As many as 43% of insurance policyholders had difficulties processing their health insurance claims in the past three years, says a survey, by localcircles.com, a social media platform for communities, governance, and urban daily life.

That is why a Third Party Administrator (TPA) for processing health insurance claims is extremely essential.

However, while TPAs have revolutionized claim processing, recent trends in the healthcare ecosystem might be putting this progress at risk.

What’s on this page?

Why do we need a Health Insurance Third Party Administrator?

The concept of a Third Party Administrator was introduced in India in the early 2000s. Before the introduction of TPAs, claims used to be processed by the Insurers themselves. Not only was this process cumbersome, but every sense of objectivity would be lost – the insurer would have an obvious bias toward not settling the claim.

A Third Party Administrator (TPA) not only expedites the process of claim settlement, but also brings in a sense of objectivity to the process.

TPAs were first introduced in India in 2001 by the Insurance Regulatory and Development Authority of India (IRDAI) as part of a broader push to improve healthcare claims management and service quality. This move allowed insurers to focus on their core business of underwriting risk while outsourcing the labor-intensive claims management process to specialized entities.

Also Read: Underwriting the Policy at the Time of Claim Settlement

TPAs greatly enhanced transparency and efficiency in health claims processing. They brought professionalism into the system by providing standardized processes and driving competition among hospitals for better patient care, ultimately benefiting the policyholder. TPAs have also helped control healthcare fraud by maintaining proper checks and balances on hospital billing.

What exactly does a Health Insurance Third Party Administrator do?

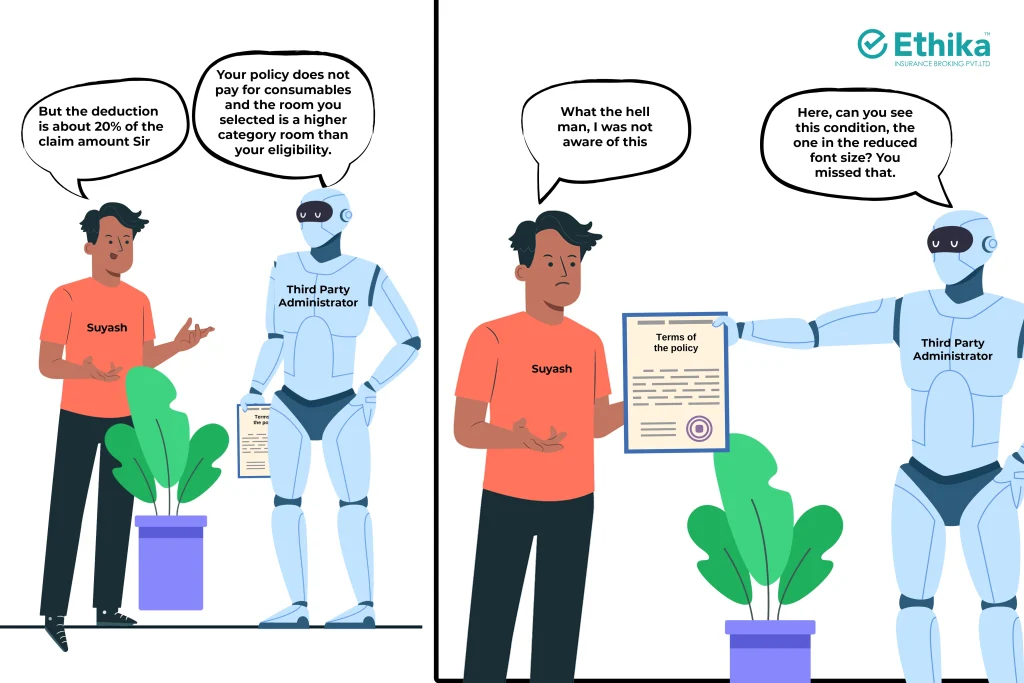

A Health Insurance Third Party Administrator (TPA) is an intermediary between health insurance companies and policyholders. TPAs are responsible for processing claims, managing customer service, and coordinating between hospitals and insurers. TPAs play a vital role in the healthcare insurance ecosystem, ensuring that claims are processed efficiently and patients receive timely access to medical services.

Health insurance claims often involve multiple stakeholders—policyholders, hospitals, and insurance companies. TPAs streamline the complicated claims process. They collect and verify necessary documents, assess claims, coordinate with hospitals for cashless treatments, and ensure that claims are settled as per the terms of the insurance policy.

TPAs provide specialized services that insurance companies may lack the bandwidth or expertise to handle effectively. Their impartiality, being a third-party organization, ensures a fair adjudication of claims, reducing the chances of conflicts between the insurer and the insured.

