The Government of India’s Insurance Regulatory Development Authority decides the insurance agent’s and insurance broker’s commission structure in India. The maximum commission in the general insurance business is paid in the motor insurance segment, whereas the minimum is paid in the group health insurance segment. IRDAI has set a cap on the commission payable under each business line. The commission payable under any line of business should be the maximum commission payable under each line of business.

Commission or remuneration is the amount payable to the insurance agents and insurance brokers for their services towards soliciting the insurance business and servicing the customers in case of need, such as endorsements and claim settlement. Insurance companies pay commissions as a percentage of premiums. Insurance agents and brokers are not allowed to deduct their commission before submitting the premium amount, as it would violate the insurance rules. Once the premium is sourced and the policy is booked, the insurance company would settle the commission to the insurance agents and insurance brokers.

What’s on this page?

Motor Insurance- Long Term:

Motor insurance long-term policies were started in 2018 after the Supreme Court ruling to increase the number of vehicles with Third-party coverage plying on the roads. As per the ruling, the honorable Supreme Court has made it mandatory for new 2-wheelers to take 5 years. Third-party policy, whereas for other than new 2-wheelers, it is for 3 years. The own damage OD section of the policy is always optional as the government of India has made it mandatory to take third-party insurance.

| S.No | Types of Long Term Motor Insurance Policies | Max Commission/ remuneration payable to insurance agents/ insurance brokers | Maximum Rewards |

| 1 | 5 years Long term Stand-Alone Motor Third Party Insurance Policy (LTSAMTIP) for new 2 – wheelers | Nil | Nil |

| 2 | 3 years Long term Stand-Alone Motor Third Party Insurance Policy (LTSAMTIP) for new Private Car | Nil | Nil |

| 3 | 5 years Long term Motor Package Insurance Policy (LTMPIP) for new 2 – wheelers | i) 1st year of 5 years LTMPIP – OD -17.5% + TP- Nilii) 2nd year of 5 years LTMPIP -OD -10% + TP- Niliii) 3rd year of 5 years LTMPIP – OD -10% + TP- Niliv) 4th year of 5 years LTMPIP -OD -5% + TP- Nilv) 5th year of 5 years LTMPIP – OD -5% + TP- Nil | A maximum of 30% of commission/ remuneration per policy |

| 4 | 3 years Long term Motor Package Insurance Policy (LTMPIP) for new private car | i) 1st year of 3 years LTMPIP – OD -15% + TP- Nilii) 2nd year of 3 years LTMPIP – OD -10% + TP- Niliii) 3rd year of 3 years LTMPIP – OD -5% + TP- Nil | A maximum of 30% of commission/ remuneration per policy |

| 5 | Bundled cover with one year term for own damage and 5 years motor third party insurance policy for new 2 – wheelers | Bundled cover – OD -17.5% + TP- Nil | A maximum of 30% of commission/ remuneration per policy |

| 6 | Bundled cover with one year term for own damage and 3 years motor third party insurance policy for new private car | Bundled cover – OD -15% + TP- Nil | A maximum of 30% of commission/ remuneration per policy |

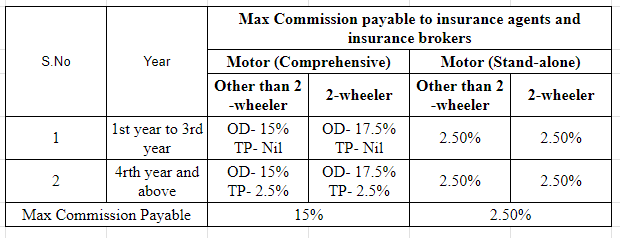

Motor Insurance- Regular:

Motor insurance policies, usually taken for 1 year to 5 years, come under this section. These policies are comprehensive or stand-alone, ranging from 1 year to 5 years.

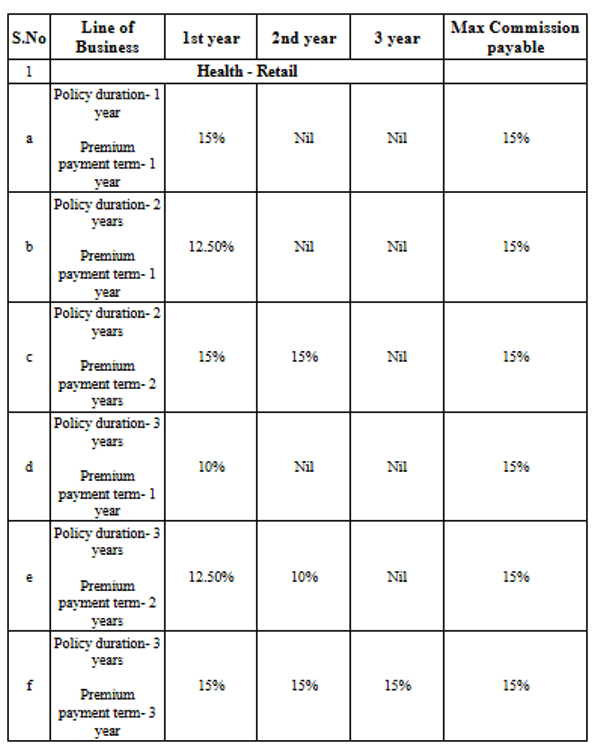

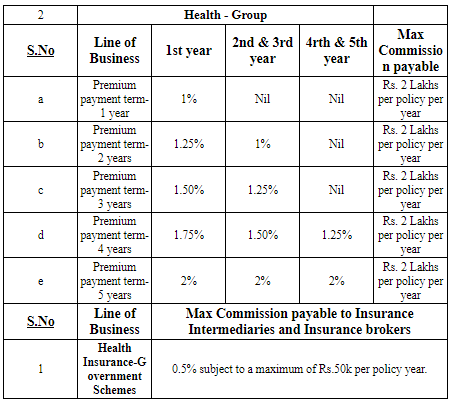

Health Insurance- General & Stand-alone Health Insurance companies:

General Insurance- Other than Motor:

| S.No | Line of business | Max commission payable to insurance agent | Max commission payable to insurance intermediary |

| 1 | Fire- Retail | 15% | 16.5% |

| 2 | Fire- Commercial (S.I<2500Crs) | 10% | 11.5% |

| 3 | Fire- Commercial (S.I>2500Crs) | 5% | 6.25% |

| 4 | Marine- Cargo | 15% | 16.5% |

| 5 | Marine- Hull | 10% | 11.5% |

| 6 | Miscellaneous- Retail | 15% | 16.5% |

| 7 | Miscellaneous- Commercial/Group | 10% | 12.5% |

| 8 | Miscellaneous- Commercial (Engineering risks with S.I>2500 Crs) | 5% | 6.25% |