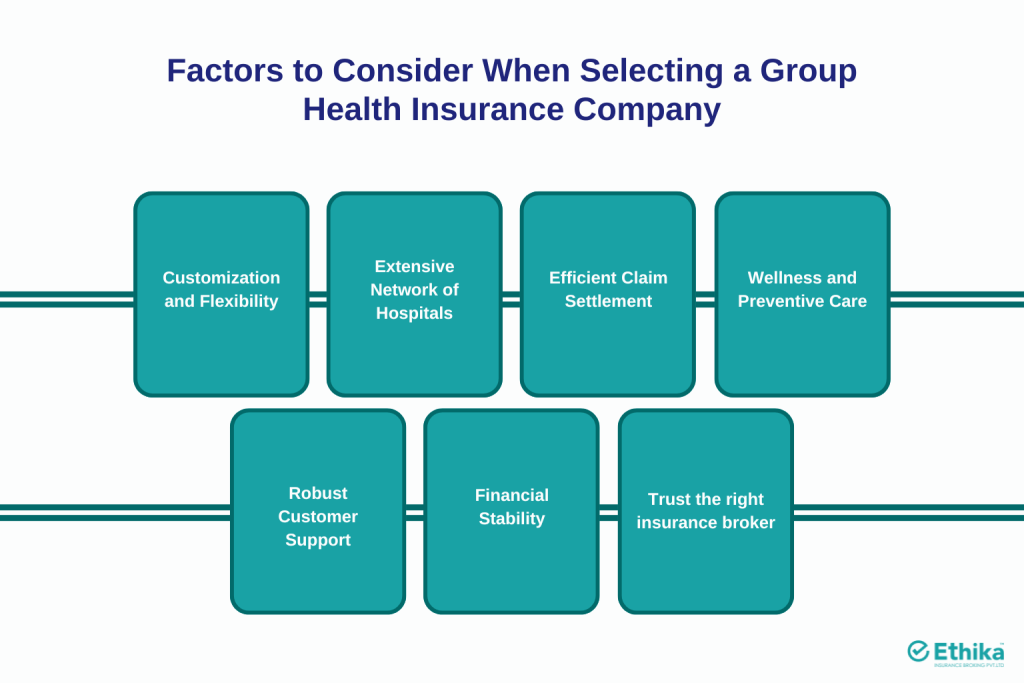

Factors to Consider When Selecting a Group Health Insurance Company

All of this information can easily overwhelm anyone. Here are some important pointers that will help you navigate this process.

Customization and Flexibility:

Look for insurers offering highly adaptable plans.

Prioritize the ability to tailor coverage to specific employee needs.

Look for options to add relevant benefits.

Extensive Network of Hospitals:

Ensure a wide network of hospitals, especially in locations convenient for your employees.

Verify seamless cashless claim processing capabilities.

Efficient Claim Settlement:

Investigate the claim settlement ratio using IRDAI data.

Look for streamlined online and offline claim processes.

Wellness and Preventive Care:

Consider providers that emphasize on wellness programs.

Value preventive care initiatives for a healthier workforce.

Robust Customer Support:

Evaluate customer support channels and responsiveness.

Look for dedicated relationship management and good digital integration.

Financial Stability:

Choose a financially stable provider for reliable claim payments.

Trust the right insurance broker

Conclusion

A group health insurance is a powerful instrument. Used the right way, it can become a strong pillar of your Employee Value Proposition. As the cost of hospitalizations keeps increasing, employees have already started showing a keen interest in the nature and quality of health benefits extended by employers.

With the increase in frequency of pandemics, this employee interest in only set to rise. Moreover, most millennials, who form a large chunk of the working population at the moment, have parental responsibilities. A good policy in such cases can become the bedrock of attracting the right talent.

Choosing the right health insurance is a complicated task. It involves selecting the right insurer, the right policy framework and the right intermediary. Each of these selections, in turn, can decide on how your policy is perceived in your organization.

Employers can choose the right plan for their organization by evaluating the insurer’s customization options, network hospitals, claim settlement efficiency, wellness programs, and customer support.

At Ethika, over the last ten years, we have helped thousands of employees through their claim settlement journey. We have also helped employers select the right policy with the right set of coverages.

Our benchmarking proficiency ensures that we fit the right employer with the right insurer. By virtue of being a bootstrapped startup, we also understand the importance of every penny that you spend. Our endeavor has always been to get the employer the right value at the right cost.

Call us for a free consultation today.

Frequently Asked Questions (FAQs):

What Is the Minimum Employee Requirement for Group Health Insurance?

While IRDAI allows for a group policy to be underwritten is the number of employees are above 7, Insurers may have their own criteria.

Can a Group Health Insurance Policy Be Customized?

Yes, as a matter of fact that is one of the main reasons why Employers buy a group policy.

How Does the Claim Process Work in Group Health Insurance?

Your Insurer generally assigns you a single point of contact who can help you with the claims processing.

The claim process for group health insurance typically involves notifying the insurance company of the hospitalization or treatment, submitting the necessary documents, and following the insurer’s guidelines.

Are Pre-Existing Diseases Covered in Group Health Insurance?

Yes, pre-existing diseases can be covered in a group health insurance policy. But the extent of waiting period can vary from policy to policy.