The Customer might forget everything else, but they will never forget their claims journey. The TPA is one of the most critical elements in this journey.

There is general perception that the Third Party Administrator deliberately delays processing of claims. That is not true. As a matter of fact, the TPAs are obligated to grant final authorization for a claim within three hours of receipt of discharge authorization from the hospital.

But, to avoid any to and fro with the TPA, here is an indicative list of documents that you might need in case of availing a cashless facility at a Hospital –

- Duly Filled and Signed Cashless Claim form

- Discharge Summary

- Medical Records (Optional Documents may be asked on need basis: Indoor case papers, OT notes etc.)

- Hospital Main Bill

- Hospital Main Bill with breakup

- Pharmacy Bills with Prescriptions (except hospital supply)

- Consultation & Investigation Papers

- Digital Images/CDs of the Investigation Procedures (if required)

- KYC (Photo ID Card) Bank Details with Canceled Cheque

While the Hospital should take care of most of those, you might need to fill the claim form and submit your identity proof.

Inhouse vs Independent Third Party Administrators

The concept of independent Third Party Administrators (TPAs) was introduced to ensure objectivity and efficiency in health insurance claim processing, but the market seems to be pivoting into a different direction: Insurers are opting to create in-house TPAs. Let’s examine the benefits of this move –

Benefits of In-House TPAs:

- Cost-Effectiveness: In-house TPAs can potentially reduce operational costs by eliminating external fees and streamlining processes.

- Improved Efficiency: By integrating claims processing directly into the insurer’s operations, in-house TPAs can potentially reduce turnaround times and improve overall efficiency.

- Enhanced Data Control: In-house TPAs provide greater control over data, enabling insurers to leverage insights for better decision-making and risk management.

- Stronger Brand Alignment: In-house TPAs can align their operations more closely with the insurer’s brand and customer service standards.

Industry observers are of the opinion that benefits aside, this pivot is leading to a conflict of interest – there is a risk of potential bias in claim decisions, as in-house TPAs may prioritise the insurer’s financial interests over those of the policyholders.

To mitigate potential challenges, insurers should prioritise transparency, fairness, and customer satisfaction in their in-house TPA operations. Strong internal controls, regular audits, and clear escalation procedures can help maintain high standards of service. Additionally, regulatory oversight and industry best practices can help ensure that in-house TPAs operate ethically and responsibly.

While independent TPAs have played a crucial role in the health insurance ecosystem, in-house TPAs offer a viable alternative with potential benefits that can eventually be transferred to the Customers.

By carefully considering the advantages and disadvantages of both models, insurers can make informed decisions to optimise their claims processing operations and deliver exceptional customer experiences.

Over the years, we at Ethika have developed significant expertise in devising solutions that best suit our Clients needs. We do not believe in a one size fits all approach and therefore tailor our solutions to suit the Clients’ needs.

Conclusion

The medical inflation in India is rising at a rate of about 15% per annum. At this rate, costs of hospitalization would double every five years. Health Insurers have started passing these costs to the Customers, every year. Health Insurance premiums have been rising every other year.

Every third “Finance Guru” of the internet is advising the common man to start an SIP instead of investing in a health policy. How long will the common man withhold this pressure? Especially in an industry as opaque as Insurance?

Trust is the one pillar that can help save the health insurance industry. The Health Insurance Third Party Administrator is an important institution that can safeguard this trust. An independent Health Insurance Third Party Administrator is the need of the hour.

Frequently Asked Questions (FAQs)

- What is a Third Party Administrator (TPA) in a Health Insurance Policy?

A TPA is an intermediary between health insurance companies and policyholders, responsible for processing claims, managing customer service, and coordinating between hospitals and insurers.

- Why is a TPA necessary?

TPAs expedite claim settlements and bring objectivity to the process, ensuring policyholders receive fair and timely access to medical services. They also help control healthcare fraud and enhance transparency.

- What are the benefits of an in-house TPA compared to an independent TPA?

In-house TPAs can be more cost-effective, efficient, and offer greater data control and brand alignment for insurers. However, they may also present a conflict of interest.

- What documents are typically needed for cashless claims at a hospital?

In-house TPAs can be more cost-effective, efficient, and offer greater data control and brand alignment for insurers. However, they may also present a conflict of interest.

- Is there a risk of bias with in-house TPAs?

In-house TPAs can be more cost-effective, efficient, and offer greater data control and brand alignment for insurers. However, they may also present a conflict of interest.